|

Getting your Trinity Audio player ready...

|

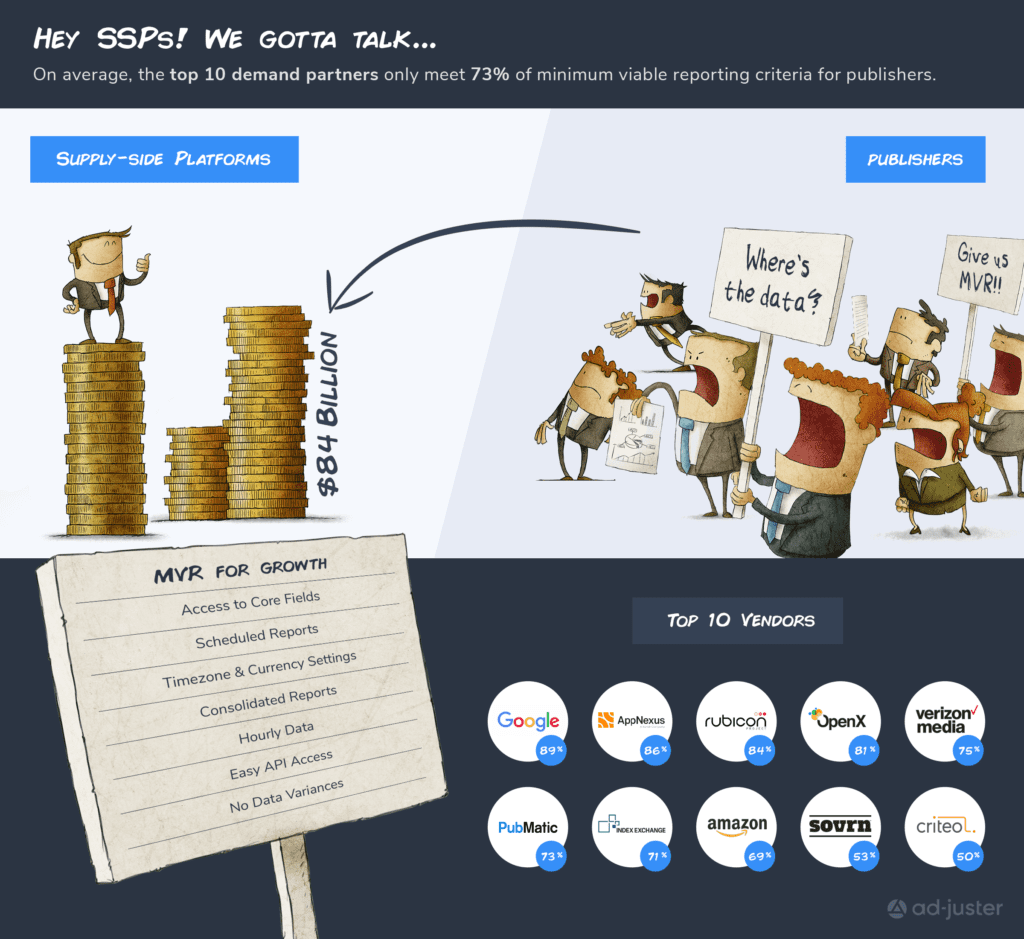

Programmatic demand has become an essential part of many EU publishers’ revenue strategy. Sell-side platform (SSP) companies have seen amazing growth—the top 10 alone account for over $84 billion in worldwide revenue. However, when it comes to analyzing critical data in order to optimize their programmatic business, publishers are left to fend for themselves.

On the one hand, SSPs often do not take into account what a publisher needs to remain competitive. On the other, publishers frequently don’t have a clear understanding of the data reporting they should expect from their SSPs even though this reporting is a critical part of a publisher’s currency for running the business.

Fortunately, publishers don’t need to continue making decisions in the dark. Through work with more than 100 of the leading EU and US publishers, a clear set of data reporting requirements has emerged, which SSPs should be expected to address. The rest of this article looks at those data reporting demands.

MVR: designing a new publisher data standard

Without agreed-upon standards, each SSP is left to determine how and what it reports on for publishers. The lack of standards leaves an inherent disconnect that makes it impossible for publishers to access and aggregate the performance data necessary to scale their operations and revenue.

Looking through the lens of a publisher, Ad-Juster has set out to develop a set of standards that define what publishers should expect from their demand partners. Because the company does not buy or sell any media—just reports on it—there is an opportunity to take a ‘Consumer Reports’ agnostic approach in starting an overdue conversation that we hope will lead to action and increased investment from SSPs in API reporting.

The Minimum Viable Reporting (MVR) standard establishes baseline data and reporting requirements to enable any publisher to develop a reliable and robust foundation for optimizing their advertising business. Effectively, MVR answers three important questions for publishers: Can I get all of the data I need? Can I get this data in the format I need? And, can I get the data in an automated, scalable way? To address these questions, we have taken a very pragmatic approach with the collaboration of our product team and countless publisher conversations to establish a fair, but effective scoring criteria. We believe MVR and the scoring criteria will, in essence, set the table stakes that allow all industry participants to win.

What should publishers expect from SSP partners?

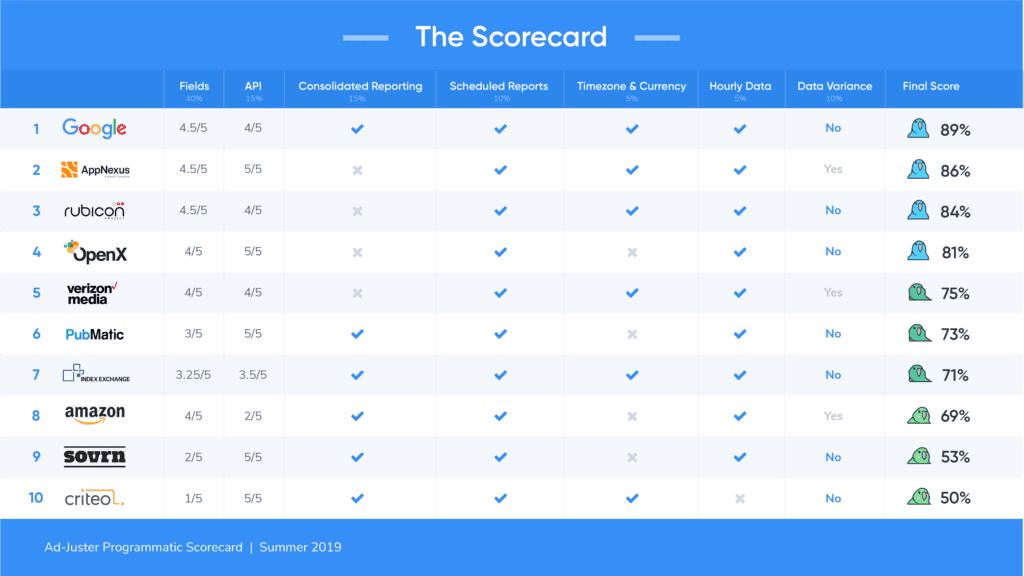

In our recent report, SSPs were scored with the MVR standard. Vendors were evaluated across seven data-related categories that publishers require for earnings-related insights.

The most important criteria, weighted at 40% of the total score, look at how many of the 12 ‘core fields’ a vendor provides via an API. These are fields, such as ‘Advertiser’ and ‘Revenue,’ that publishers rely on to understand how their inventory is performing. Without automated access to these data points, publishers will struggle to build a scalable foundation for their business.

The key to scalability here is that access to these fields is automated, which is why the availability of a public API that is easy to set up (15%) has the second largest impact on the overall score. It is not realistic for a publisher with more than two or three demand partners to manually pull these critical fields from the vendor’s user interface (UI) and expect to have an efficient, accurate reporting process. (We all understand the issues with manual reporting by now, right?)

If a vendor does not provide everything through its API, scheduled reports (10%) that feed into a single location is the second-best option for building scale into your operations. However, even if a vendor has an API that provides all of the core fields or allows for scheduled reporting, it still may be difficult to get all of the necessary data without consolidated reports (15%). Some vendors will have data restrictions, such as a limit to the number of rows allowed in a single data pull or limits on the number of dimensions that can be included. Many publishers also want the ability to join various data sets that are found in multiple reports, which can prove difficult when these kinds of limitations exist.

The report also looks at the ability to set time zone and currency at the report level (5%), which is critical for publishers with international audiences. It also examines whether the vendor offers real-time and hourly data (5%), and if there are any noted variances between data accessed via API versus what we see in the UI (10%).

Our goal with this report is to give a voice to publishers in order to drive an important industry conversation, provide publishers with transparency prior to entering into a relationship, and empower SSPs with insights on how to better serve publisher clients.

For SSPs this is a critical crossroad—failure to provide publishers with MVR, and thus not aligning with the needs of their clients, will lead them towards extinction. Several vendors mentioned in this first report are already taking note and are eager to understand what they need to do to improve their score. This is exactly the kind of movement we need in order to progress.

It’s exciting to see that the conversion is moving forward, but we have a lot of work to do. The average score across the top 10 is only in the low 70’s. And, considering the billions in revenue that these top SSPs are generating, publishers should expect more. Publishers rely on this data and will reward SSPs that make the investment in a strong MVR foundation. It makes economic sense to do better.

How did they score?

It will be interesting to see how these conversations evolve into action and how this list changes over time. We urge SSPs to take this challenge seriously and work to better meet the needs of publishers. The development of these conversations and alignment on industry data standards is paramount for a future of growth.

The full Data Scorecard can be downloaded here.

Dan Lawton, Chief Marketing Officer and Chief Business Development Officer, Ad-Juster

About: Ad-Juster is a market-leading SaaS provider of unified data reporting and analytics for digital advertising, serving more than half of the top 50 comScore-ranked web publishers (ranked by impression volume). Since 2007, the company has worked with over 150 blue-chip publishers,

agencies, ad-tech platforms, and ad networks to deliver a digital advertising measurement product line for streamlining workflows, overcoming billing discrepancies, optimizing programmatic performance, and maximizing revenue.