|

Getting your Trinity Audio player ready...

|

Content licensing, previously the preserve of large media empires, is being disrupted by a number of startups gaining serious traction with many publishers. Future plc, Immediate Media, The Independent, London Evening Standard, and Autovia are just some of the publishers now gaining extra revenue from licensing their content in foreign territories, both in English and native tongues.

At WAN-IFRA’s World News Media Congress 2022 in Zaragoza, one of the biggest exhibition stands was for the licensing division of The New York Times. The distinctly Citizen Kane-esque hulk of a stand summed up perfectly the general perception of content licensing: staid, expensive, and the preserve of all but the largest media groups.

No longer.

A number of startups have sprung up that are now disrupting the content licensing space and opening it up to publishers of all sizes. Moreover, these startups have proven business models and are attracting publishers of the caliber of Future Plc, Immediate Media, The Independent, and others.

Joris van Lierop, CEO of The Content Exchange told WNIP that the economics are straightforward, “publishers need to maximize the revenue produced off the back of their content and content licensing provides a seamless way to do so. It won’t change a publisher’s core business, but it will add a healthy revenue stream for minimal effort.”

Content alliances are not new – Getty Images has built its business off the back of it. But the new generation of content licensing offers something new, a dynamic marketplace, and also a chance for regional publishers to make their work available at a national level.

Joris van Lierop, CEO of The Content Exchange

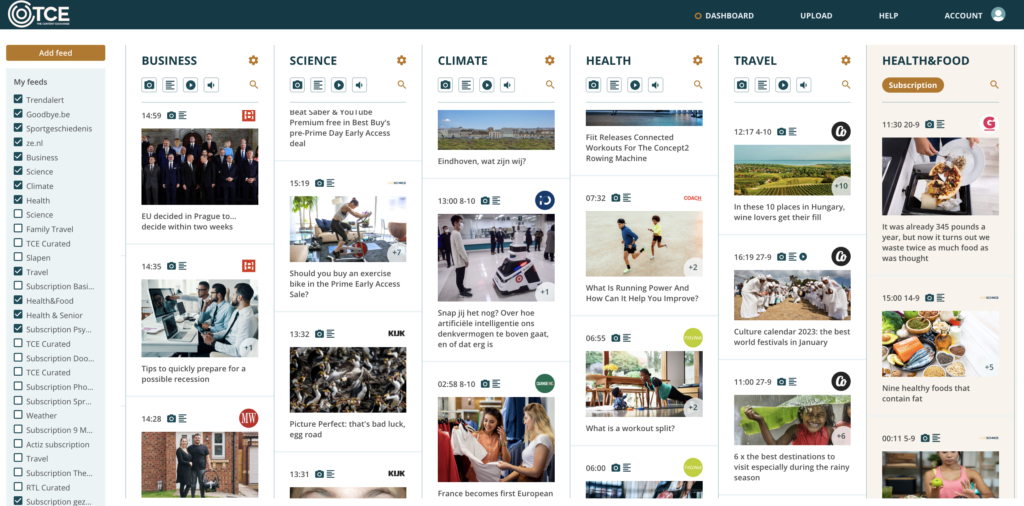

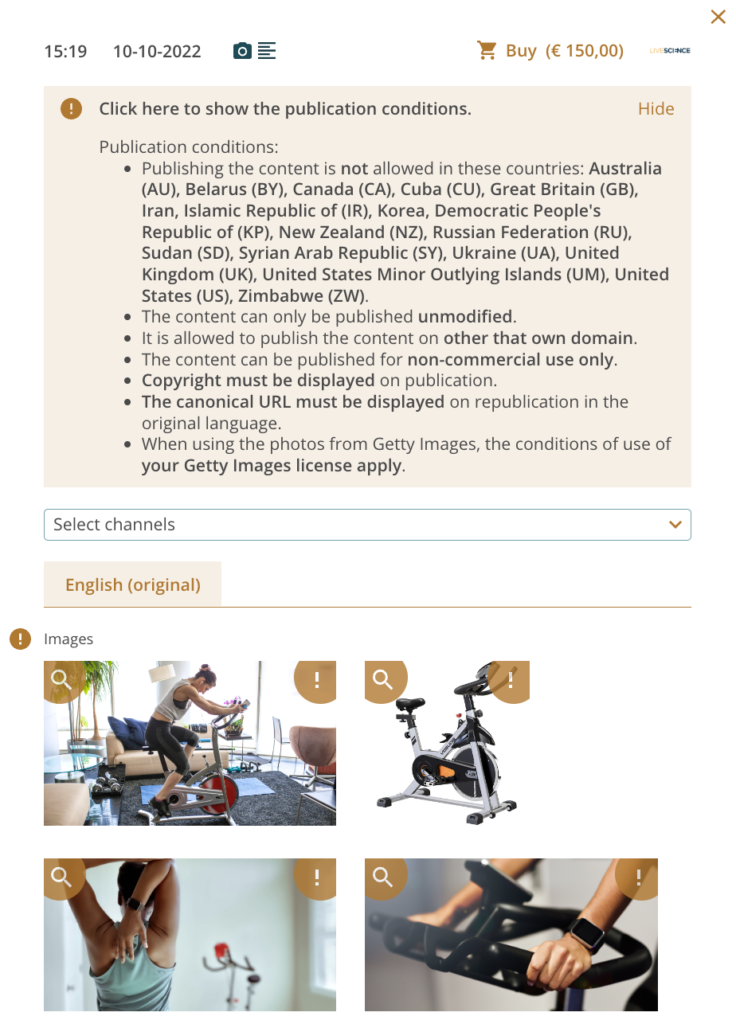

The business model of The Content Exchange is straightforward: Participating publishers have full control of what content they make available to third parties and the content is listed in a marketplace format by category. Third-party publishers can then select the content they wish to re-publish under license, typically using a minimum bundle package, “Participating publishers don’t like to either purchase or sell features on an individual basis – it’s inefficient. We operate on a minimum bundle basis.”

The importance of checks, balances, and safeguards

Van Lierop told WNIP that nearly all the licensed content is re-published in foreign territories, “Content is normally licensed abroad so it doesn’t compete with a publisher’s own market and, if it is re-published in English, canonical URLs are stipulated to ensure that the original owner of the content is safeguarded.”

Language barriers are getting smaller and smaller, and using machine learning our platform is able to translate content into 20 languages. It’s 98% accurate, and all it needs is subsequent editorial tweaking to ensure that it is perfectly native in its written form.

Joris van Lierop, CEO of The Content Exchange

The Content Exchange has also struck a deal with Getty Images to ensure that every story on the platform (currently totaling 200,000) is also accompanied by a recommended image option. Users can refine search, select pictures, and download the story and the pictures in one package.

As a publisher, we remain in control of our content, end usage and pricing, while TCE takes care of distribution, translation and payments. For us it is an ideal way of maximising distribution and a revenue opportunity.

Sophie Hanbury, Director of Strategic Content Partnerships, The Independent and London Evening Standard

Journalism — priceless or worthless?

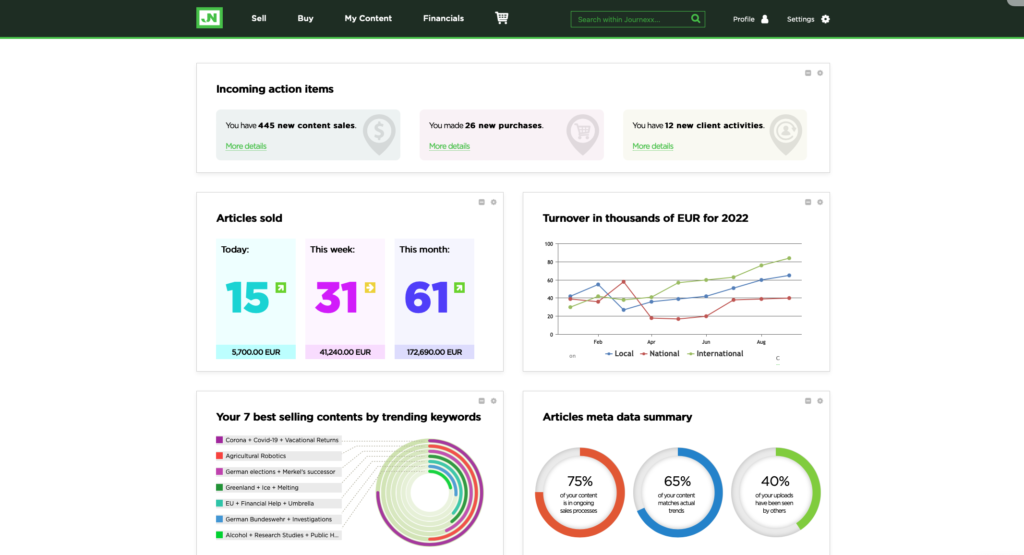

Another disruptor into the content licensing space is Journexx, which describes itself as the ‘digital marketplace for journalistic content’. Headquartered in Berlin, the company is in Beta and plans to launch early next year – it already has dozens of European publishers signed up according to its CEO and Co-Founder, Axel Breuer.

Journexx’s USP is that it is a dynamic content trading platform where articles change price according to their demand and newsworthiness. Breuer, who we met at WAN-IFRA World News Media Congress in Spain, explained that journalism is the only commodity in the world that doesn’t have a price, “publishers have to start to understand the value of their content as a commodity – our platform shows them its value in real-time, across multiple territories.

“We charge per article but it is dynamic pricing according to demand, and the price will also vary according to the territory where it is sold. For example, a Swiss publisher will be charged more than a Nigerian publisher for the same piece of content.”

By using Journexx, publishers start to really understand the market value of their content as a commodity, as something to be exchanged and traded. Demand changes, as in all markets, and because our platform is trend-oriented, we can share that intelligence with our publishers.

Axel Breuer, CEO and Co-Founder, Journexx

Journexx is free to use and charges via a commission structure. The startup is launching a VIP phase with select customers from Germany, the US and Spain starting tomorrow (Tuesday 18th October). Interested publishers can register at https://www.journexx.com

Breuer ended our conversation with a call for publishers to really understand the value of their content:

Journalism is one of the highest value commodities in the world. Look at Google, which has based its business model on content and now has a GDP equivalent to half of Africa. But if content doesn’t have a price attached to it it is essentially worthless. We want to rectify that, and by attaching a price to content we can make it far more marketable.

Axel Breuer, CEO and Co-Founder, Journexx

Can The Content Exchange and Journexx sit side by side as disruptors? Yes, no doubt – both come from slightly different angles, with different unique selling points. More importantly, as the tech giants have unfortunately shown with their monopolies, competition must be encouraged in what is rapidly becoming a new content licensing ecosystem.