|

Getting your Trinity Audio player ready...

|

Shifts in advertising and consumer behaviours, a “new respect for affiliate models,” coupled with advances in the eCommerce capabilities of platforms and social networks, are all helping to lay the groundwork for the next stage in eCommerce’s evolution.

The strategic implications of this were shared in my report, The Publisher’s Guide to eCommerce, which was published at the end of October 2019.

In this article I expand on some of the ideas in that report to show how many of the foundations for eCommerce’s growth in the next decade are already starting to emerge.

These developments will impact content creators, business models, and advertisers; and as a result, these are trends which publishers – large and small – cannot afford to ignore.

1: Shifts in advertising spend

According to Group M (part of WPP), eCommerce related ad spend is growing faster than digital advertising, a trend which “holds implications for both marketers and media owners.”

As Brian Wieser, Group M’s Global President, Business Intelligence, has explained:

“The increasing importance of e-commerce is two-fold: it shapes the behaviors of consumers and manufacturers and it also has a significant impact on the media industry because of the different ways advertising is used to support different kinds of e-commerce activity. Consequently, variations in growth between direct-to-consumer (D2C), first party online retail and third-party marketplaces are important to monitor.”

In the U.S., some of these changes can already be seen.

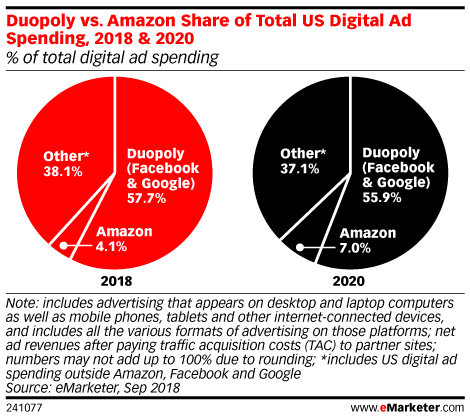

Amazon’s reach and impact is such that it is already the third-largest digital advertising platform (by $). With 4.1% of all digital ad spending in the U.S. spent on Amazon in 2018, that’s some way behind the Google-Facebook duopoly. However, this still translated into $4.61 billion of American advertising spend, which is not a number to be sniffed at.

Moreover, Amazon’s percentage of the advertising pie is only expected to grow.

2: Changes in shopping habits

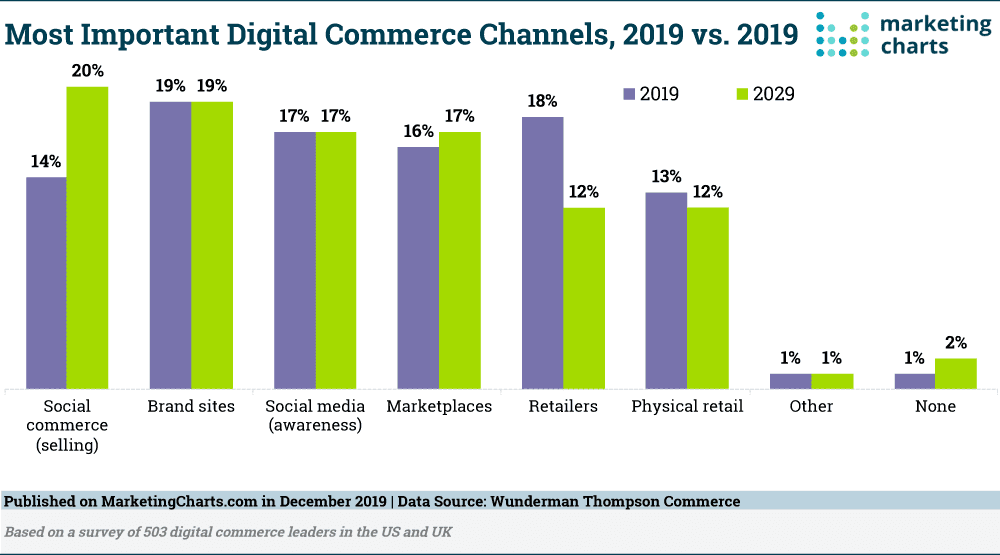

By the end of the decade, as What’s New In Publishing’s Faisal Kalim recently explained, social commerce will be the top digital commerce channel of the future.

That’s the conclusion of one in five (20%) of the 503 industry leaders in the US and UK surveyed by Wunderman Thompson Commerce, an eCommerce consultancy, who ranked the ability to sell items through social commerce as more important than the eCommerce potential of brand sites (19%) and online marketplaces (17%).

Interestingly, in this survey, the retail potential of social commerce was the only digital commerce channel expected to grow in significance over the coming decade, as other channels held steady. (NB: ignore the typo in the title of the chart below and instead look at 2019 figures in purple and compare this with the 2029 figures in green.)

A key driver for this shift will be the changing attitudes, and media habits, of consumers.

Digital natives have grown up with the convenience and potential of online shopping. As a result, 72% of digital commerce leaders surveyed by Wunderman Thompson Commerce believe that consumers will increasingly prefer to shop online, with more than half (55%) saying they see little value in physical commerce.

3: Social networks finally get their act together

Most conversations about publishers and eCommerce, tend to examine the use of social networks like Facebook and Pinterest as channels for the promotion of commercial products and services.

This interest in social commerce is not surprising, given the amount of time we spend on social media (1/7 of our waking lives). Moreover, according to data from GlobalWebIndex, “nearly 3 in 10 cite researching/finding products online as a main reason for using social media.”

Despite this, adoption of social commerce has arguably been slower to take off than many industry watchers had predicted.

“The holy grail of “social commerce,” [is] an area that has eluded social platforms like Facebook for years and killed many other startups tackling the category along the way,” VentureBeat noted in 2016.

“F-commerce, so to speak, failed because people weren’t ready to shop on Facebook,” they wrote. “Retailers have found integration with social platforms to be frustrating as well.”

Four years on, however, things are beginning to change.

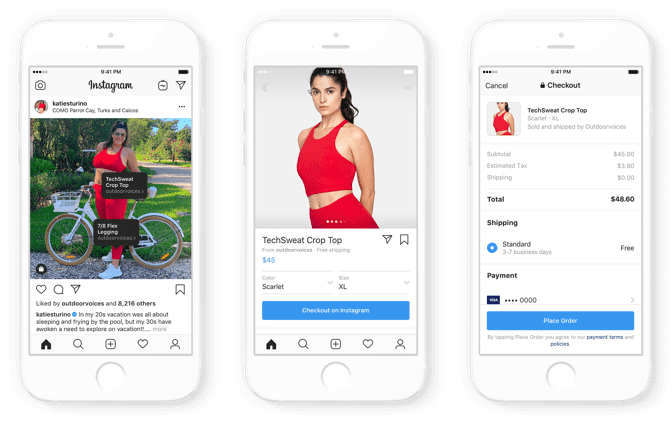

As Jia Wertz, CEO of Studio 15, a socially responsible fashion brand, has noted, “the line between social media and e-commerce is increasingly becoming blurred.”

Pinterest, WhatsApp, WeChat and even TikTok are all generating new opportunities for eCommerce, as social networks – including chat apps – increasingly roll out opportunities to shop in-app, or reduce the hoops you have to jump through from discovery to purchase.

4: Mobile matters more than ever

Improvements in the user experience (often driven by platforms, but not exclusively so,) changing consumer habits and an increasing willingness by content creators to recognise – and embrace – the implications of these trends, all mean that social commerce is slowly becoming more widespread.

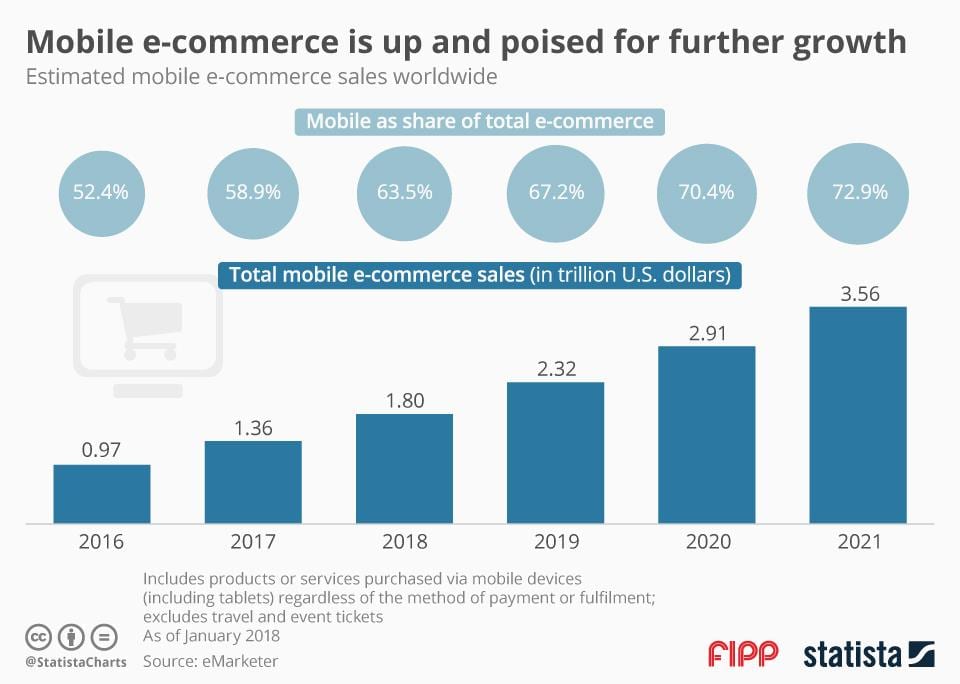

GlobalWebIndex has highlighted how the move to mobile shopping increasingly underpins these developments.

“The mobile phone is now the device of choice for all stages of the purchase journey – from researching, to buying through to reviewing.”

As a result, mobile eCommerce is projected to be a $3.5 trillion industry by 2021.

“The mall of the future is not a sprawling metropolis of stores, punctuated by the occasional soft pretzel stand and megaplex movie theater, but a platform on your phone.” Arielle Pardes, predicted in Wired last year.

60-Second Case Study: PinkNews

For publishers, the example of PinkNews, a UK-based LGBT+ news site, demonstrates some of the eCommerce potential to be found at the intersection of mobile and social media. Last summer the publisher started selling products directly to their Snapchat users.

As reported by The Drum, Pink News’ “founder predicts first-party sales in shoppable ads will soon become its biggest revenue source.”

“There is something thrilling about a user who visited PinkNews on Snapchat to learn the latest about James Charles, deciding to swipe up and buy a pair of $40 sunglasses from us on the spur of the moment,” their CEO Benjamin Cohen wrote on Medium.

In an end of year round-up, Cohen shared how Pink News had dived deeper into this space. “2019 also saw the launch of PinkNews Commerce and the beginning of our moves for the business to become a D2C brand,” he wrote.

“Initially launching on Snapchat, we are now selling products designed by Daniel Dvir and his team across all platforms as well as on our owned and operated PinkNews.shop,” he added.

With a new Director of Commerce, former Facebook and NET-A-PORTER exec Sarah Watson, leading these efforts, Cohen shared PinkNews’ evolving eCommerce vision:

“We want to create great content, to draw in users who can then purchase products and services from us. We have an aim that by 2021, at least half of our revenue will come direct from consumers.”

This article is adapted, and updated, from our free to download report, The Publisher’s Guide to eCommerce.