|

Getting your Trinity Audio player ready...

|

Zuora Subscription Economy Index shows enduring power of subscription businesses amid economic uncertainty

Times of economic uncertainty can favor recurring revenue businesses, which appears to be playing out today, based on an analysis of SEI companies in the first half of 2022. Subscription Economy businesses continued to show resilience, growing at faster rates compared to the S&P 500 and U.S. retail sales. Churn also remained lower than pre-pandemic levels, demonstrating that these companies are retaining subscriber relationships at higher rates compared to before the pandemic.

Revenue growth for companies in the SEI was 9% greater than companies in the S&P 500 for the first half of 2022

Zuora, Inc., a leading monetization platform provider for recurring revenue businesses, today released a Subscription Economy Index™ (SEI) Snapshot, which found that even as the world faces economic uncertainty, subscription businesses in the SEI were resilient in the first half of 2022, with higher revenue growth compared to businesses in the S&P 500.

These recurring revenue companies increased customer acquisition and revenue growth during the first half of the year, and subscription cancellations continued to be lower than pre-pandemic levels.

“Even amid increased inflation and bearish markets, we’re continuing to see recurring revenue business models provide durable growth and stability,” said Amy Konary, Founder and Senior Vice President of The Subscribed Institute at Zuora.

Historically, even as budgets tighten, and traditional, product-based revenues become more erratic, recurring revenue business models, such as subscriptions, usage-based, and other digital services, continue to provide growth and stability, even during unpredictable times.

By providing ongoing value through outcomes and experiences, these services can become indispensable to customers, allowing the companies to nurture and monetise digital relationships.

Amy Konary, Founder and Senior Vice President of The Subscribed Institute at Zuora

Key findings:

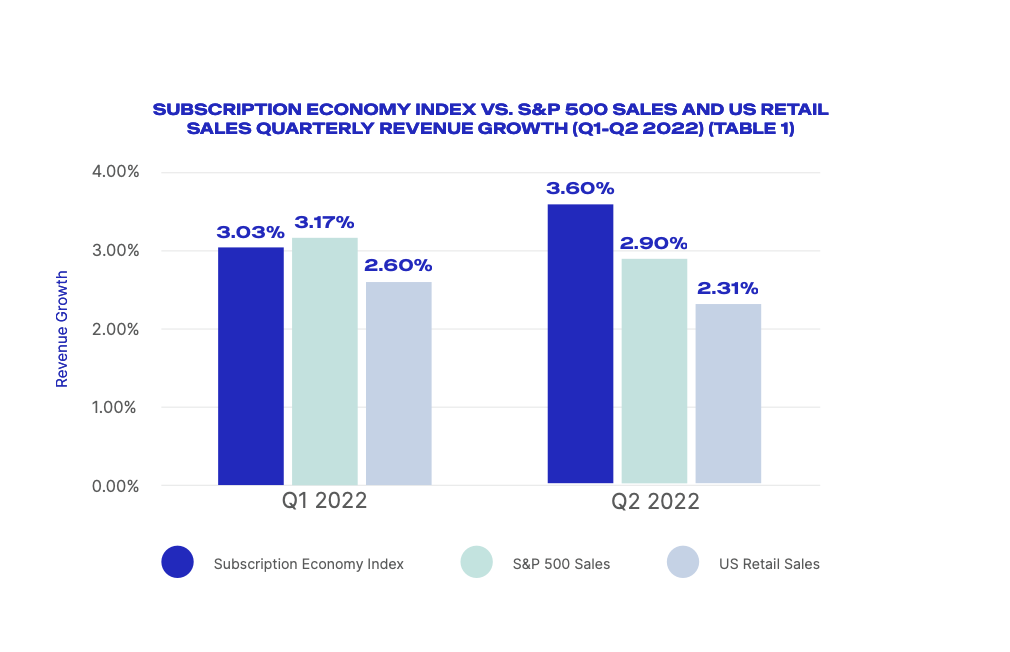

- Subscriber-centric companies in the SEI continue to outperform more traditional, product-centric businesses: In the first half of 2022, revenue growth for companies in the SEI was 9% greater than companies in the S&P 500 (6.74% revenue growth for companies in the SEI compared to the S&P 500’s 6.16%).

- In Q2 2022, while S&P 500 companies’ revenue growth decreased, SEI companies’ revenue increased. Revenue growth for companies in the SEI was 24% greater than companies in the S&P 500 in Q2 2022.

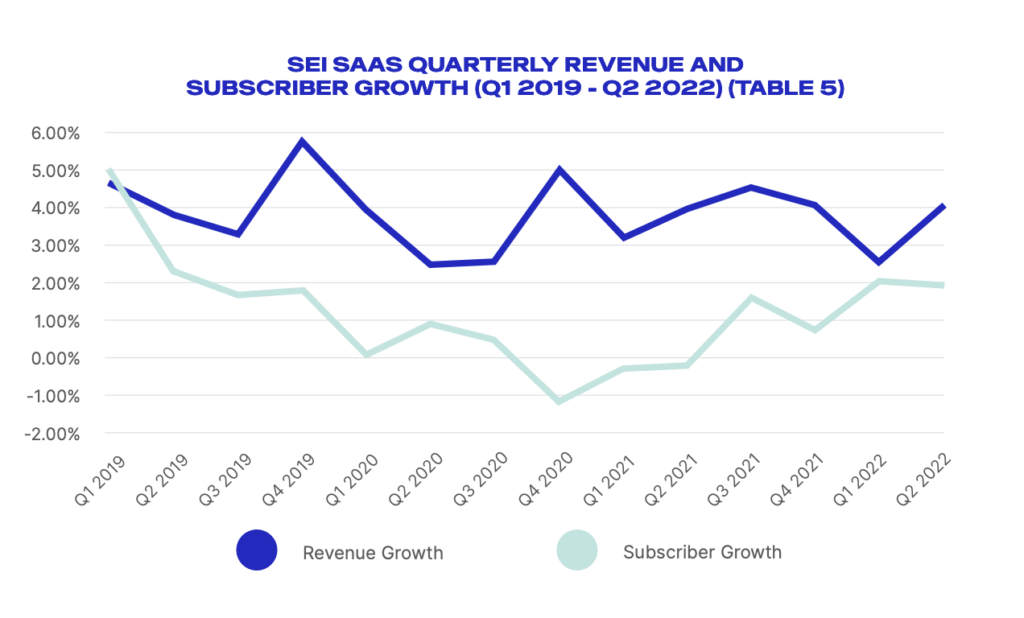

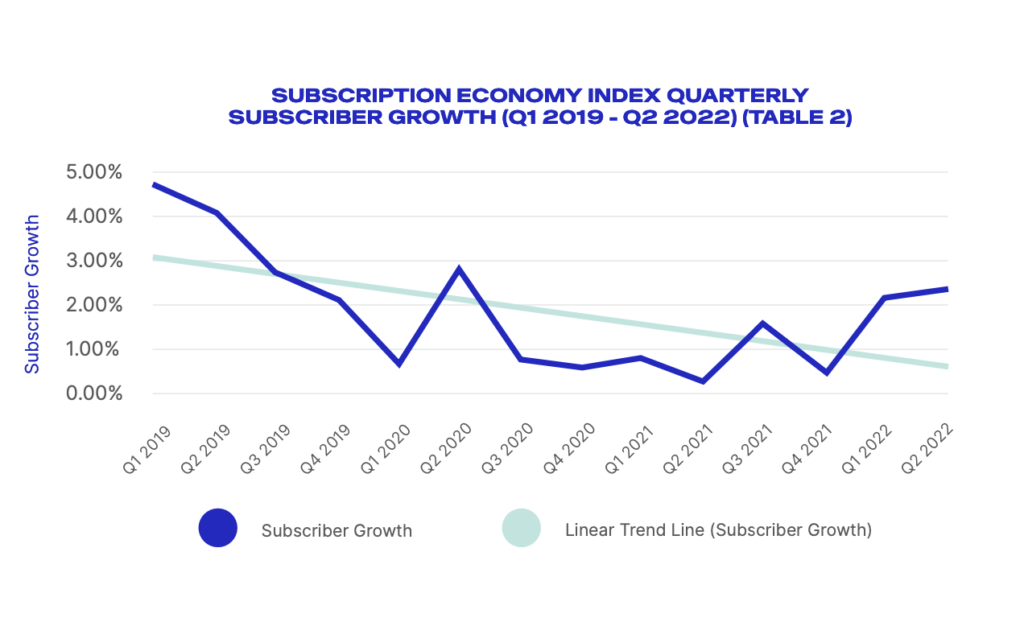

- Despite macroeconomic headwinds, companies in the SEI increased subscriber acquisition. Companies in the SEI experienced subscriber growth rates through the first half of 2022 that were, on average, more than double that of those in 2021 (2021 quarterly average of 0.86% compared to 2.35% for the first half of 2022).

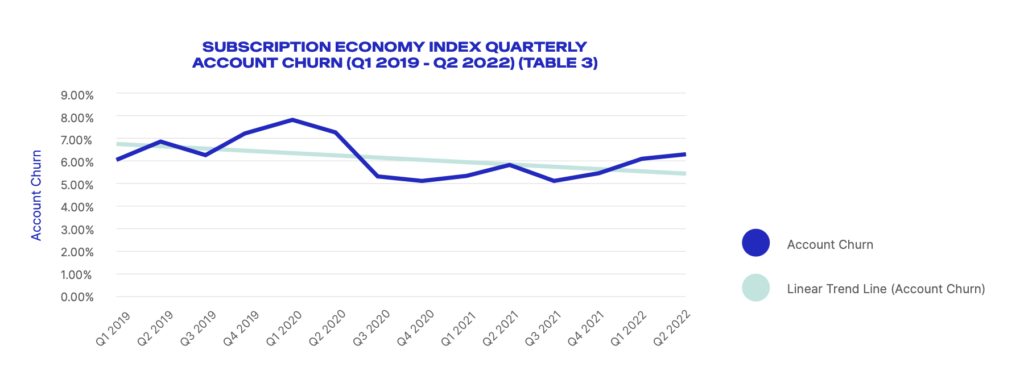

- SEI companies are retaining subscribers at higher rates than before the pandemic. Churn (a metric that can measure the health of subscription businesses) remains lower for companies in the SEI than pre-pandemic levels, with a 2019 average quarterly churn rate of 6.50% compared to 6.13% for the first half of 2022.

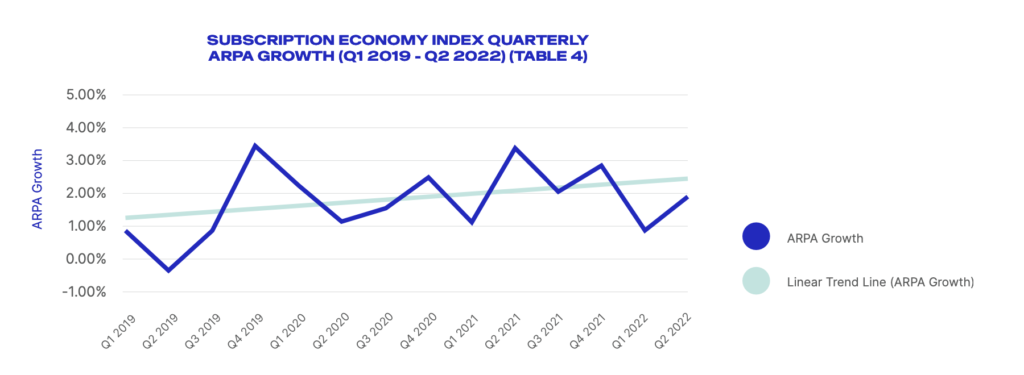

- SEI companies are better at nurturing and growing ongoing customer relationships. Average revenue per account (ARPA) growth in the SEI decreased from 2.78% in Q4 2021 to 0.94% in Q1 of this year, before rebounding in Q2 to 1.89%, which is higher than the three-year average of 1.81% (2019-2021).

The Subscription Economy Index serves as a benchmark for recurring revenue businesses, comprised of a subset of more than 500 Zuora customers across industries around the world.

The most recent SEI report is available for download here.