|

Getting your Trinity Audio player ready...

|

As part of WNIP’s series based around our Publisher’s Guide to Ecommerce report, Damian Radcliffe looks at how platforms are shaping the future of online shopping, from Pinterest and Facebook to Amazon and more.

The relationship between content creators and social networks is often an uneasy one.

Despite recent overtures from tech giants to support their work – ranging from paid pilots of new platforms (e.g. Facebook Live) to new services (such as Facebook Watch, and Facebook’s new news tab), as well as training (Facebook Journalism Project) and investment in innovation (Google’s Digital News Innovation Fund) – this fraught dynamic is unlikely to change anytime soon.

Indeed, it’s only likely to become more complicated as Amazon continues to muscle into this space, both in terms of content and digital advertising.

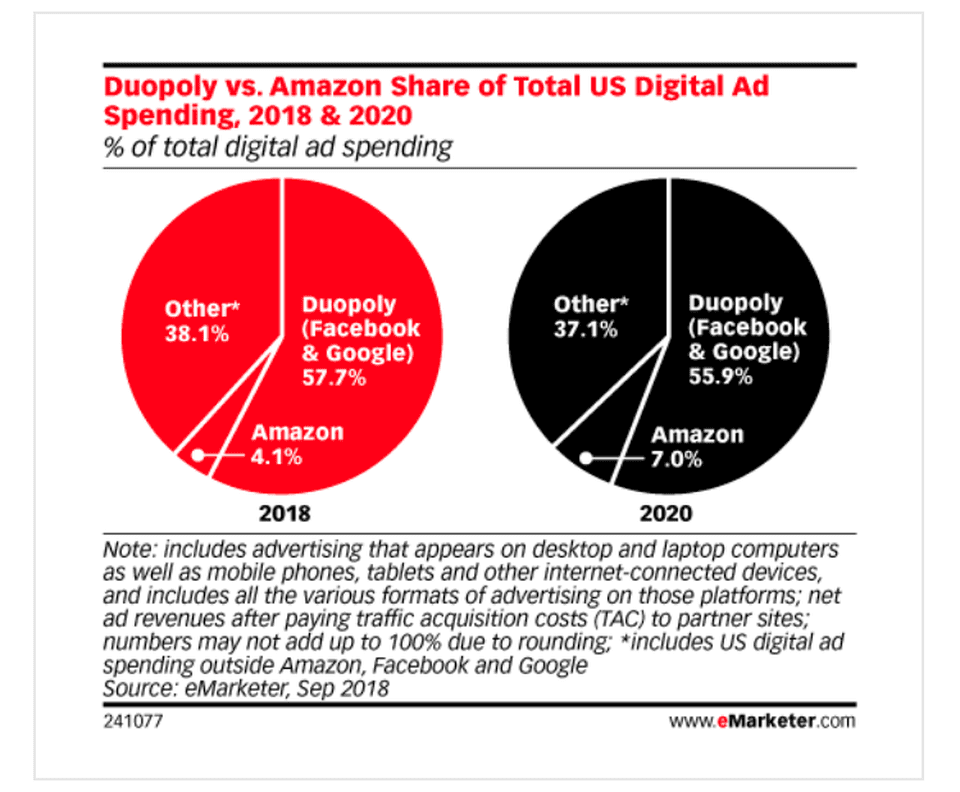

eMarketer predicts that Amazon, Facebook and Google will home nearly 70% of digital spending in the U.S. by 2021.

Because of this, it is incumbent on publishers to diversify their revenue streams and look for new sources of income. That many outlets have also been burned by putting all of their eggs in the platform basket (e.g. the infamous pivot to video) also further reinforces this strategic imperative.

The experiments outlined in this recent series (looking at BuzzFeed, POPSUGAR, Marie Claire UK, NBC Universal, Dennis Publishing and others) play out against that backdrop.

However, the eCommerce environment is a space where the uneasy relationship between platforms and publishers is only likely to continue, not least because of the role that major social networks are playing in mobile commerce.

Although a number of publishers are seeking to create a frictionless experience between viewing content on their website, or app, and the ability to “shop the story,” they’re competing against the reach, technology and user experience associated with some of the biggest social platforms. It’s all a bit David and Goliath.

The size of this challenge can be seen in Mexico, where WhatsApp users can order their groceries from Walmart using the messaging app. Penetration of WhatsApp among social media users is 93%, meaning that it’s an interface consumers are used to, whereas publishers are likely to all have their own UX and design. And of course, they can only dream of that type of reach!

Moreover, when looking at one emerging area, video shopping (explored in more detail below,) as Zenith notes, much of the potential in this space is already being driven by the work being done by platforms, rather than publishers.

“It is becoming easier to shop via video because of the platforms that are available, whether its YouTube’s shoppable ads, Instagram Stories’ shoppable video layer or Snapchat’s “swipe-up” as an e-commerce call to action.”

These examples are not unique. Here’s some of the key ways in which platforms are developing their commerce capacities, all of which have potential implications for publishers.

Pinterest’s recent IPO valued it at $10 billion. Described as “an underdog platform for publishers,” by NewsWhip’s Gabriele Boland, Pinterest’s IPO documentation (their S1) states how valuable their retail audience is:

“Pinterest reaches more than 250 million monthly active users, two thirds of whom are female…This includes eight out of 10 moms, who are often the primary decision-makers when it comes to buying products and services for their household, as well as more than half of all U.S. millennials.”

Having generated $755.9 million in revenue at the end of last year, compared to $472.9 million for the same period in 2017, the platform is growing fast; expanding its advertising capabilities, geographic footprint, and the ease with which consumers can shop on the platform.

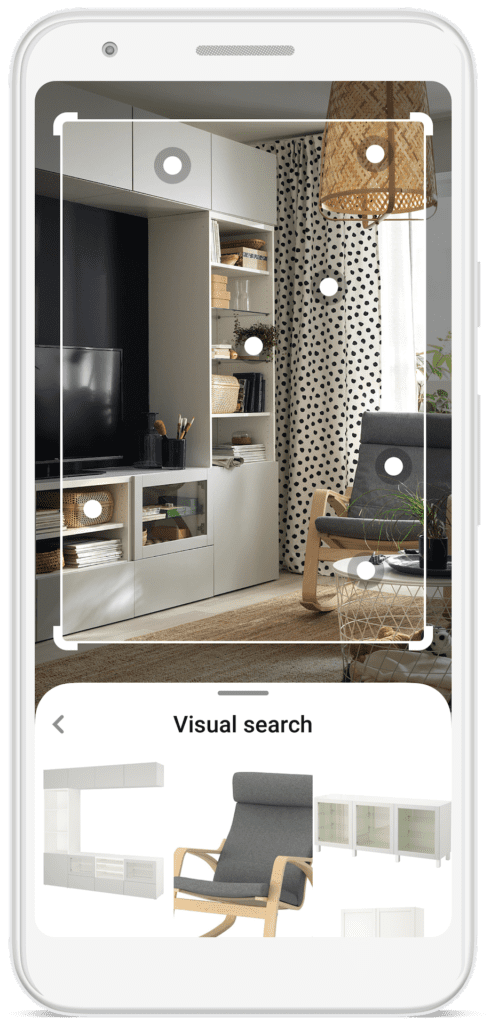

This includes being able to use your smartphone camera for visual searches, as well as “Shop the Look ads” (a concept and terminology we’re seeing publishers using) and the ability to view retailers online catalogues on the site. WhatsApp similarly introduced product catalogues for small businesses last month.

Data published last year by NewsWhip, showed how a range of publishers – from BuzzFeed to the Daily Mail, New York Times and Vogue – were all enjoying engagement on Pinterest, while The Nation’s Olga Nasalskaya (in a previous role) has outlined some of the benefits of the platform for advertisers and marketers. This goes well beyond simply using Pinterest as a way to simply spot trends.

With 300 million MAUs (monthly active users) at the end of Q2 2019, and Mary Meeker’s Internet Trends Report way back in 2016 already reporting that 55% of Pinterest users were using the site to find and shop for products (compared to 12% of Facebook users,) it’s perhaps no surprise that some commentators are calling for a “pivot to Pinterest.”

The Facebook Family

Similarly, Facebook owned properties are also expanding their eCommerce capacity.

Business can set-up a shop on the social network, which includes the ability for consumers to buy products. Although, interestingly, at present you can only sell physical items – which thereby excludes digital or downloadable products – from a Facebook Shop page.

However, Facebook is increasingly looking to integrate elements of Instagram’s functionality on the original social network (e.g. with cross-postings of ads and Stories, as well as monetisation of the Stories format), as it looks at new revenue streams for its core product. This may well include more partnerships, including those of the eCommerce variety, with publishers.

On Instagram, most efforts from publishers, at present, focus on driving subscriptions, app downloads and engagement. But, again, that may change as the network evolves.

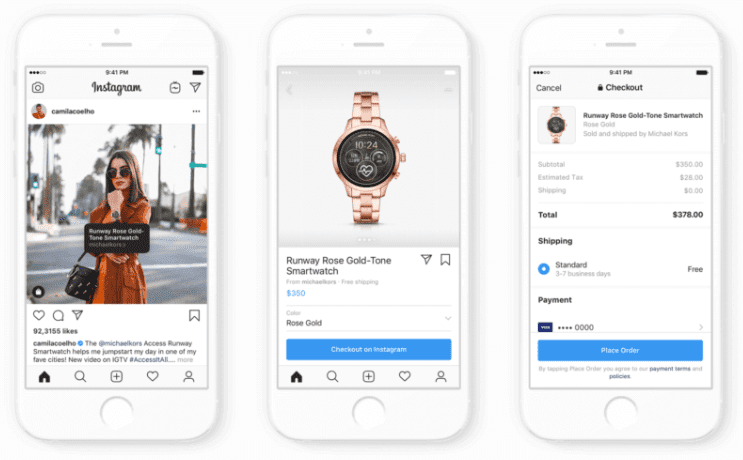

Instagram launched an in-app checkout function in March 2019, working with 20 major brands, enabling consumers to purchase products without leaving the app. This was later expanded to include influencers and publishers like Vogue, Elle and GQ.

Via Instagram Business Blog

POPSUGAR, meanwhile, has built an Instagram tool that helps retailers with their e-commerce, demonstrating the potential for publishers to think about B2B, as well as B2C, in this arena.

Quite the quandary

As Amalie Nash, Vice President and Executive Editor for Local News at the USA Today Network has previously explained (during her time at the Des Moines Register) for publishers, the platform conundrum can be summarised thus:

“Are you hoping the money follows, or are you doing it just because that’s where an audience that you’re to reach is, and you’re hoping they will hear our message and then come back to your site? What does success look like on a platform like that?”

That remains the $64,000 question.

But, one thing’s for sure, all of the social networks are exploring opportunities to improve their eCommerce capabilities, increasing the likelihood that publishers will need to work with them in this space, whether they want to or not.

“When we send our followers off-platform, we typically direct them to our link in bio,” Rachel Karten, associate director of social media for Bon Appétit and Epicurious, told Digiday earlier this month. “It can sometimes feel like a clunky process, especially when we are asking them to buy something, so I love that we can keep the purchase within platform.”

Even the new kid on the block, TikTok, is exploring the social commerce arena. With the app recently hitting 1.5 billion downloads, the reach of this – and other social media networks – the lure for publishers to work with these platforms will (understandably) be too big to resist.