|

Getting your Trinity Audio player ready...

|

There could be a shift in dynamic amongst tech giants for digital ad revenue

The relationship between publishers and big tech is a widely debated topic. Recently, we have seen more and more initiatives being taken and some first small victories coming to fruition in the fight with big tech. We take a look at what changes and small wins we have seen over the first few months of 2022.

Big tech dominance slowing in the ad market

Over the course of the pandemic, ad revenue for big tech took to new heights. Industry estimates from Group M found that Amazon, Google and Facebook/Meta doubled their share of ad revenues over the last 5 years outside of China. In the US, this saw Google, Facebook and Amazon control 64.1% of the advertising market.

But the giants are starting to come back to earth after the pandemic boom. Whilst Facebook recorded growth of 56% in the second quarter of 2021, the tech giant only saw a 6.1% increase in ad revenue growth for the first quarter of 2022. Amazon’s advertising service sales hit $7.88 billion, up 25% year over year. According to Todd Spangler at Variety, analysts expected a higher take.

But eMarketer predict that Amazon will rebound at the expense of Google and Facebook. There could be a shift in dynamic amongst tech giants for digital ad revenue. Could this give hope to publishers?

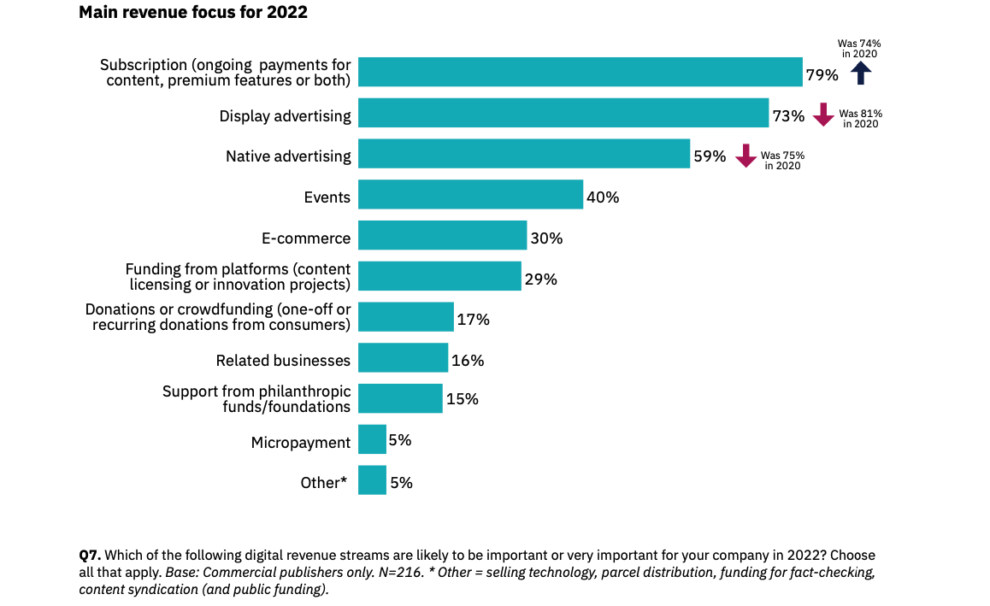

Big tech domination has indeed caused a significant decline in digital ad revenue for news publishers. For 2022, display and native advertising declined as a main revenue focus for publishers. Display advertising has gone from 81% to 73% in 2 years. Native advertising has dropped even more significantly from 75% to 59%. This drop has coincided with this rapid growth of big tech domination but also the focus around digital subscriptions for publishers.

However, this year’s WAN-IFRA World Press Trends Report suggests there could be some digital ad revenue hope for publishers. The report identified that digital advertising revenue for publishers actually increased by 16.5%, 2% higher than digital subscription revenue. With a digital advertising market seemingly in some form of flux following the pandemic, could we see ad revenue return to publishing? The answer to this remains unclear. Subscriptions still represent a more sustainable revenue source for the future of publishing.

Apple offering publishers the chance to do external subscriptions but at a cost

This change has been a big one for publishers. Apple FINALLY have allowed publishers (and other “Reader Apps”) to offer their subscriptions externally. This is a seismic shift in an industry where digital subscriber revenue is a publisher’s number 1 priority according to Reuters.

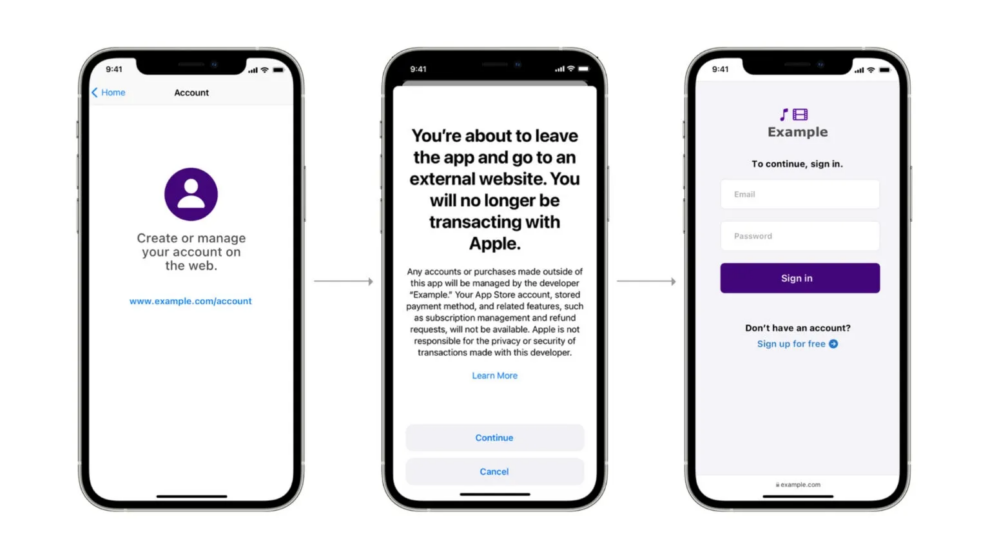

So, what does this mean going forwards? Publishers can now connect their apps to an external purchase pipeline. This means that subscribers can be taken elsewhere for account creation, management and subscription purchasing. Publishers can take back full control and receive full price for their subscriptions rather than giving 30% to Apple.

It is not just about revenue. This change also means that publishers can gather better audience data. In-app data went through Apple and was encrypted when passed through to the publishers. This meant that relationships were difficult to build.

On the face of it, publishers can receive their full deserved revenue and data. But of course, it is not that easy. The process is caveated. Apple prefer and will continue to favour developers using their own in-app subscriptions. Therefore, enabling an external link means publishers forfeit the right to sell their subscriptions in-app. Along with this, the user experience of the process is invasive, and prices are unable to be displayed in the app. No information can be passed through this outbound link and an external list feature must be requested by Apple.

Whilst this looks like a friendly move, there are still many decisions for publishers to make. We are intrigued how publishers react to this change.

Europe moves to limit the power of big tech

Big tech beware – the European Union have agreed on their rules around the future of the European Digital Market. And it seems that the lobbying of big tech hasn’t paid off. The legislation comes in the form of 2 flagship bills: The Digital Markets Act and The Digital Services Act. How will they impact big tech?

DMA is important because it will set out, for the first time, the rules of how large online platforms must compete in the EU’s market.

David Tvrdon, Journalist at The Fix

The Digital Markets Act aims to increase competition and cooperation in digital. In theory, the move will encourage EU tech players to thrive and provide an alternative to the traditional big tech platforms. We could see large messaging services like iMessage and Facebook Messenger forced to open up and interoperate with smaller messaging platforms, if they request. Users of smaller platforms could therefore communicate across messaging apps and platforms. In practise, the true impact remains to be seen and challenges are foreseen. What happens if big tech overstep the mark? Strict sanctions are cited in the European Parliament’s Press Release:

If a gatekeeper does not comply with the rules, the Commission can impose fines of up to 10% of its total worldwide turnover in the preceding financial year, and 20% in case of repeated infringements. In case of systematic infringements, the Commission may ban them from acquiring other companies for a certain time.

European Commission

With the legislation set to come into force in Q4 of 2022, it will be interesting to see how the tech giants change their products to comply with these new restrictions. To keep an eye on progress, the EU have adopted the “Keep your friends close but your enemies closer” approach and are opening an EU office in San Francisco.

The Digital Services Act puts pressure on big tech outlets to take more responsibility for content on their platforms. The act forces tech companies to act quicker to remove illegal and harmful content and goods from their platforms, take stronger action to limit the spread of misinformation and be transparent about their algorithms. According to the European Commission, “The DSA sets out an unprecedented new standard for the accountability of online platforms regarding illegal and harmful content”.

The Digital Services Act will enter into law either 15 months after the final text is voted through the European Parliament or on 1st January 2024.

Legislative moves to support local journalism in the US

Big changes are afoot in Europe, and there could be more to come in the US. There has been significant campaigning around the Local Journalism Support Act (LJSA), which was encompassed by the Build Back Better Act. The legislation, which passed the US House of Representatives in November, has currently stalled in the US Senate.

The legislation aims to offer greater support to help local journalism thrive and survive across the USA. In doing so, LJSA ensures local communities can receive accurate news about their area. Not only does the legislation do this through financial contributions to newsrooms and journalists, but it also aims to help them in their digital transition and dealings with big tech. This is a fundamental part of the LJSA as local newsrooms lack the power to negotiate deals with big tech unlike their national media counterparts.

This additional resource will provide the local news industry time to continue its transition to a more digital future and to work out a better arrangement either through legislation or other means to be paid when Google and Facebook use their content.

Dean Ridings, CEO of America’s Newspapers

Of course like with any legislation, there is no promise that problems will be solved. Some see the bill putting money into the wrong hands of those who own local newspapers, whilst others believe government interference should stay out of the media. The progression of the LJSA is a factor to follow in the fight between journalism and big tech.

Other developments to follow

- Following the example of Stuff in New Zealand, NRK, the public service media of Norway, is closing its news-focused Facebook page, citing limited value of the audience dialogue.

- News content from British publishers generates GBP 1 billion in UK Revenue for Google and Facebook, so one could be forgiven for thinking their influence on media will be around for many years to come….

- But there is fear that Meta will unfriend the publishing industry (despite their recent commitment to invest $1 billion into news between 2021 and 2024) to avoid incoming legislation requiring them to pay to host news content.

- Could this move actually benefit publishers? Australia’s media has thrived following the move to force Big Tech to pay for content.

- iOS 15 privacy changes are impacting open rates for publishers and beyond. These have often shown inflated results and have signalled signs of overachieving – so can they still be a reliable KPI.

Publishers clearly face an uncertain future relationship with big tech. Whilst some moves may look friendly on the surface, it is important to read between the lines. Building up sustainable business models will be crucial to keep publishers afloat for the future.

Matthew Lynes

Media Innovation Analyst @ Twipe

Get Twipe’s weekly insights on digital publishing, artificial intelligence, and paid content in your mailbox. Sign up here.