|

Getting your Trinity Audio player ready...

|

According to the latest IPA Bellwether Report, internet marketing is growing strongest as firms target digital and social media, and adspend is rising modestly, with bigger improvements forecast for 2020 onwards.

However, political and economic uncertainty has generated caution among businesses, with firms reporting no change in available marketing budget expenditure.

Following a return to growth in the opening quarter of the year, buoyed by firms taking a more pro-active approach to offset risks to their businesses, latest Bellwether data signalled a stalling of growth, with the net balance falling from +8.7% to +0.0%.

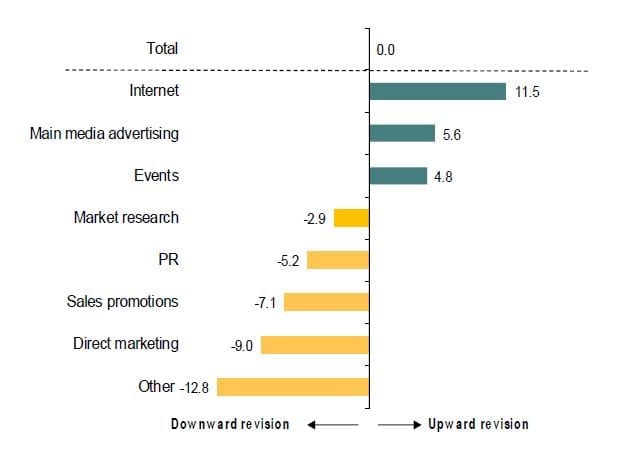

Marketers revise up internet, main media and events marketing budgets

Nevertheless, marketing executives were given extra discretion over internet-based advertising in the second quarter, as signalled by a net balance of +11.5% of firms reporting budget growth (+17.2% in Q1). Within internet, search/SEO budgets also grew solidly (net balance of +9.9% from +14.2%).

Main media advertising budgets were also given a boost in the second quarter, as some firms used big ticket marketing campaigns to build brand recognition and expand customer bases. There were also suggestions that marketing was being deployed as a defensive strategy due to increased competitive pressures. Overall, a net balance of +5.6% of companies reported greater main media marketing budgets (+5.2% in Q1).

The other Bellwether category to register growth in the second quarter was events. The net balance increased to +4.8%, from +3.4% previously, its highest since the first quarter of 2018 and corroborating with forecasts made earlier in the year that events budgets would grow over the 2019/20 financial year.

According to Joe Hayes, Economist at IHS Markit and author of the Bellwether Report, “The expansion in marketing budgets during the first quarter proved short-lived, but developments in the wider economy during Q2 have shown that more intense challenges lie on the horizon for UK businesses. Firms have subsequently adjusted to this, belt-tightening in some cases and withdrawing into a wait-and-see approach once again.”

Internet marketing remained a bright spot. We see continued growth in the digital space, with panellists pointing to ongoing drives through technological improvements and social media channels. Firms also kept boosting main media marketing spend, with brand recognition and building initiatives ongoing.

Joe Hayes, Economist at IHS Markit and author of the Bellwether Report

Adspend acceleration beyond 2020 foreseen

Bellwether remains cautious towards 2019, expecting only a modest 1.1% annual increase in adspend over the year as a whole. Various factors underpin its reservation, namely ongoing Brexit uncertainty, but also recent developments in the UK economy, which this year so far have largely been negative.

Nevertheless, Bellwether believes businesses will be eager to accelerate marketing efforts once uncertainty has cleared, and subsequently see 2020 onwards being more positive on the adspend front. It expects growth of 1.8% in 2020, followed by stronger rates of increase in 2021 (2.0%), 2022 (2.2%) and 2023 (3.1%).

Paul Bainsfair, IPA Director General, commented, “Between Boris, Jeremy and Brexit, coupled with a dip in consumer confidence, it is perhaps no wonder that this quarter’s Bellwether shows zero growth to overall UK marketing budgets. Until a clearer political and economic path is outlined, the vast majority of companies are locked in stasis.”

It is reassuring to see, however, that some companies are revising up their investment in main media advertising; this is where they will build the longer term growth of their brands, which is crucial to weathering these tougher times.

Paul Bainsfair, IPA Director General

Own-company outlook muted

Bellwether panel members remained negative regarding financial prospects in the second quarter, casting more downbeat assessments towards both industry-wide and company-own finances than seen during the opening quarter of 2019.

With precisely 34% of marketing executives reporting a pessimistic outlook towards finances in their industry, compared to approximately 8% that were optimistic, the resulting net balance (-25.6%) signalled the second-most negative assessment since the fourth quarter of 2011 (surpassed only by the Q4 2018 reading of -28.6%). Furthermore, this was down from a net balance of -22.6% seen in Q1.

Latest data also pointed to deeper negativity towards own-company financial prospects. The net balance fell to -9.8%, from -2.7% in the first quarter.

Despite the mixed outlook, Kirsty Giordani, Executive Director, International Advertising Association (UK Chapter) urged advertisers to look beyond short-term thinking, “While we’re in an uncertain political climate, it is often tempting to focus on immediate performance metrics to measure success and allocate spend, but a bigger picture view is needed. For example, spend in internet marketing remains strong and main media, digital and social have also been given another boost. The upward trend in these areas indicates a move towards longer-term thinking from marketers as they look to invest in channels and tactics that will support steady brand growth over time.”

Click here to download the full Q2 2019 IPA Bellwether Report