|

Getting your Trinity Audio player ready...

|

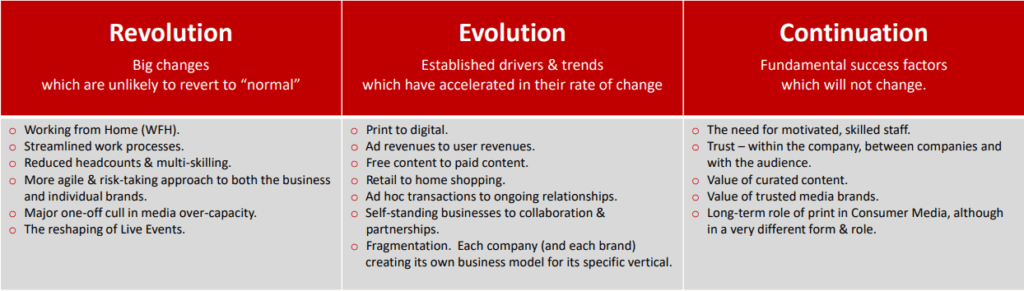

Publishing industry insiders and commentators have often used the word acceleration to describe the effects of the pandemic on various business trends. The latest mediafutures Europe report published by Wessenden Marketing drills down into the specifics. It examines how key business trends were accelerated and what lies ahead.

Wessenden Marketing tracks changes in the UK publishing and media industry through its annual mediafutures project. It examines business trends across five broad industry categories: Consumer Media, B2B, Events, Customer Media and News Media. This year, the project involved 177 companies in the UK, Europe & Asia Pacific and 154 companies in the USA. It was executed in collaboration with InPublishing, Folio and Flashes & Flames.

“Individual companies are finding their own specific solutions”

The “initial panic and flurry of activity at the start of the pandemic” was followed by a period of dramatic cost-cutting and a drive into digital, subscriptions and virtual events, writes Jim Bilton, MD, Wessenden Marketing. This often involved giving away content free or at heavily discounted rates in order to hold on to the audience base. Currently, media companies are taking a more measured, strategic and planned approach.

The profile of the revenue streams is shifting more rapidly than ever before. Publishers are shifting from ad to audience revenue. Print is finding a new premium role in multi-platform offers. Digital growth is rapid, complex and moving in “bewildering number of directions.”

“What is very clear is that individual companies are finding their own specific solutions,” comments Bilton. “There are three key reasons for this. Firstly, the dynamics of each market, and indeed each brand, can be very different. Secondly, the skills base, culture and tech that are at hand in each media company are very varied. Thirdly, the available cash to sustain a business is not consistent across the industry.”

Although times are tough and stressful, the industry is actually in better shape than many others.

Jim Bilton, MD, Wessenden Marketing

“Towards a more focused “Subscription First” strategy”

The report projects a significant acceleration from ads to audience revenue. Currently, advertising accounts for 60% share of total sales among the benchmark companies. It is expected to drop to 54% by 2022. This represents a significant acceleration compared to the -4% forecast in last year’s survey.

There is a marked acceleration in this year’s survey towards a more focused “Subscription First” strategy, which stretches right across Consumer, B2B and News. This is elevating subscriptions to a top priority ahead of (1) retail channels and (2) advertiser revenues.

Jim Bilton, MD, Wessenden Marketing

Publishers are continuously working to add value to their subscription packages. This is often leading to the development of membership packages that include print and digital products, events, exclusive goods & services, experiences, training & educational packages, etc. These are offered via bundles, tiered packages, pay-as-you-go top-ups, all-you-can-eat offers and so on.

Primary challenges in building a subscription revenue stream include subscription fatigue, competition from other media companies (including publishers offering free content), information overload and technological readiness among others.

“Smarter use of data is a thread that runs through every subscription activity, with a recognition that many publishers still have some way to go in terms of their data sophistication in shaping personalised content packages, customer journeys and tiered/dynamic pricing models,” adds Bilton. “Selling-on insights about readers to advertisers & partners is a growing revenue stream for the more sophisticated media companies.”

“Opened up more opportunities with new advertisers”

Sectorwise B2B (69% now) and News (58%) are much more ad dependent than Consumer (38%). Events have the highest share of ad revenue at 76%.

B2B is shifting out of ads and into audience revenue relatively faster. It is expected to reduce its ad revenue share by 10% points in 2 years compared to News (-4%) and Consumer (-3%). However, the Events business model is becoming increasingly ad/sponsor dependent.

“Continuing to build a more rounded bundle of multi-platform activities for advertisers is still seen as the dominant opportunity,” says Bilton. These include sponsored content (via emails & enewsletters, video and audio/podcasts, whitepapers etc.), services & activities (virtual live events, ecommerce and B2B consultancy and added value (lead generation and profiling of users and prospects).

There is an increasing shift towards overseas revenue (29% now, +5% points in 2 years). B2B leads in this (35% now) followed by Consumer (22%) and News (3%).

“The launch and/or acquisition of new brands in new sectors has opened up more opportunities with new advertisers. The expansion of online brands outside the UK has opened up more monetisation opportunities with new, non-domestic advertisers.”

Respondent, mediafutures project

The current dominant challenge is the volatile economic environment and the “sheer level of competition from every direction.” These include publishers offering free online content, advertisers taking over media activities themselves and tech companies like Google and Facebook.

The resilience of print and rapid shift to digital

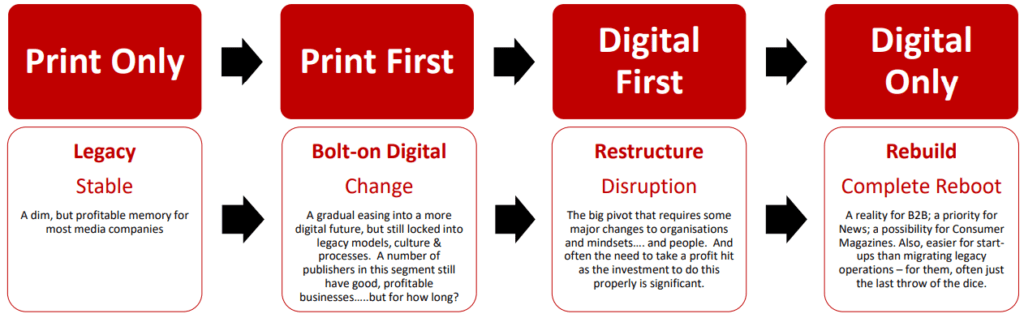

Print accounts for 52% of total revenues across all companies. This is expected to decline by 9% points to 43% in 2 years compared to last year’s -5%. News (73% now) and Consumer (62%) are much more print-skewed than B2B (38%).

Customer media is expected to shift out faster in 2 years (-14% points) compared to News (-10%) and Consumer (-9%). B2B maintains its steady migration (-8%) which started several years’ ago at a much faster rate.

Although there is a general trend out of print, it continues to be a resilient medium encouraging many publishers to find new opportunities in the form of premium products.

Digital products and services make for 28% of total revenues. This is expected to increase by 11% points to 39% in 2 years. Consumer is leading the shift (+12% from 20% now). News has the lowest digital share (12% now) and B2B the biggest (43% now). Both are expected to shift +10% points in 2 years.

Right now the digital revenue model is ad/sponsor driven. It accounts for 68% of total digital revenues for Consumer + News + Customer, 74% for B2B and 90% for Events. However, its importance will reduce over the next two years primarily due to the decline in advertising. The report predicts a -13% point shift for Consumer, -8% for B2B, and -3% for Events. User-paid content will be the major beneficiary from this shift.

Digital opens up new opportunities for publishers, including:

- The ability to serve the more tech-savvy readers

- The ability to produce insight-driven content resulting in stronger editorial quality

- Segmenting audiences to deliver a more tailored and personalised service

- Create higher quality bundles

- Flexible payment methods (paywalls, micropayments, etc.)

- More focus on international growth

The challenges are similar to subscription and ad models as in increased competition from other publishers, OTT and social media, tech capability, staff upskilling and costs.

Finding balancing between old and new revenue streams

Diversification is also a priority at most of the companies covered in the report. Individual companies range from 3 to 12 activities. “The general strategy is to diversify as rapidly as possible,” writes Bilton. “Yet a lack of the required skills, knowledge & resourcing are creating challenges. Also, too much diversification can be as dangerous as too little.”

“Changing the business model demands more investment not less,” writes Bilton. He recommends having a strategy for the declining streams as well as for the growth areas. Publishers should try to balance what still works now against what might work in the future. “Prioritise. Prioritise. Prioritise,” he concludes.

The real challenge is building an organisation that can ride the turbulence of disruption.

Jim Bilton, MD, Wessenden Marketing

The Executive Summary of the main mediafutures EUROPE report is available free of charge to WNIP readers. Contact Jim Bilton atinfo@wessenden.com