|

Getting your Trinity Audio player ready...

|

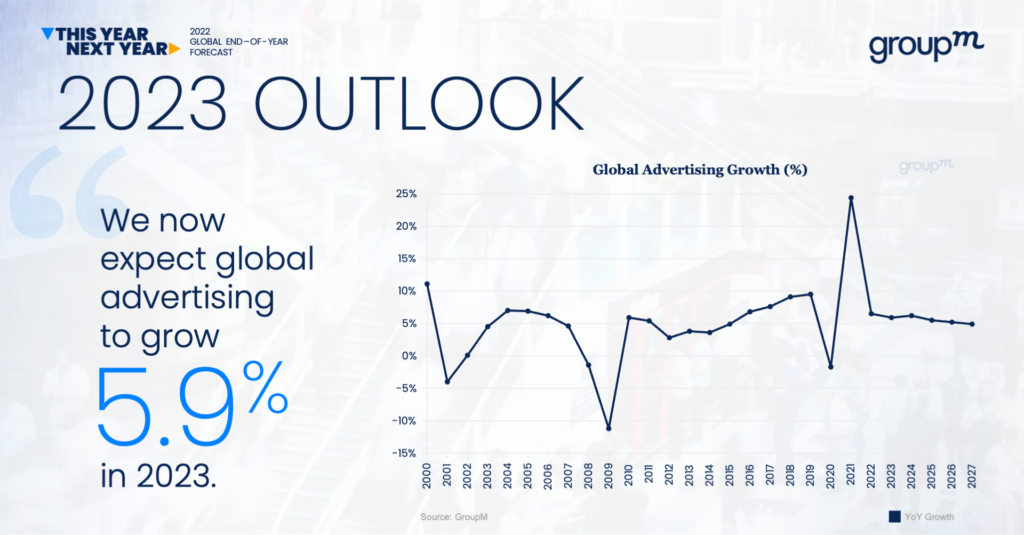

In an optimistic forecast, GroupM expects global advertising to grow 5.9% next year. Whilst representing a slight downgrade from its 6.4% estimate in June, the company does not expect 2023 to experience a ‘perilous economic state’. On the contrary, for some markets like India, growth will be significant.

GroupM, the holding company for some of the world’s biggest media agencies including Mindshare, Mediacom, and Wavemaker, has today announced that they expect global advertising to grow 5.9% in 2023, with strong gains in connected TV, retail media and fast-growing markets like India.

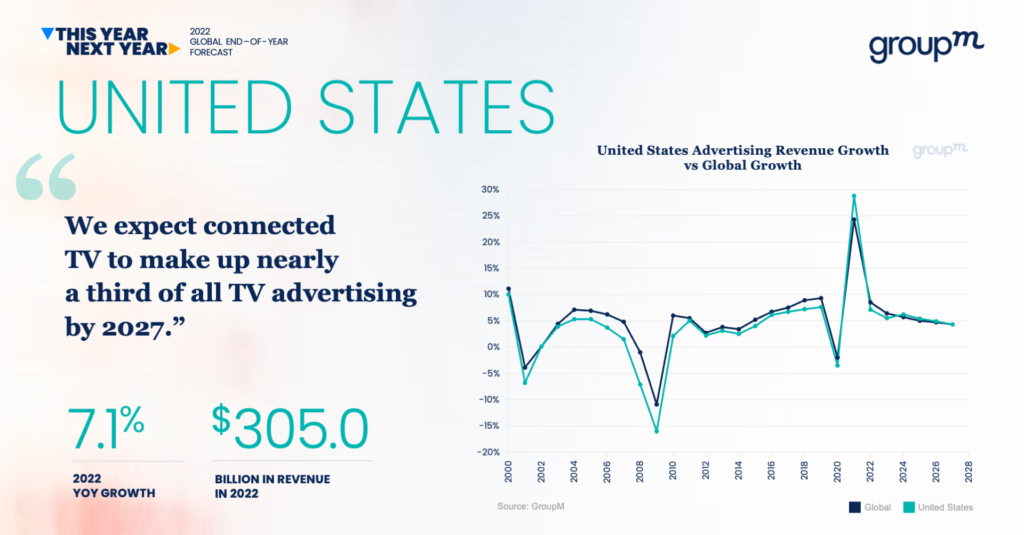

Whilst this is good news for publishers, the company added a caveat that whilst some markets were growing ahead of inflation, the UK, U.S., Canada, and Germany will grow behind country-level headline inflation amounting to a slight net decline over the year.

However, GroupM was at pains to stress that they don’t see a perilous economic state ahead, notably because of low unemployment, the continued growth of digital media, and the fact larger advertisers are still seeing revenue gains despite publically voicing caution.

Other highlights from GroupM’s press briefing:

- Digital advertising: 9.3% growth globally in 2022, bringing the overall share of digital advertising to 67% of the industry total. This share is expected to rise to 73% by 2027.

- Audio advertising: 1.3% expected growth in 2023. Digital audio now represents nearly a quarter of total audio advertising revenue and is forecast to grow by double-digits in both 2022 and 2023.

- Television advertising: forecasted to grow 1.7%. However, by 2025, all pay-TV providers combined will reach fewer than half of homes in the U.S.

- OOH advertising: forecasted to grow 2.2% globally.

- Top 10 tracked markets:

- Australia, Brazil, France, India and Japan will grow ahead of inflation

- The U.K., U.S., Canada and Germany will grow slightly behind country-level headline inflation.

- In addition to China, only Sri Lanka, where a cost-of-living crisis persists after mass protests led to the president’s resignation in July, is expected to record a nominal decline.