|

Getting your Trinity Audio player ready...

|

The impending ‘Cookiepocalypse’, scheduled for the end of 2023, “could bring with it a new era of growth in digital media,” notes James Hewes, President & CEO, FIPP in the introduction to a new report, First-party data playbook for publishers.

“While it is true that we will soon be leaving behind the cookie-based infrastructure that has dominated the digital landscape for decades, the shift back towards more contextually targeted environments puts publishers, by their very nature, in prime position to benefit.”

“More subscriptions, digital advertising, and e-commerce”

As one prominent global media executive said, “This is the perfect storm for media companies to seize an opportunity to grow first-party data. The result will be more subscriptions, digital advertising, and e-commerce.

The shift from third-party cookies will be as fundamental as the shift to web-based services and smartphones at the start of the 21st century.

Julia Clyne, Head of Media Sales & The Trust, Dow Jones, APAC

The FIPP report authored by Martha L. Williams, CEO of World Newsmedia Network – provides a tangible blueprint for success in the post-cookie era. It includes several case studies from publishers like Dotdash Meredith, The South China Morning Post, and RTL, and also offers a deep-dive analysis into some of the key challenges – and opportunities in front of publishers.

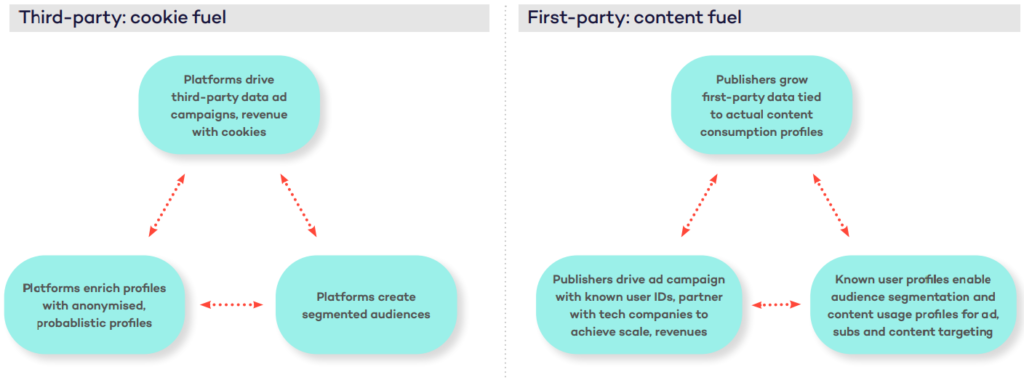

“The switch will drive a profound, historic shift from platform-controlled unknown user data to publisher-controlled known customer data,” writes Williams.

The seismic shift signals an opportunity for publishers, who own a wealth of content. Media companies can leverage their content assets and their trusted relationships with customers to drive more first-party data, which will inform new products, content, ad campaigns, subscriptions, e-commerce, and more.

Martha L. Williams, Author, First-party data playbook for publishers

Publishers accelerating their first-party data strategies

There are significant hurdles to overcome as well. According to, The Demise of Third Party Cookies and Identifiers, a 2021 report by McKinsey, the publishing industry could lose US$10B in ad revenue. It will have to be replaced with revenue from different forms of advertising, subscriptions, and other sources. This is a challenge for many publishers who report that less than 3% of their traffic comes from known users.

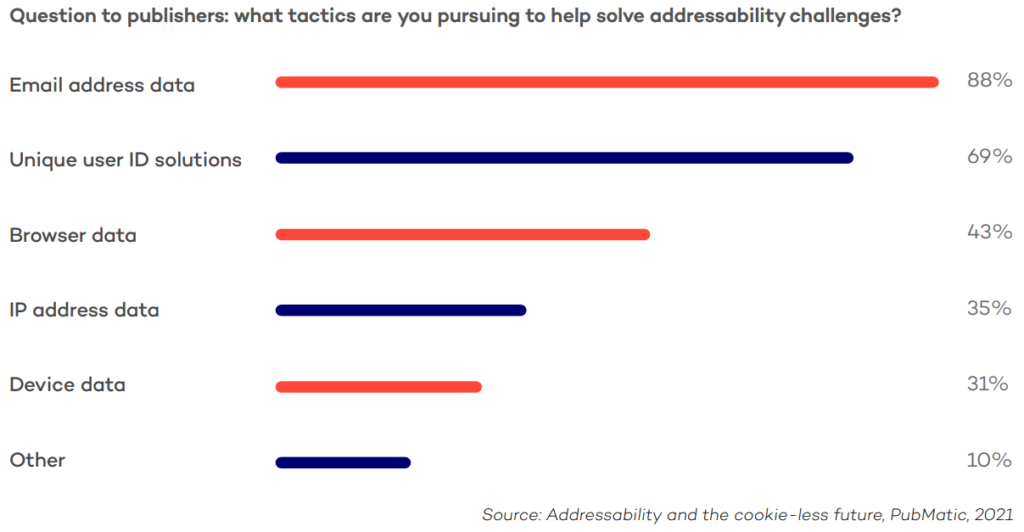

They are launching or accelerating their first-party data strategies. A 2021 global survey of publishers by PubMatic found that 36% of the respondents were working on first-party data “addressability” issues for a year (since 2020), 41% started last year (2021) and 14% said they’ll start in 2022.

“Addressability refers to the use of media sites to target individuals with messages, products or offers, rather than large groups of anonymous third-party cookie groups,” explains Williams. “It requires publishers to target users across multiple devices and sites, while simultaneously eliminating redundancies.”

Top publisher solutions include adding email address data (88%); creating unique user ID solutions (69%); collecting browser data (43%); collecting IP address data (41%); and collecting device data (10%).

Contextual advertising projected to grow to $335.1B by 2026

“We don’t need third-party cookies to be successful and we don’t need our users’ private information to help them achieve their goals,” says Alysia Borsa, Chief Business Officer, Dotdash Meredith. The publisher is amping up its contextual advertising – its first-party database is built with content and advertising usage data, and includes purchase intent data, which helps drive a robust advertising and e-commerce businesses.

“Meredith possesses rich, exclusive data with massive scale in content-rich environments,” says Borsa. “Using those assets, we’ve built an exclusive, in-depth 12,000+- term taxonomy, a proprietary identity graph, and over 12B intent signals to achieve an unmatched, comprehensive and timely understanding of women and their purchase intent – the holy grail for our partners.”

Intent-driven contextual advertising beats cookie-based advertising in performance every time.

Neil Vogel, CEO, Dotdash Meredith

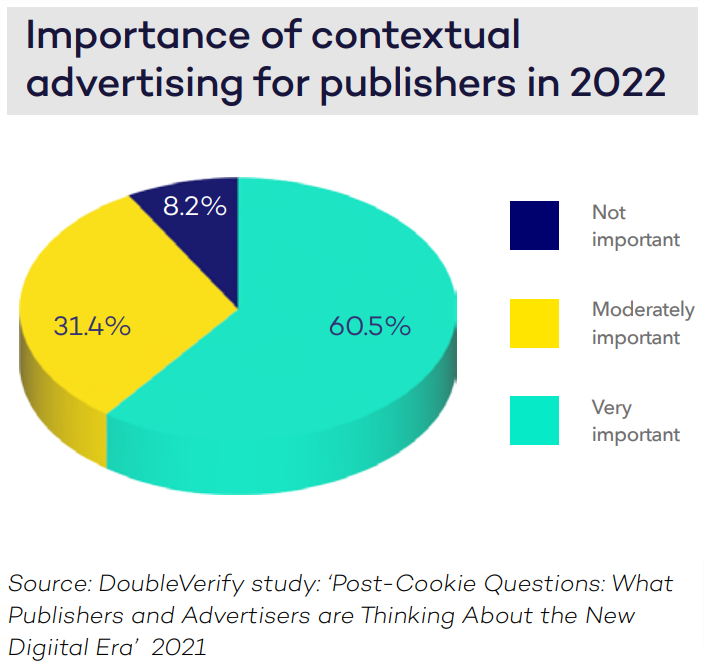

Contextual advertising is growing at a rate of 13.3% YoY. The global market estimated at US$157.4B in 2020 is projected to surge to $335.1B by 2026. More than 90% of 300 publishers surveyed for a 2021 DoubleVerify study said that contextual targeting capabilities will be either moderately or very important in 2022. 95% said they planned to use it in 2022.

“As simple as providing quality content as a value exchange”

Accelerating the growth of registrations and/or subscriptions is an effective way of harvesting more first-party data. It is “predicated on value exchange with the users, that is, the offer of valuable content or services in exchange for personal information,” writes Williams. “These value exchanges can transact at registration and subscriptions, in exchange for a newsletter or a set number of articles per month or an infinite number of other content or services.”

Dotdash Meredith was one of the first publishers to use a value exchange approach with their readers as a part of their first-party data strategy, according to its VP for Innovation and Data, Tiffany Johnson. “Our first-party data strategy is as simple as providing quality content as a value exchange,” she explained.

“For example, at allrecipes.com, you create your own account and sign up for info you want to receive. Consumers are willing to give their data as long as you give them that content. We are set up with brands and content they want to hear about. People are more than willing to safely provide that kind of data, so they can continue to read that content.”

“First-party data is like oxygen”

“First-party data is a necessary foundation to drive all of publishers’ strategies: content, product, revenue and growth,” notes Williams. “Publishers must accelerate their collection of first-party data with the necessary technology, training, structure, workflow and finesse.”

This will require them to make fundamental structural and technological changes. “Most media companies are structured with separate subscriptions and advertising operations,” she adds. “However, the future model will be a unified commercial strategy with consumer’s detailed, first-party data at the center.”

It can be accomplished with cross-functional teams that include people from advertising, subscriptions, technology, editorial, marketing, and more. These teams would focus on developing data sets and products that grow both revenue streams. Publishers using this strategy include the New York Times, Financial Times, RTL, and the Philadelphia Inquirer.

“If you’re thoughtful about it, the subscriptions business powers your advertising business,” says John Slade, Chief Commercial Officer, the Financial Times. “You have a direct reader relationship, great data comes from that relationship and can drive a much more effective, analytical, targeted advertising business.”

In the long run, first-party data is like oxygen. It is the foundation on which the future is built.

Pete Doucette, Chief Revenue Officer, Philadelphia Inquirer

The full report can be downloaded from FIPP:

First-Party Data Playbook