|

Getting your Trinity Audio player ready...

|

The Reuters Institute’s annual Digital News Report has become a hotly anticipated release over the past few years, and more so than ever this year as the industry grapples with the impact of coronavirus.

From record levels of traffic to growing mistrust and news fatigue, the report acknowledges that the crisis is “very likely to accelerate long-term structural changes towards a more digital, more mobile, and more platform-dominated media environment.”

Amidst all this comes the evolving role of podcasts. With half of all respondents saying that podcasts provide more depth and understanding than other types of media, the opportunities for publishers looking to engage their audiences on a deeper level have never been clearer.

Here, we have summarised the key findings on podcast consumption in 2020 from the report, and what this means for publishers who either have their own podcasts, or who are looking to launch them.

Coronavirus: drops in listenership, but breakout hits

Not even podcasts were immune to the impact of coronavirus. As the world locked down, some podcast listening fell by as much as 20%, as people adjusted to the loss of a commute – one of the most popular times to listen to podcasts.

But as many podcasts began to see lulls in listenership, breakout hits emerged. The report highlights Das Coronavirus-Update, a 30-minute show featuring one of Germany’s top virologists, which reached the top spot in the charts there.

This reflects what we at WNIP have seen from other publishers launching coronavirus podcasts; The Telegraph’s daily podcast, ‘Coronavirus: The Latest’ had a million listens in its first 10 days across all platforms when it launched back in March.

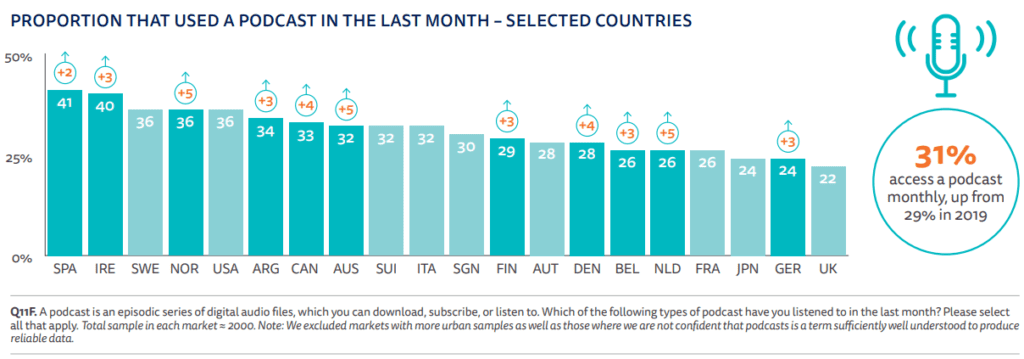

Despite the impact of coronavirus, the report has found that the underlying picture remains one of growth. There is also evidence to show that the initial drop in listening for many podcasts returned to ‘normal’ levels in April and May as people adapted to new routines. Overall podcast listening has grown to 31% – a rise of3% – across 20 countries Reuters have tracked since 2018.

The disparity between countries continues

Despite English-language podcasts dominating the audio scene, it is notable that the UK still lags behind when it comes to listenership, with just 22% of people accessing at least one podcast each month.

However, rather than seeing this as a limitation, it is important for publishers seeking UK listeners to view this as an opportunity. Discoverability is still a huge blocker to many would-be listeners, and publishers are in a position to unlock those listener numbers by harnessing and educating audiences on other platforms about where to find podcasts and how to listen.

When it comes to countries with higher numbers, Spain is one of the leaders, with just over four in ten people listening to a podcast at least once a month. They are closely followed by Ireland at 40% and Sweden, Norway and the United States all at 36%.

Most countries have seen modest growth in overall listenership over the past few years of between 2 and 5%. It is unclear whether this has been slowed by the coronavirus crisis, but as Spotify and Apple continue to jostle to be the dominant podcast provider, this growth is likely to continue.

News and specialist dominate the charts

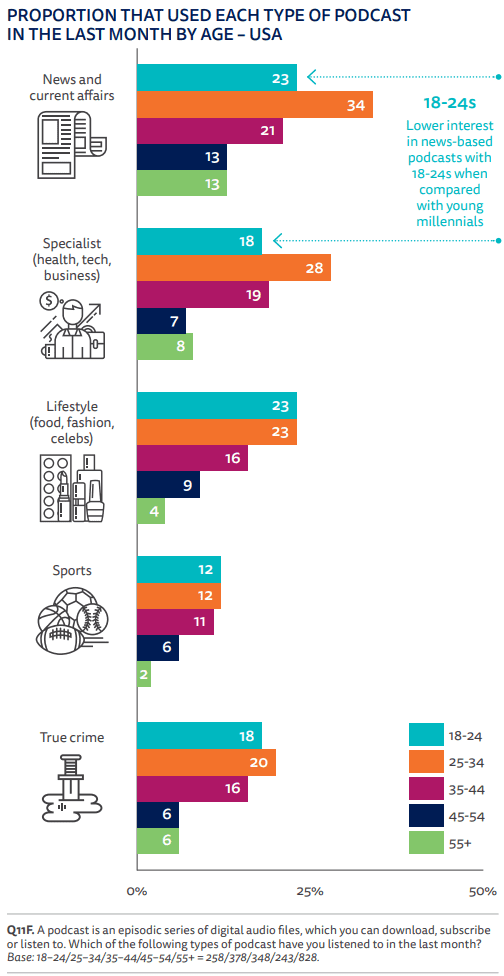

It’s no surprise that news and politics podcasts are among the most widely listened to. According to the report, about half of podcast users in the US listen to a news podcast, with users saying that podcasts offer a greater depth and understanding of complex issues, and a wider range of perspectives than other types of media.

Although podcast listenership skews very heavily towards younger people, with 43% of 18-24’s in the UK listening monthly, news podcasts are more popular with those aged 25-34, or ‘young millennials’. Specialist podcasts like health, tech and business are also disproportionately popular with this age group, suggesting that these curious listeners are the

Instead, the 18-24 age group are heavy consumers of lifestyle and celebrity podcasts, as well as true crime.

For publishers looking to reach younger audiences, podcasts remain a strong performer in building loyalty. But subject area and approach needs to be considered carefully depending on the target age group, as there are wide variances in performance of different types of podcast among age groups.

Are opportunities for paid podcasts on the horizon?

One point in particular that the report surfaced this year was the growing willingness to consider paying for podcasts. 39% of Australians said they would be prepared to pay for podcasts they liked, and similarly 38% in the United States and 37% in Canada agreed.

Sweden and the UK were outliers in willingness to pay with just 24% and 21% respectively saying they would be prepared to pay for podcasts they liked. Reuters attributes this to the number of popular podcasts coming from free-to-air public broadcasters.

Paid podcasts are an area which has seen limited success so far. But as people forge deeper, long standing connections to their favourite shows, there could be an opportunity for podcasts with established audiences to consider spinning off paid-for episodes and series.

Read our complete launch coverage of the Reuters Institute Digital News Report 2020

- Digital News Report 2020: 5 must-read charts for publishers

- Email newsletters are resurging, says Reuters Institute

- What we learned about changing podcast consumption, from the Digital News Report 2020

- “Habits continue to become more distributed”: Gateways to news that matter most to publishers, from Reuters Institute

- The “silent majority” want news to be neutral: Insights from Reuters Institute’s Digital News Report 2020

- “Subscription, membership, and donations will move center stage”: Reuters Institute Digital News Report 2020

- Digital News Report 2020: 5 overlooked charts publishers must see