|

Getting your Trinity Audio player ready...

|

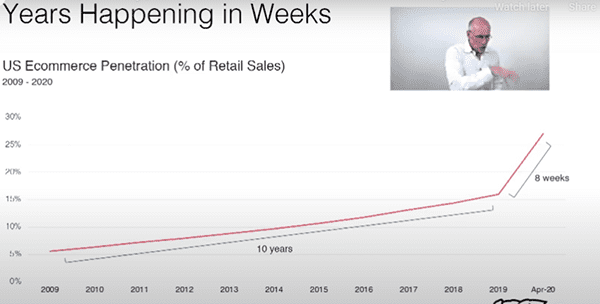

Ecommerce exploded during the pandemic. A decade’s worth of retail sales across the industry was made on US digital channels in eight weeks, according to NYU Professor Scott Galloway.

“The percentage of retail done on digital channels has gone up one percent each year. And as of 2020 it was at 18%, and then in eight weeks it went to 28%! We had a decade in eight weeks,” said Galloway at the Lions Live event in June.

“Advertising revenues were crashing, ecommerce revenues were exploding”

Ecommerce grew 54% in the UK in July 2020 alone, according to GroupM. “Growth was similar to the 55% pace of growth observed during the entire second quarter, suggesting that elevated levels of growth for ecommerce are likely to persist beyond the duration of the pandemic,” said Brian Wieser, GroupM Global President/ Business Intelligence.

“While advertising revenues were crashing, ecommerce revenues were exploding for those set up to take advantage of that shift,” writes John Wilpers, US Director and Senior Consultant, Innovation Media Consulting Group in FIPP’s Innovation in Media 2021 World Report. “The size of the shift was almost beyond belief. At least in pre-pandemic terms.”

Many publishers, including Hearst, took advantage of the shift.

Hearst’s purpose is to get more out of life. From mid-March [2020], that really became our MO: Helping readers find what they need and couldn’t get before, help them pass the time, help them with life spent at home.

Betsy Fast, Chief Content Development Officer, Hearst UK

Hearst UK’s ecommerce revenue grew 322% during the second quarter of 2020, according to Digiday. The Strategist, New York Magazine’s shopping site, saw an 85% YoY increase in revenue during the same period. Marie Claire matched its 2019 ecommerce revenue within the first seven months of 2020.

Wilpers rounds up the most popular ways publishers use to generate revenues via ecommerce:

675% annual growth in digital revenues

Many publishers generate ecommerce revenues through affiliate activity. For Marie Claire UK, ecommerce and affiliate revenue accounted for only 2% of total revenue in 2017. By late 2020, it had increased to 40% of all digital revenues, representing 675% annual growth. The publisher expected to double its 2019 performance with a 70% profit margin.

However, affiliate commissions were slashed by companies like Amazon and Walmart in 2020, affecting the revenues of many publishers. This dependence on external players and their whims has driven some publishers to sell directly from their websites and also create/license products under their brand name.

BuzzFeed is one of them. The publisher made $300M in revenue in 2019 from affiliate ecommerce. In 2020, it launched Shop BuzzFeed where readers can make purchases on the site itself.

“We know that we drive meaningful discovery for our audiences, and we’re now focused on collapsing that journey from discovery to conversion,” Nilla Ali, Senior VP of Commerce, BuzzFeed told AdAge.

Creating our own ecommerce platform gives us the opportunity to own the entire user journey and create an even deeper, more direct relationship with our readers.

Nilla Ali, Senior VP of Commerce, BuzzFeed

The company also said it expected an average of 25% commission on sales from its own store, compared to just 10% from sales with affiliates.

Other publishers having their own online stories include Condé Nast, Vogue and Wired. Meredith and Hearst also have online stores for some of their media properties, according to the report.

Other ecommerce revenue options commonly used by publishers include Licensed products, Subscription boxes and Bookazines.

$25.1B in retail sales of licensed merchandise

“Brand licensing can be big business,” writes Wilpers. He points to Meredith which generated $25.1B in 2019 coming second after the Walt Disney Company in global retail sales of licensed merchandise in both 2019 and 2020. The momentum accelerated in 2020 with the publisher reporting a 21% YoY increase in branded content sales in Q1 of 2021 compared to Q1 of 2020. Other publishers on the list include Playboy ($1.5B), Hearst ($500M), and Condé Nast ($150M).

75% retention rate

Subscription boxes are not a new idea. Companies in the food and beverage and education space have been doing very well in this area. Among publishers, Condé Nast’s GQ offers a quarterly subscription box priced at $50 individually or $190 a year. It’s called the “Best Stuff Box and contains a collection of products selected by GQ’s staff. The product nearly tripled its revenue in 2020 and has a retention rate of more than 75%.

There is considerable potential in this space as seen in the high demand for food and beverage and education-related subscription boxes. These areas fall within the scope of many publishers’ expertise and are ripe for commercial exploration.

“A very profitable business”

Bookazines—a blend of books and magazines—are “a very profitable business,” says Doug Olson, President and GM, Meredith Magazines. The publisher whose newsstand revenue grew by $3M in Q2 2021, specifically cited bookazines in its earnings report, according to CNN. Meredith also produces bookazines for partners such as The Los Angeles Times, The New York Times (NYT) and Rolling Stone—which makes for another revenue stream.

A higher price tag and lower production costs (because of the archival nature of content) contribute to bookazines’ profitability. This has driven publishers like Bauer Media Group USA, Hearst and National Geographic to significantly increase their annual production of bookazines.

[Bookazines that] sell a fraction of the copies of an issue of one of our magazines can be successful.

Steven Kotok, CEO and president of Bauer Media Group USA

The content expertise of publishers combined with the trusting relation they share with readers prime them for success in ecommerce. “Publishers have an edge against commerce sites because they have organic traffic returning to their sites and many are returning several times a week,” says Jonas Sjostedt, Founder and CTO of Tipser, an ecommerce platform.

“Publishers have a strong media brand that people trust and editors who curate the world and make it relevant to the readers. Publishers can leverage that brand and capitalise on consumers directly where inspiration strikes,” he concludes.

More people are shopping online, conversion is higher and we’re getting better at anticipating consumer demand because it’s happening in real time. If you have not had a commerce business in the past or you haven’t doubled down on it, now is the time to do so.

Nilla Ali, Senior VP of Commerce, BuzzFeed