|

Getting your Trinity Audio player ready...

|

It’s too early to understand the full implications of the COVID-19 pandemic and its impact on publishers.

For some, it could be an “extinction-level event” with outlets around the world being affected. Others may emerge stronger, as a result of increased digital subscriptions, revenue diversification, and reduced – or hollowed-out – competition.

Whatever happens, it’s likely that the industry will look very different on the other side of this crisis. Given all of this uncertainty, what do we know about the current media landscape?

Although there are some data-lags, we can discern some notable trends. Here are eight of them:

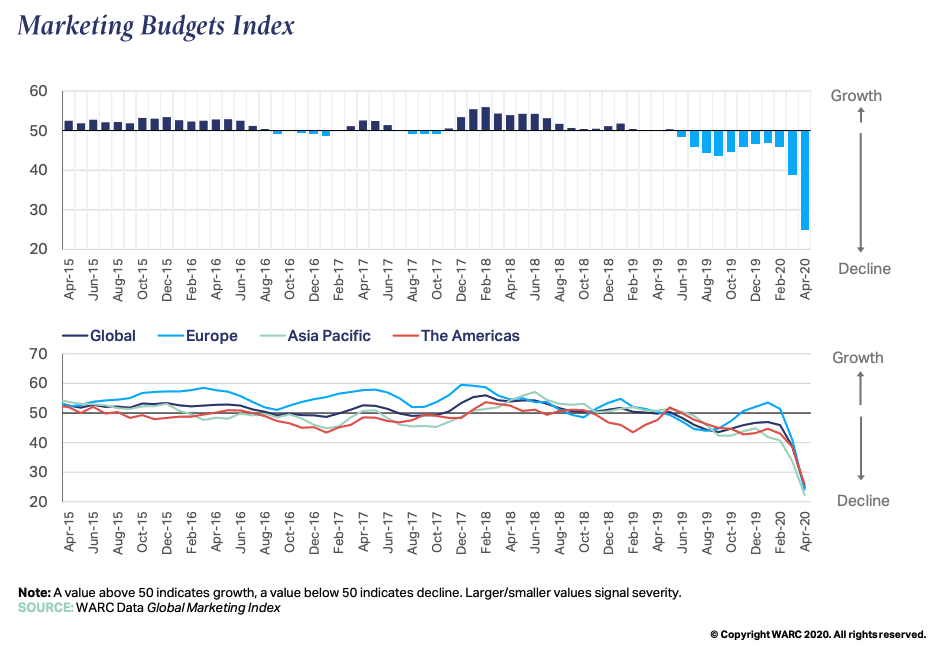

1: Marketing Budgets are down worldwide

“Almost all product sectors will record a decline this year,” WARC recently revealed, “with the most severe falls seen among travel & tourism (-31.2%), leisure & entertainment (-28.7%), financial services (-18.2%) and retail (-15.2%).”

The company published the data in its latest monthly Global Ad Trends report. This makes for sobering reading for publishers who remain heavily advertising dependent.

Nevertheless, “Opportunities can come from this, both for advertisers and for media owners,” writes Brian Wieser, Global President, Business Intelligence at GroupM (WPP).

“Every brand should be looking for opportunities, and questioning assumptions about their company’s competitive position. What are the ways in which you can reinvent the category? That the economy will be weak is a given, but any one business’s outcomes are not, and shouldn’t be taken as given.”

Addressing this should be a priority for publishers, as well as the brands we work with.

2: COVID-19 has changed our media habits

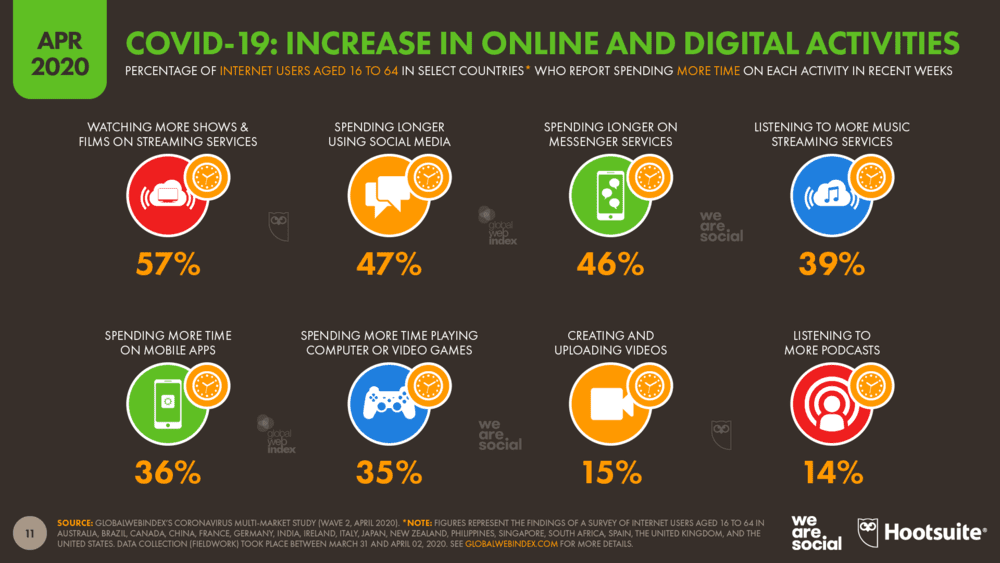

Declining marketing budgets come as no surprise. Neither does the finding that, with much of the world on lockdown, our media behaviours have evolved too.

Research from Kantar indicated that one in five UK homes signed up for a new video streaming subscription during COVID-19 lockdown, although much of this was led by Disney+ which was scheduled to launch during this time anyway. How much of a bump it got, as a result of the pandemic, it’s hard to say.

What we can say, however, is that globally, the data consistently finds that we are spending more time with streaming services, social media and messenger services. Gaming has also seen a major pandemic bump.

Notable here, as Simon Kemp identifies, is that:

“Many people say that they expect their new habits to continue after the COVID-19 outbreak passes too. One in five internet users say they expect to continue watching more content on streaming services, and one in seven (15 percent) say they expect to continue spending more time using social media.”

Given this, publishers need to giving further thought to ways in which they can make their new relationships with audiences as “sticky” as they can.

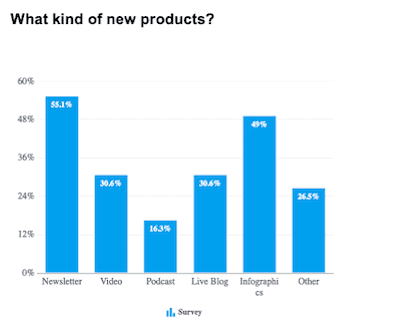

3: Publishers are producing new products

In response to our new media habits and changing information needs, many publishers have experimented with efforts such as dropping their paywall (with the hope of converting some fly-by’s into subscribers) and launching new products like (but not exclusively) coronavirus podcasts, alerts, and newsletters.

According to members of WAN-IFRA’s Global Media Trends Panel, more than half of the editorial executives they surveyed had launched new products as a result of the pandemic.

“Newsletters are the most common product,” they found, “with some 55% saying they have launched them, followed by infographics (49%), and videos and live blogs (30%).”

You can read more of our recommendations for newsletter strategies here.

4: Some local outlets are seeing a coronavirus bump

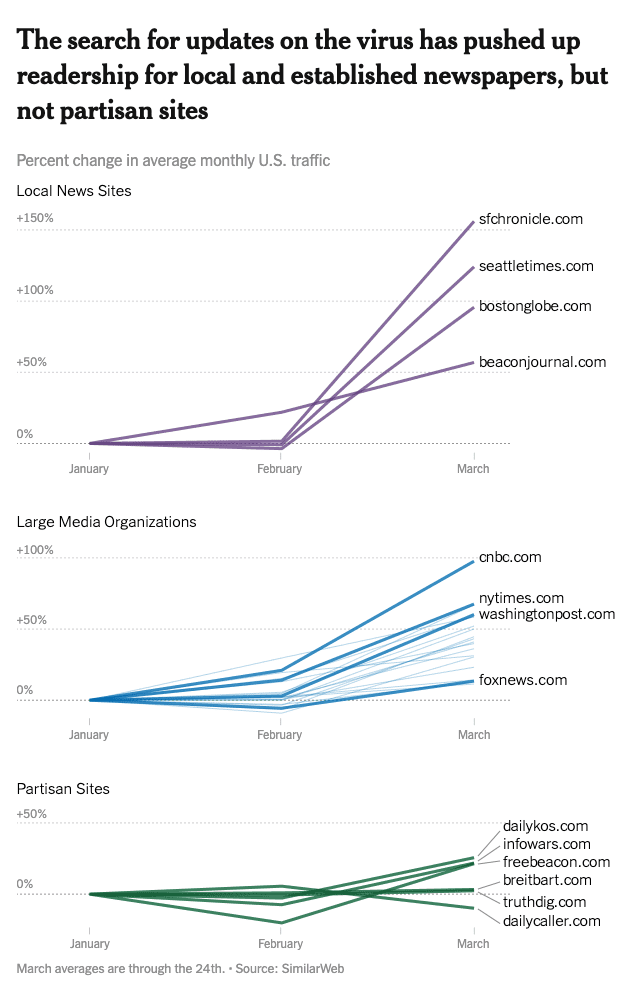

“While publishers are yet to release digital subscription figures which shows their performance since lockdowns started, internet traffic numbers hint that local news publishers might be the biggest beneficiaries of changing internet behaviour,” observes James Hewes, President and CEO of FIPP.

Hewes, cites an article from the New York Times which revealed: “Among the biggest beneficiaries are local news sites, with huge jumps in traffic as people try to learn how the pandemic is affecting their hometowns.”

“These figures suggest a welcome consumer shift for more locally focussed news media, who have been struggling to grow their subscription bases as rapidly as market-leading national news outlets and specialist content publishers,” FIPP comment in their Global Digital Subscription Snapshot 2020 (Q2).

Unfortunately, increased traffic does not necessarily equate to increased subscribers. Despite record audiences at many outlets, in the USA alone, more than 36,000 news media workers have been impacted by COVID-19, with jobs lost, journalists furloughed and over 30 local newsrooms shuttered. A similar dynamic is playing out across the globe.

5: Pandemic-led subscription gains are holding steady

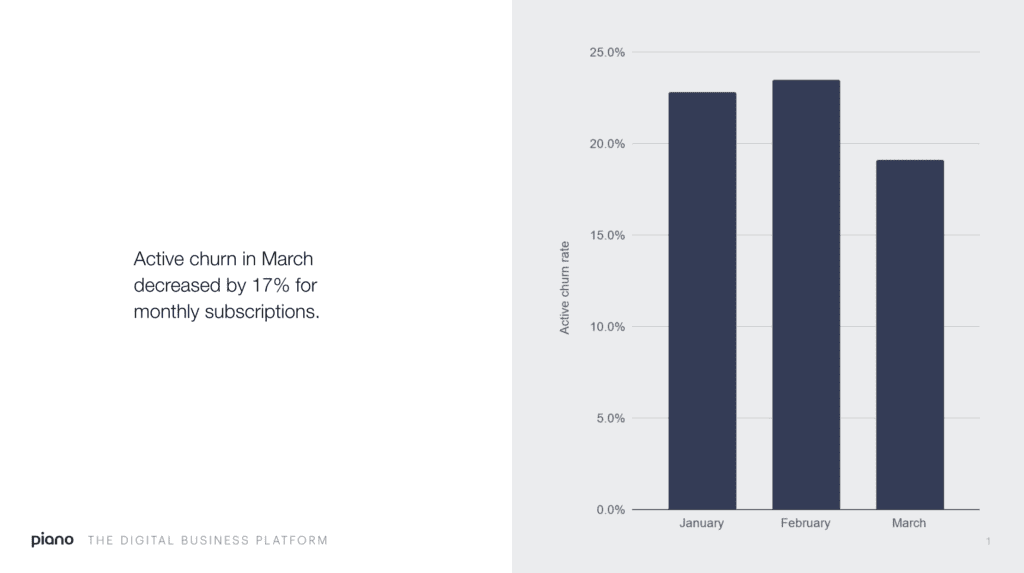

The shift to reader revenue has already encouraged many publishers to focus on reducing churn. After all, finding new subscribers is more expensive than keeping existing ones.

With the coronavirus driving new subscriptions, for some outlets (and advertising projected to be in the doldrums for some time), then this need has become even more paramount.

So far, early signs are favourable. Although, as the Atlantic found, subscription growth is not necessarily a panacea for wider business and revenue challenges.

Writing at the end of May, Digiday’s Lucinda Southern observed:

“The curve in subscription growth is starting to flatten for some but still remains higher than before coronavirus. Still, publishers including Bloomberg Media, The New York Times and The Guardian anecdotally say they are seeing signs of stronger retention rates from subscribers who have signed up since February and March.”

“Most say it’s too early to declare this as a win,” Southern cautions, reminding us “Publishers measure churn in their own ways and discounted monthly trial periods often need longer for data collection.”

Nonetheless, “Segmenting by geography, Europe is where the real churn improvement happened — dropping by about 34%,” Piano noted on their blog. “In the US, churn was flat overall. But even flat is impressive, given the big increase in acquisition.”

The company – whose software is used by publishers such as GateHouse, Business Insider, NBC, Condé Nast, The Economist, and Hearst – highlights onboarding, encouraging repeat visits and strategically managing trials and price, as “fundamentals” that “Publishers looking to improve retention should focus on… regardless of the pandemic surge.”

Read more about the latest digital subscription trends and their strategic implications for publishers in this recent WNIP series (Part One, Part Two).

6: Consumers want brands to run “normal” ads

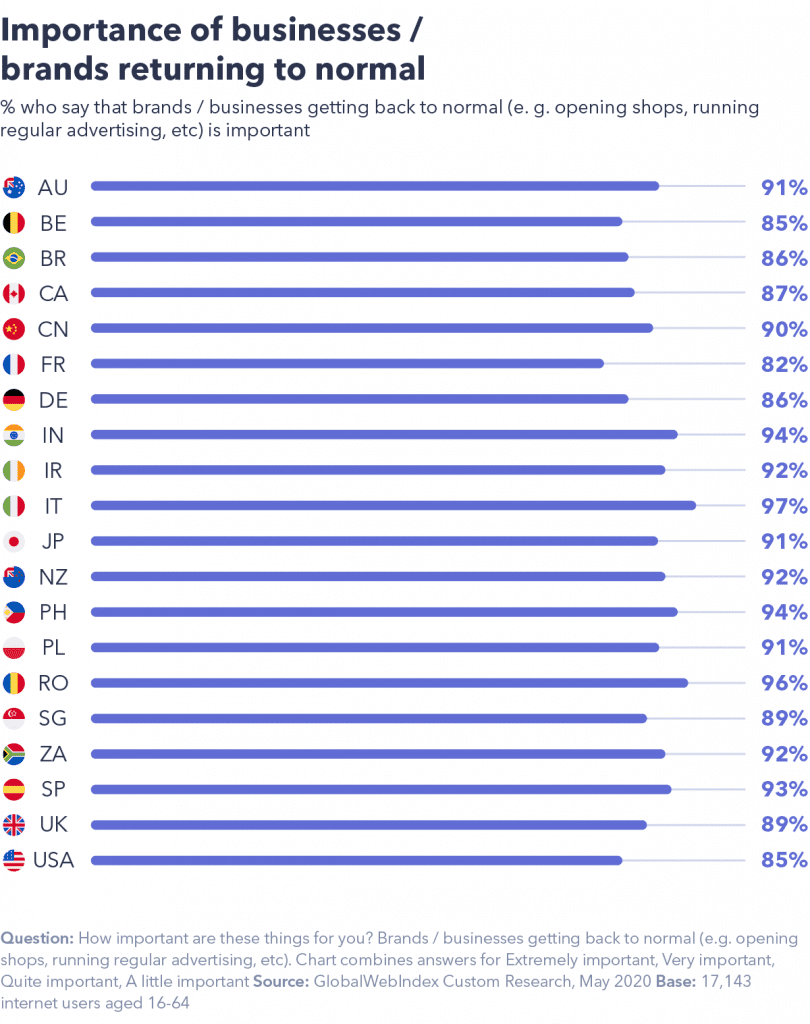

Fresh insights from GlobalWebIndex (GWI) offer some interesting perspectives on coronavirus-shaped attitudes and behaviours, based on a survey of more than 17,000 internet users in 20 countries last month.

For publishers, perhaps the most notable takeaway from their fourth multi-market study sees consumers in favour of “widespread – and growing – approval of brands advertising as normal.”

As Jason Mander, GWI’s Chief Research Officer, writes:

“Across the 20 countries surveyed, only 12% of consumers disapprove of brands running “normal” advertising. That dips to as low as 6% in New Zealand.”

“Conversely,” Mander says, “we’re seeing small but consistent decreases in approval for coronavirus-related advertising.”

More widely, GWI also highlighted increased interest in staycations, on-going financial concerns and environmental sustainability, all of which publishers should be aware of.

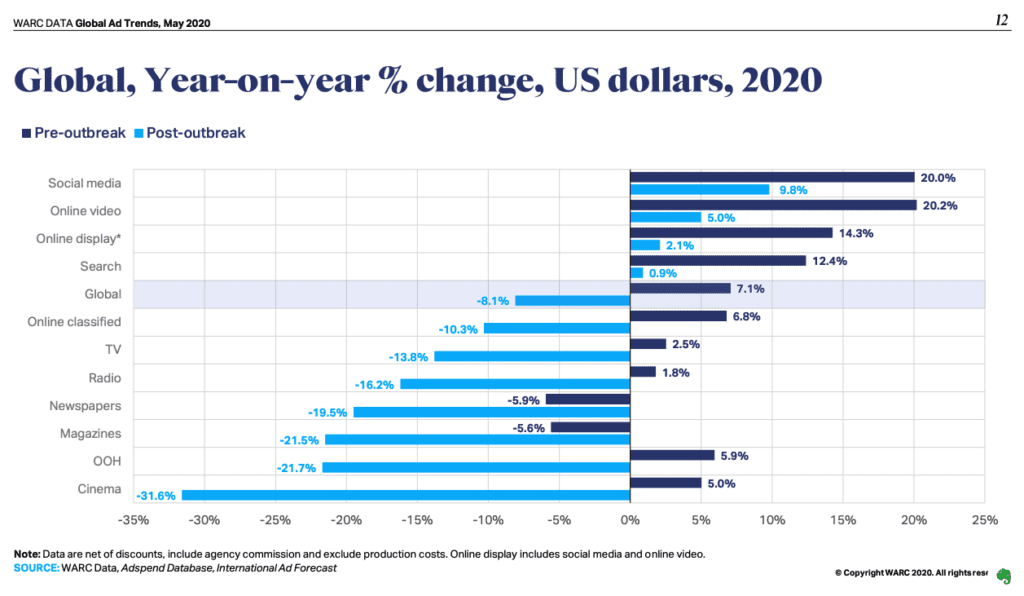

7: Global advertising down in 2020, but digital remains strong

Despite this consumer optimism for advertising to return to normal, data from WARC paints a less rosy picture. Their latest Global Ad Trends report concludes that advertising spend looks set to fall 8.1% – $49.6bn – worldwide this year.

Interestingly, this is a lower percentage than 2009, when the advertising market fell by 12.7% ($60.5bn), and some sectors – notably social media, online video and search – are still growing post-outbreak.

Traditional media channels like newspapers (-5.9%) and magazines (-5.6%) were already declining year-on-year, pre-pandemic; with this trend exacerbated by the coronavirus.

COVID-19 has also had an adverse effect on traditional channels – such as TV, Radio, Out of Home Advertising (OOH) and Cinema – which had previously been projected to grow this year.

Looking ahead, Dr. Daniel Knapp, Chief Economist for IAB Europe, reflects how difficult it can be to make predictions in the current climate. “The basic dynamics are known,” he writes. “Advertising expenditure does not just follow economic trends – it amplifies them. This is particularly the case if GDP growth is flat or negative.”

“All three advertising recessions in Europe over the past 20 years – the dotcom crash and 9/11 in 2001, the financial crisis in 2008/09 and the Eurozone crisis in 2012, showed this dynamic,” he states. “However, history is not always a good guide. The current crisis lacks precedent in its combination of factors from epidemiological to policy and economic issues, all while embedded in a global environment that is impossible to control in a local setting.”

8: Consumers, more than ever, need a broad content mix

Although the coronavirus outbreak produced a bump for many news organisations, it wasn’t long before that appeared to be over.

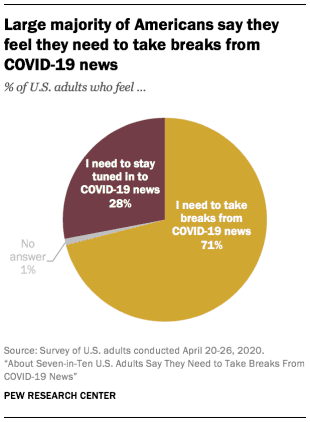

One key reason for this, as the Pew Research Center shared, is that: “About seven-in-ten Americans (71%) say they need to take breaks from news about the coronavirus, and 43% say the news leaves them feeling worse emotionally.”

News avoidance and fatigue, as the Digital News Report has shown, was already an issue pre-pandemic. Abstinence, the authors suggested, “may be because the world has become a more depressing place or because the media coverage tends to be relentlessly negative – or a mix of the two.”

To address this, I argued at the start of the year, that it would be incumbent on news outlets to do things differently.

This may involve telling stories in fresh and innovative ways, changing the tone of content, engaging with audiences online and offline, as well as exploring new beats and approaches to storytelling (such as solutions journalism).

In the world of COVID-19, those words seem more pertinent than ever.

To this, I would also recommend looking more at the power of your archive, evergreen content, and highlighting stories from the past 3-4 months which may have been overlooked as a result of the pandemic.

The coronavirus isn’t going away any time soon, so publishers need to recognise that the “new normal,” for advertisers and consumers alike, may not look that different from where we are today.