|

Getting your Trinity Audio player ready...

|

For the past 14 years, the Pew Research Center – based in Washington D.C. – has published an annual report highlighting the latest financial and audience developments across the American news media.

The Center has recently moved away from large scale, all-encompassing reports (these PDF documents from 2004-2017 are available here) to focus on publishing Fact Sheets on specific verticals such as Cable News, Audio and Podcasting, or Hispanic Media.

Here are five fundamental things you need to know from these deep dives:

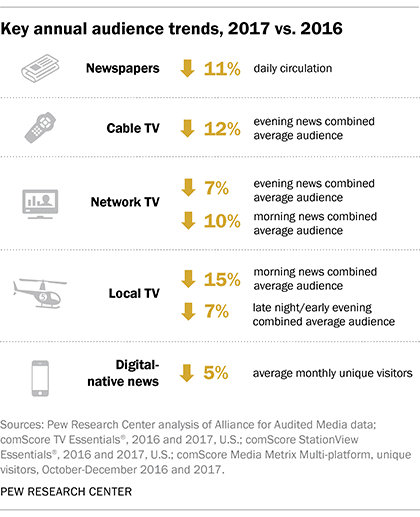

1. Audiences declined for most news verticals in 2017

Key findings

With the exception of radio – which measures total audience numbers, but does not capture data relating to specific programming types – every other news vertical saw its audience decline last year.

To some extent, this is not surprising. Donald Trump’s candidacy meant that the election year of 2016 resulted in a number of news organisations enjoying a “Trump Bump” and although interest in politics remains high with some demographics, there’s less interest across the general populace.

Alongside this, deliberate news avoidance (as previously observed by the Reuters Institute for the Study of Journalism in Oxford), as well as the continued importance of news consumption on social media platforms, also look to be having an impact on native news outlets.

About two-thirds of U.S. adults (68%) get news on social media sites, and one-in-five get news there often, Pew’s data finds.

Implications

Although year-on-year data here is, to some extent, skewed by comparing an election vs non-election year, Pew’s data reinforces the need for news organisations to double-down on efforts to diversify their revenue bases and reduce their dependency on advertising.

Membership programs, innovative subscription packages, paywalls, events, eCommerce and other income streams will continue to be important as audience numbers fluctuate (and in some cases continue to decline over time).

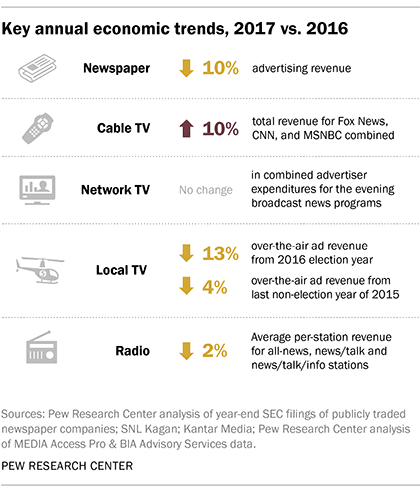

2. Cable TV was a rare bright spot for revenue growth

Key findings

Newspapers, radio and Local TV news providers all witnessed year—on-year declines in revenue, with the long-term financial woes of print newspapers being well documented.

In a country of 325 million people, Pew note that “the estimated total U.S. daily newspaper circulation (print and digital combined) in 2017 was 31 million for weekday and 34 million for Sunday, down 11% and 10%, respectively, from the previous year.”

Conversely, revenue for cable news – specifically Fox News, CNN and MSNBC combined – rose 10% in the past year.

Implications

Interestingly, although the revenue for these three major cable news providers grew to $5 billion in 2017 (as a result of advertising and affiliate license fees), audiences – of evening shows – declined by 12%.

Daytime audiences remained steady at just 800,000 average viewers across the different dayparts, but the evening shows dropped from an average of 1.3 million to 1.2 million viewers.

These numbers suggest that, although not a true mass media (given the size of the audience) there is an attractive niche audience here that remains appealing to advertisers. As we’ve argued previously, niche can be a potentially advantageous strategy for different publishers.

3. Income for the major Business News networks may have plateaued

Key findings

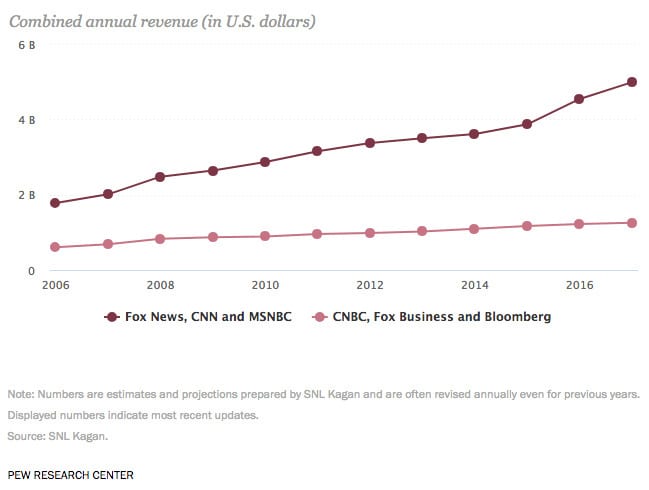

Digging deeper into the data for Cable TV, however, reveals that the growth in revenue for the sector steams from general news and opinion networks (Fox, CNN and MSNBC).

In contrast, the financial, business news, networks such as CNBC, Fox Business and Bloomberg, saw little or no income growth.

Moreover, looking back at Pew’s data for this sector from the past decade, the income growth for these business networks is far from impressive.

Implications

Financial News can be lucrative, as demonstrated by specialist outlets such as the Wall Street Journal, Financial Times and the Economist.

And it’s also been an area which has seen – and continues to see – digital innovations from players such as Reuters, Cheddar

A combination of new entrants, digital innovators and the ability to serve paying subscribers (at the FT, WSJ et al) perhaps more reflectively than in the immediacy of a 24/7 rolling news environment, may be more appealing for both audiences and advertisers. Unless something radically changes, the financial outlook for these business TV mainstays looks like to be more of the same.

4. News providers are increasingly focusing on iOS-only apps

Key findings

More than nine-in-ten adults (93%) consume news online (via mobile or desktop devices), with 35 digital-native news outlets averaging at least 10 million unique visitors per month.

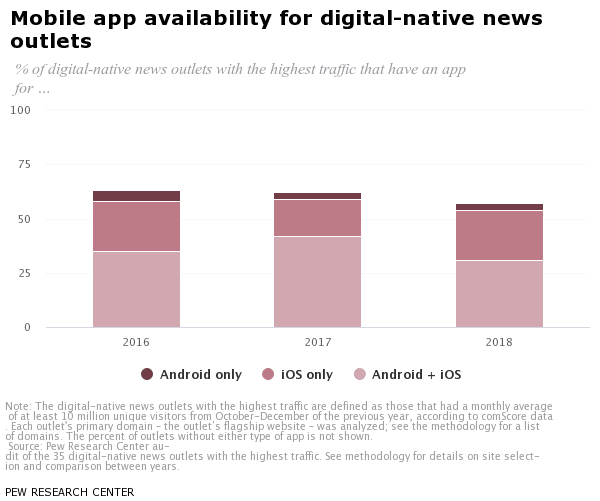

According to a Pew Research Center audit of 35 outlets conducted in early 2018, news providers are increasingly focusing their app-related efforts on iOS.

“Compared with 2017 there has been some movement away from offering apps on both platforms,” Pew reveal. “31% of digital-native news outlets offer both in 2018, down from 42% in 2017,” they wrote. “Instead, more outlets in 2018 (23%) have just an iOS app than in 2017 (17%), while just one outlet (3%) offers only an Android app.”

Implications

Although Android continues to be the leading mobile operating system around the world the more

Given the time and investment required to develop apps, and the relative ease (in terms of both time and money) with which some other channels – such as newsletters or podcasts can be developed, it may be that more media organisations will focus their efforts on these other channels.

With the continued development of Apple News, Apple’s Texture service, and the continued rise of Flipboard, perhaps publishers will start to eschew native apps entirely in the coming year.

5. Online session durations remain fairly consistent

Key findings

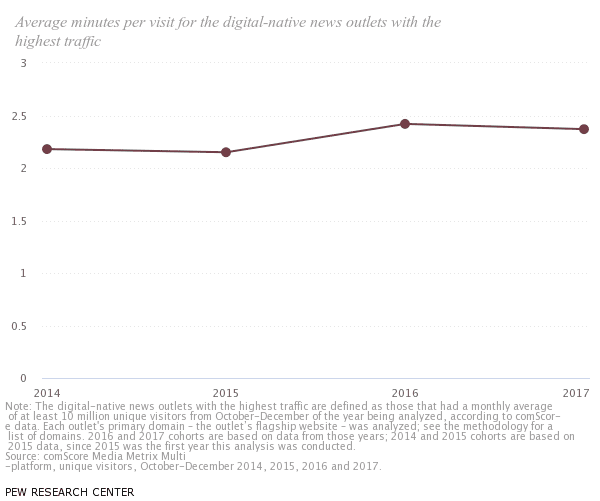

Despite more opportunities to go online – through greater smartphone ownership, greater Wi-Fi availability, improved mobile broadband connections, as well as efforts to create compelling content (e.g. video, immersive storytelling techniques, endless scrolling etc.) – Pew’s data suggests that session visits to digital news outlets have barely changed since 2014.

The average minutes spent on a digital native news outlet’s content in 2014 was 2.18 mins. This rose to 2.37 minutes in 2017. An increase, but not a significant one. (Unfortunately the data doesn’t aggregate these figures to tell us if total online time has changed.)

Implications

Just over 13,000 people work as reporters, editors, photographers or videographers in the newsrooms of digital-native outlets in 2017, up from 7,400 in 2008, according to data from the Bureau of Labor Statistics’ Occupational Employment Statistics.

Pew’s data is a reminder for all content providers of the brevity behind many people’s digital experience. Understanding – and catering – for this is paramount for everyone working in this space.

To read Pew’s full list of briefing documents on different news verticals visit: http://www.pewresearch.org/topics/state-of-the-news-media/