|

Getting your Trinity Audio player ready...

|

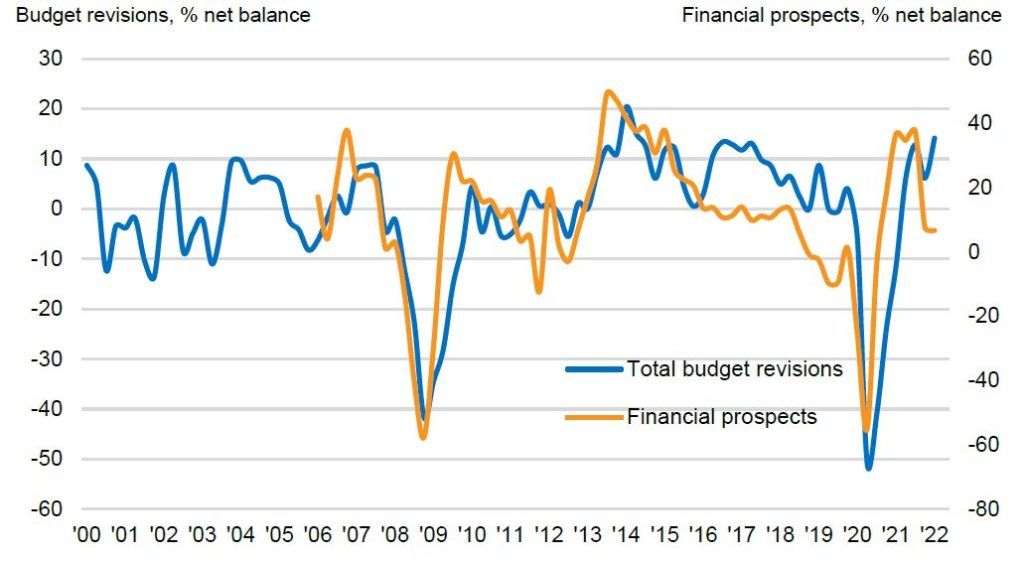

This is the highest since Q2 2014, and marks the 4th successive quarter in which marketing budgets were upwardly revised

Total UK marketing budgets were revised up to an almost eight-year high during the opening quarter of 2022, according to the latest IPA Bellwether Report published today, with UK companies stepping up efforts to promote their brands as pandemic-related risks recede.

According to Bellwether data, marketing budgets were upwardly revised by nearly one-quarter of survey panellists (24%). By contrast, 10% of companies recorded budget cuts, yielding a net balance of +14% in Q1 2022. This was the highest since Q2 2014 and marked a fourth successive quarter in which marketing expenditure has expanded.

Not surprisingly perhaps, as the UK re-emerges from two years of restrictions, the top-performing segment during the first quarter was events, with a net balance of +19%. Solid budget expansion was also seen in main media (+9%), with other online (+19%), video (+9%) and published brands (+1.3%) driving growth.

The outlook among surveyed marketing executives with regards to their budgets for the 2022/23 period was strongly positive, with 44% of respondents anticipating growth in their available marketing spend in the coming year. This compared with 11% that expect cuts, resulting in a net balance of +33%.

That said, regarding their industry as a whole, survey respondents were more pessimistic than they were three months ago due to high inflation and a squeeze on household budgets, supply chain disruptions and labour shortages, as well as the conflict in Ukraine.

Living costs are rising, we may see inflation get close to or even hit double digits in the coming months, and this will weigh on purchasing power. Supply chain issues are still prevalent and have been exacerbated by the war in Ukraine. Rising geopolitical tensions also create uncertainty, and it may lead to companies re-assessing their decisions until all of these risks reduce.

Joe Hayes, Senior Economist at S&P Global and author of the Bellwether Report

Industry reaction

Alison Harding, VP of Data Solutions, EMEA, Lotame comments, “The increase in online spend shows that marketers and publishers are now in a better position for the retirement of third-party cookies. This is due to the introduction of more identity testing and maybe even having the adoption of identity solutions as part of the marketing mix. There is also an argument to be made that businesses may be pivoting spend into online advertising as they are being boxed out of the Apple mobile universe, and are moving budgets to fill this gap.”

Jacopo Gerini, Chief Commercial Officer, Clickio says, “While there’s reason to be optimistic about adspend forecasts, publishers are struggling to keep on top of changes and protect their bottom line. Moving forward, publishers should channel their efforts into optimizing their sites for the user experience, focusing on features that increase loading speeds, boost engagement, and drive advertising revenue. Working with Consent Management Platforms will also be key – helping publishers stay abreast of industry initiatives while optimizing site design to boost consent rates.”

Pierce Cook-Anderson, Managing Director, Northern Europe, Smart AdServer says, “As budgets continue to grow, the industry needs to channel them into tools that continue to drive value path optimization, rather than convolute the supply chain further. Curated marketplaces, for example, deliver better efficiency and more streamlined workflows by packaging up ready-made audiences with high-quality inventory. This saves time and resources, meaning ad budgets can be better allocated. At the same time, curation gives publishers back control over their data and increases demand for their inventory.”

Mari Kim Novak, Chief Marketing Officer, Yieldmo adds, “As growth towards video continues, marketers need partners who can help them create differentiated, high-quality video ad experiences that consumers want to pay attention to, and find those audiences that will be essential to the success of their campaigns. Consumers expect brands to provide integrated seamless advertising experiences and therefore the marketers that are able to provide these will win the lion’s share of sales. This can only be achieved by utilizing intelligent predictive data and unique, shoppable ad formats.”

Publishers who diversify will come out on top

Sivan Tafla, CEO of Total Media Solutions comments, “This isn’t the time to get comfortable. The persistence of supply chain issues, the cost of living crisis and war in Ukraine, serve as a reminder that the ecosystem is susceptible to shocks. Publishers that can diversify their business models and product offerings to protect against fluctuations in audience income and varying interests based on the news agenda, will be best placed to retain audiences and offer continued advertising opportunities to brands.”

Andy Ashley, Global Marketing Director of SmartFrame Technologies comments, “Advertising budgets may be reaching new highs but it’s clear there are still many hurdles to overcome before confidence returns to pre-pandemic levels. In an extended period of economic uncertainty, tech innovations can deliver reliable solutions despite the constant change. Selecting tools that empower flexibility – while also maintaining confidence that placements are brand-safe and highly relevant in the soon-to-be-cookieless world – will help advertisers navigate this challenging period and maintain progress towards a better, more informed industry altogether.”

Nick Reid, SVP & Managing Director, EMEA , DoubleVerify, says, “It’s great to see the UK industry’s continued recovery and growth. Brands are building momentum from this growth through investment across platforms and environments, whilst utilizing technology that can optimize from a media quality baseline. We are also seeing the transition away from reliance on the third-party cookie for digital advertising. For this reason, we can expect an even greater focus on areas such as context and attention from targeting, measurement and optimisation perspectives.”

Isabella Jenkins, Agency Partner at Permutive comments, “It is exciting to see the growth of marketing budgets on an eight-year high following the turbulence of the pandemic. However, ad spend forecasts have reduced for the next two years. If ad spend is to reduce, brands will need their advertising to work harder as a result, making more out of less spend. One way brands can achieve this is by leading with a strong first-party data strategy, reaching the right audiences in the most effective way possible. This strategy will necessitate partnering with publishers, providing brands with access to consented first-party data that publishers hold.”

Ryan Afshar, Head of Addressability UK at LiveRamp comments, “To ensure that their ad spend budget is being directed efficiently, brands should continue to build campaigns based on people-based identifiers. Simultaneously, publishers who can increase their authenticated user base using strategies such as content walls, newsletters and email subscriptions, will build trust and loyalty with their audiences as privacy and personalisation are balanced. Publishers and brands who can work together on strategies that have addressability at their heart will thrive as we enter a privacy-centred, addressable future.”

Matt White, VP EMEA at Quantcast comments, “Last quarter saw an increase in marketing spending despite the Omicron variant causing restrictions to be reintroduced, and this quarter follows the same trajectory with marketing budgets increasing yet again. This is hugely positive for the industry after what has been a difficult two years.

“However, this doesn’t show the whole picture for the UK. Inflation and the cost of living crisis mean that the economic situation is precarious, and many consumers will find themselves altering their everyday spending habits. In this instance, an increase in marketing spend is necessary to keep the economy moving; consumers will be less likely to spend money, so campaigns need to be more compelling than ever to attract attention. This economic turbulence may mean that marketing budgets could once again experience many unprecedented peaks and troughs as we continue through the year.”