|

Getting your Trinity Audio player ready...

|

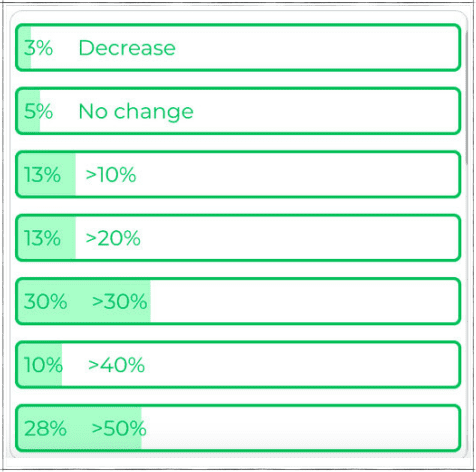

Nearly 60% of publishers are anticipating more than 30% subscription growth this year, 28% of that are expecting 50%, according to polls conducted during the Digital Media Europe 2020 virtual event.

Additionally, investing in data and digital reader revenue are the top two priorities for nearly 90 publishing executives worldwide, according to WAN-IFRA’s latest World Press Trends Outlook data.

DME20’s reader revenue part of the program focused on the different aspects of subscription marketing. WAN-IFRA has published a report, Reader Revenue: Subscription Marketing, featuring key takeaways from the program. It includes 13 publisher case studies and advice from industry experts.

Digital reader revenue … has quickly become many publishers’ top priority after watching much of their advertising revenue take a plunge during the pandemic.

Reader Revenue: Subscription Marketing

Here we highlight key strategies publishers are using to grow subscriptions. A common factor among them is the use of data to understand readers better and provide them personalised communication and services.

“Personalisation is playing a key role now”

Norwegian publisher Schibsted Media Group (over 20 news brands in Sweden and Norway) was generating 500,000,000 NOK from digital reader revenue in 2017. It set a target to reach 1B NOK by the end of 2020. The publisher reached the goal in August this year. Its next goal is becoming digitally sustainable.

“Schibsted has a goal for all of its newsrooms to be digitally sustainable so that print revenue is like an add-on,” says Tor Jacobsen, SVP, Consumer Marketing & Revenue, Schibsted.

We do hope to be digitally sustainable within the next year or the next year so all the costs are taken with the digital revenue.

Tor Jacobsen, SVP Consumer Marketing & Revenue, Schibsted

The publisher plans to drive subscription growth by:

- Increasing the value of its products. This will include producing more podcasts, videos, live event rights, and non-news content.

- Developing more verticals and “top ups” to differentiate its products.

- Repackaging and pricing to understand what works and adjust accordingly.

- Increasing the portfolio of subscription services. These will include services that are not content-related. For example, the publisher will look at how it can use its e-learning platform to offer a more personalised service.

Schibsted also pays particular attention to onboarding and nurturing subscribers. The first 100 days are crucial, says Jacobsen.

It’s important to get them (subscribers) on board, but if you can keep them till that time (100 days), keeping them long-term is much easier.

Tor Jacobsen, SVP Consumer Marketing & Revenue, Schibsted Media

“One example is the onboarding process,” he adds. “Now it’s much more trigger-based than it was in the past, focusing more on their usage, data and habits. You can choose [an] editorial profile to take care of you in the first days or weeks, to suggest interesting articles, for example. So personalisation is playing a key role now.”

“Find a clear correlation between engagement and subscription”

And that’s true for The Financial Times too. The publisher offers readers a feature called myFT which allows them to track news and topics they are interested in. It uses data science to propose the right tags for articles to editorial, as well as recommend readers additional stories and topics to follow based on their consumption behavior.

The FT also studies the recency and frequency of its readers’ visits along with the volume of content they consume to measure their engagement levels. It calls this combination of metrics RFV, or the North Star metric.

“The goal was actually to increase the number of engaged users,” said Gadi Lahav, FT’s former Director of Product.

It’s very hard to measure the impact of anything you do on the subscription itself. However, if users are more engaged you can see it quite quickly, and if you find a clear correlation between engagement and subscription then you use a metric that is way closer to what you do on a daily basis.

Gadi Lahav, Former Director of Product, FT.com

After the first year, the RFV of people that used myFT was up 86% compared to the control group, and a year thereafter another 35%. The metric has played an important role in helping the FT reach 1M paid subscribers in 2019, a goal it intended to reach by 2020.

Try things. Many things have failed, more things have failed and then succeeded, and you just need to eventually find the ones that are successful and iterate on them.

Gadi Lahav, Former Director of Product, FT.com

25% of subscription sales from Facebook

Data features heavily in Norwegian publisher Amedia’s churn reduction strategy. In 2014, it launched a log-in system called aID (Amedia ID). The system uses mobile phone numbers as unique customer IDs. Readers can use it to access digital content across Amedia’s 70-plus titles. The publisher gets access to user data that helps it build a customer-centric and reader revenue strategy.

For example, it helps the publisher understand which types of articles are triggers for conversions. These are then used to attract new subscribers. Amedia often uses social media to grow traffic and acquire new users. It promotes articles that a potential subscriber has a high likelihood of clicking on, with a marketing message like, “Try us for 10 crowns for 10 weeks.”

Around 25% of its subscription sales originate through a Facebook post or promotion, according to the report.

Because we have the mobile phone number, we are able to attach 120 data points for every single user that we can capture through their reading habits and also their third-party data. Third-party data will tell us their specific location, their age, income and so forth.

Haakon Johansen, VP Consumer Market at Amedia

Amedia, like Schibsted, is also very particular about the onboarding process. New subscribers who have not visited the site by 8 pm on a given day are sent an email newsletter of suggested articles. This process continues for the first 35 days. Regular subscribers are sent an email with story suggestions if they have not visited for three days.

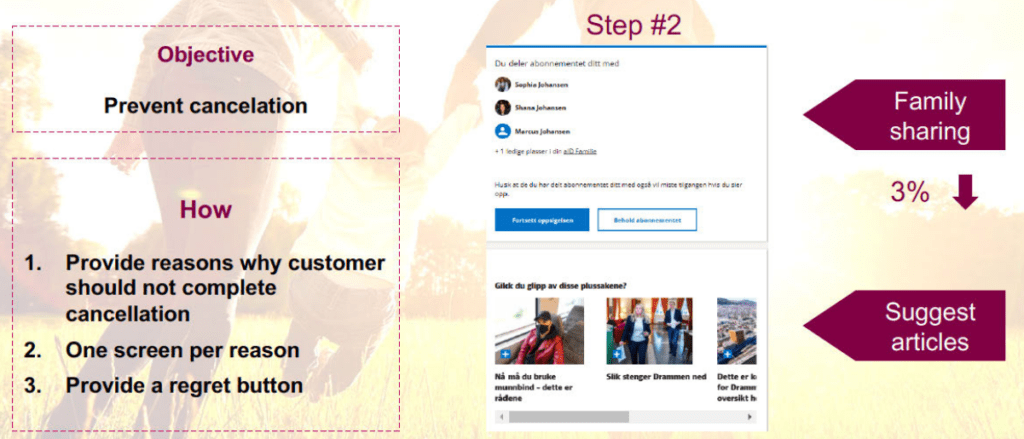

The publisher uses an Engagement Index tool, which rates a subscriber’s behaviour to determine how likely they are to keep subscribing. It has created a cancellation process which conveys the value of the subscription to the readers across different screens.

Each screen contains articles similar to ones that the subscriber has shown a preference for. It also has messages like one that reminds the user that family members using the subscription will also lose their access. This has helped stop around 1,000 cancellations every week, “a great reduction over previous years.”

“Like any relationship, it doesn’t end with conversion”

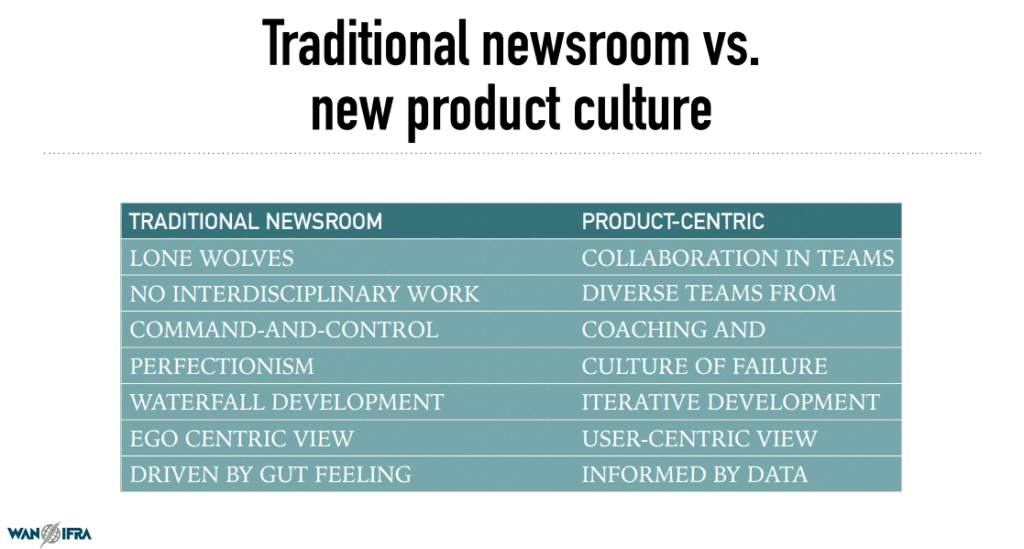

The above examples demonstrate user-centric product development and thinking. “A trend that has been finding its feet in the last few years,” according to the authors. It “became an even clearer focus area for several large and small media organisations globally this year.”

How are products connected to subscriptions? When publishers want readers to pay for products, memberships, subscriptions or event tickets, they need to understand how to truly serve them. Several pandemic-related products have been successful because they were built to serve a particular user need.

Reader Revenue: Subscription Marketing

“We also emphasise the importance of continually strengthening your relationship with members,” adds Arun Venkataraman, Global Strategy Lead, GNI, USA and co-author of GNI’s Reader Revenue Playbook.

“This is really the retention part of the funnel, but absolutely crucial because, like any relationship, it doesn’t end with conversion. Keeping it strong and healthy requires care and attention over time.”

The full report is available from WAN-IFRA:

Reader Revenue: Subscription Marketing