|

Getting your Trinity Audio player ready...

|

Highlights from Sovrn’s new Advertising Performance Benchmark Report, based on data from 6,000 publishers generating 25B daily page views across 60,000+ global sites.

“CPM seems to have returned to the usual patterns of seasonality in the latter half of H1 2022 while still flatter overall than what we would expect to see,” according to Sovrn’s latest Advertising Performance Benchmark Report. “For the second half of 2022, there remains a significant amount of uncertainty impacting global ad spend, driven by macroeconomic concerns and a softening of consumer spending, plus lingering effects of the Covid-19 pandemic and the ongoing war in Ukraine.”

The report offers a snapshot of advertising performance in the first half of 2022, including insights from the last quarter of 2021. It uses data from more than 6,000 publishers working with Sovrn. Collectively, they generate over 25B daily page views across 60,000+ global sites. This uniquely positions the company to provide granular ad performance insights to the industry at large and help publishers optimize their advertising strategies.

CPMs reflecting typical seasonal trends

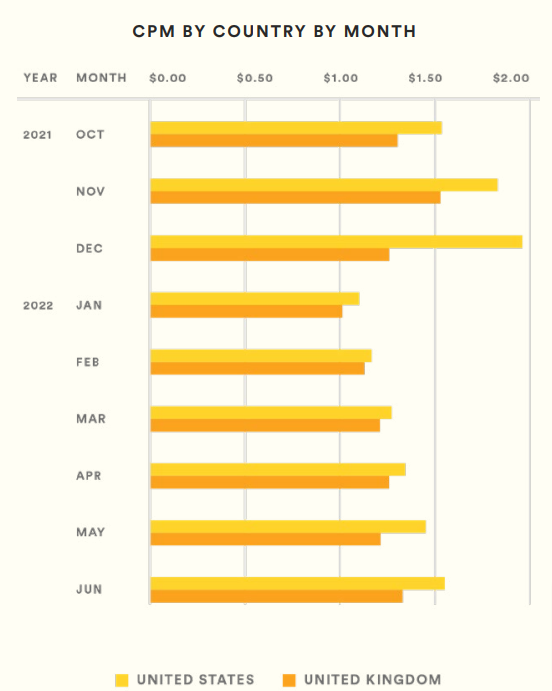

The data shows a seasonal increase in CPM in the run-up to the end of 2021 with a drop-off into early 2022 that was comparable to 2021. CPM recovery in 2022 is, however, slower than expected. The UK performed better than the US in the first half of 2022.

CPMs for news and business sites witnessed a downward trend as they were mostly dominated by updates on the Russia-Ukraine war. Advertisers were wary of appearing alongside negative news and adjusted spending accordingly. CPM rates for the travel sector in Q1 and Q2 were in line with Q4, as countries began to open their doors to tourism. And those for lifestyle, arts, and hobbies reflected typical seasonal trends from Q1 to Q2.

Ads with 80%+ viewability fetch 3x greater CPM

The report looks into the factors influencing CPM. “Advertisers evaluate and optimize each ad request against a myriad of variables before deciding how much to bid,” it notes. “The level of emphasis placed on each variable comes down to the individual buyer and their targets.” However, there is a common group of factors that “consistently have an outsized impact on CPM rates.” They are ad, user and page attributes.

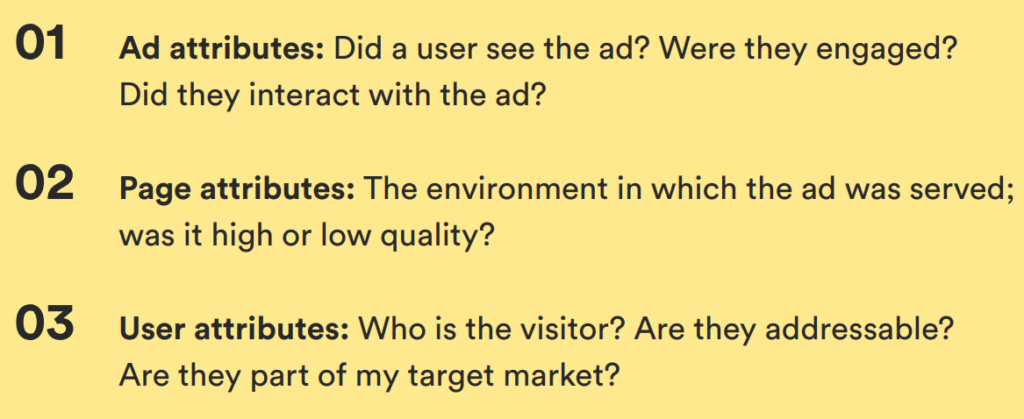

Viewability determines ad performance – ads with 80%+ viewability fetch 3x greater CPM. “The longer an ad is visible, the greater the chances it will be seen — and command higher CPMs,” according to the report.

“But that viewable time must also be high quality, while the user is actually engaged with the content — otherwise it’s less likely to make an impact.” This is leading buyers to optimize their bids toward user engagement. Sovrn data shows 85% CPM increase after 12 seconds of engaged time, and 2x after 16 seconds.

“Reach visitors in the right environment at the right time”

The data does not show any correlation between the volume of site traffic and the amount of attention that a publisher’s content captured. “Publishers capture the same level of user attention per page view regardless of the traffic volume,” according to the report. “That said, there is a slight bias from ad buyers toward high-traffic sites, but this is a marginal difference compared to other areas covered in this report.”

Advertisers want to reach visitors in the right environment at the right time, therefore much attention is given to selecting the right websites and page sections for creative placements.

Advertising Performance Benchmark Report

The report recommends publishers consider “where their ad is positioned on the page to match what buyers are seeking and not just which page is available for targeting.”

“Huge opportunity for publishers to monetize audiences”

“For ad buyers, ensuring ads reach the right user has always been the holy grail,” the report notes. This is done in digital advertising by micro-targeting users with the help of third-party cookies. “However, privacy headwinds are making addressability (and, by extension, attribution) an ever-evolving challenge.” Publishers, though, are in a good position as they have the opportunity to develop a deeper understanding of their audience and control their data, as well as drive revenue from readers.

Buyers are looking at Universal IDs (UIDs) as a possible alternative to continue identifying and targeting users in a world without third-party cookies – 61% of all bid requests now include UIDs. “Data from leading demand-side providers (DSP) shows a 5x variance in uplift based on the individual UID employed,” according to the report.

In environments that do not support third-party cookies, such as Safari and Firefox, where traffic had a UID match, it saw a 71% uplift in CPMs. This demonstrates there is a huge opportunity for publishers to monetize audiences using cookieless browsers.

Advertising Performance Benchmark Report

“While third-party cookies still lead the way in performance, UIDs are playing a growing part in driving CPMs,” the report suggests. “The more publishers and advertisers explore this approach, the better the results for both buyers and sellers. Publishers should be exploring today the opportunities that alternative browsers offer to unlock more revenue from their existing audiences.”

The full report can be downloaded from Sovrn:

Advertising Performance Benchmark Report