|

Getting your Trinity Audio player ready...

|

Subscription revenue has become increasingly more important to publishers as advertising revenue has declined. Publishers, especially those with general interest publications, have traditionally pursued individual consumers. Now many are exploring the B2B subscriptions model to attract subscribers in bulk from businesses and organisations.

B2B has a huge uncovered potential. This is also the case for the potential B2B user revenue market at Aftenposten and Schibsted. As the media industry goes through a digital transformation … so does the market.

Siri Holstad Johannessen, Head of Sales and Marketing, Schibsted

However, “[most publishers] have not built a structure for B2B sales,” says Greg Piechota, Researcher-in-residence, International News Media Association (INMA). “They have focused on [building] the consumer business for the past decade, and now they realise there is an opportunity in [selling to] businesses. And once they try to do that, they realise that the way you sell to businesses is very different.”

INMA has published a new report focusing on this potentially lucrative business vertical for publishers. The report, “The Growing Promise of B2B In Media’s Reader Revenue Model” is authored by Paula Felps, Ideas Blog Editor, INMA. It uses examples from publishers across the world—Financial Times in the UK; Insider, The Wall Street Journal, and The New York Times in the US; Schibsted in Norway and Sweden; and Nikkei in Japan—to show how they are growing their B2B subscriptions business.

“The way you sell to businesses is very different”

Understanding the differences in the motivation and behavior of individual vs. corporate consumers is important for the success of a B2B subscription campaign. “B2B subscription campaigns must be created to factor in the way businesses buy, which is vastly different from consumer purchases,” writes Felps.

Selling to a consumer is about persuasion, which is not how you approach a business. You need to educate them about the product and what value it offers. You may need to be sort of an advisor, teaching them the best ways to use it.

Greg Piechota, Researcher-in-residence, INMA

Piechota shares five key differences between the two types of consumers:

- Market: Consumer products have a broad focus to appeal to the masses. Corporate products require a narrow, niche focus.

- Time: Individual consumers may subscribe promptly. B2B subscriptions sales usually take longer as they require multiple approvals.

- Motivation: Individual purchases can be driven by emotions. Businesses look for return on investment, customer service and overall value.

- Sales: Selling to an individual consumer is about persuasion. Businesses are looking for value. So they need to be educated about the product.

- Offer: Individuals want a simple, easy-to-understand offer. Business offers are more complex as they usually have different price structures to fit with the varying requirements of their users.

“Your marketing needs to be adjusted,” says Piechota. “Your product might need to be adjusted, or the positioning of your product should be adjusted, or the way you frame the value proposition needs to be adjusted.”

You’re going to have to have a different framing for the value proposition that you are selling.

Greg Piechota, Researcher-in-residence, INMA

How the FT grew its B2B subscriber base from 250,000 to over 625,000

“Using existing core strengths, whether they are for a local or international audience, can be a successful starting point,” suggests Felps. “Tailoring subscriptions to the needs of the individual organisation is an effective way to encourage engagement and renewals.”

That’s how the Financial Times tailored its strategy and grew its B2B subscriber base from 250,000 to more than 625,000 customers, according to Caspar De Bono, MD/B2B, Financial Times.

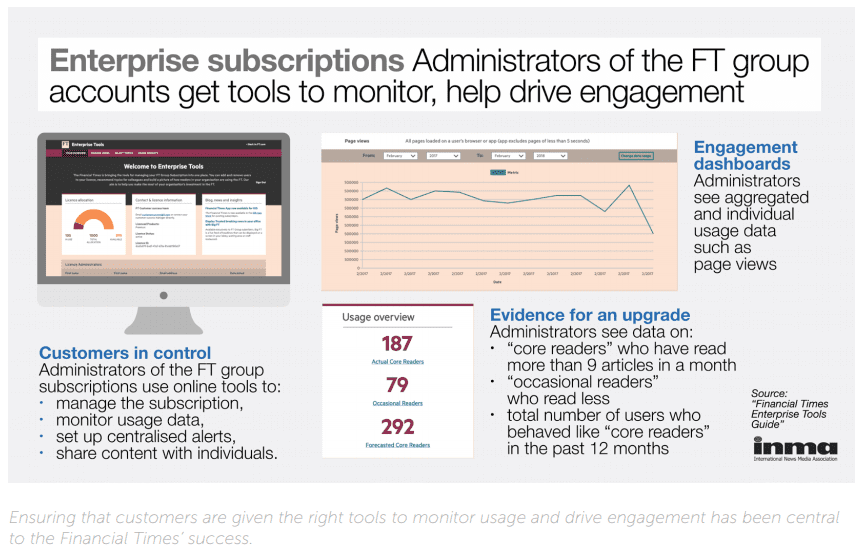

The publisher created a structure that took into consideration factors like the size and type of organisation and the level of demand for FT content. It also based pricing on engagement—corporate customers only pay for readers who consume nine or more articles. Those who read below that frequency are free. This strategy is based on FT research which shows that people who read nine articles or more per month were likely to renew.

FT also provides each corporate account with a dedicated customer success manager. It does this to have a better understanding of the business’ objectives in signing up. The customer success team monitors the usage levels of B2B readers and tries to ensure that they are getting value.

The publisher also shares usage data with corporate subscribers “so they can see and manage their access,” adds De Bono.

“By ensuring that customers are achieving the results they want, FT has seen the number of engaged readers grow,” notes Felps. This also makes the “business customer more likely to renew and spend money with the FT.”

The Wall Street Journal uses similar tactics for its B2B strategy. It offers tailored subscriptions for specific topics, like bankruptcy and private equity. The publisher also has a dedicated sales team for B2B prospects. “They need to understand more about what they’re getting,” says Christina Komporlis, SVP/WSJ Professional Membership. “It’s a more complex product and a bigger investment; they need to talk with someone. So the layer we’ve added is telesales and an account manager.”

The role of the account manager is similar to that of the customer success manager at the FT.

The important part is keeping them engaged. It doesn’t do us any good to sell your whole organisation access to the Journal and only 1% of your employees are using it. Because when renewal comes up, we’re not going to be able to convince you that it’s worthwhile.

Christina Komporlis, SVP, WSJ

“Reach a new audience that we think is of high value”

Apart from ensuring that content/services are packaged to appeal more directly to the company’s specific needs, publishers can also consider developing new content for business customers.

The Vogue brand is synonymous with fashion, its magazine is targeted at individual consumers. In 2019, parent company Condé Nast, launched Vogue Business, an online publication for the fashion industry. It focuses on the business of fashion and operates as a separate entity with an entirely autonomous editorial team, according to the report.

Other strategies publishers are using to grow their B2B business include:

Partnerships: Insider partners with American Express to offer its members free six- or 12-month subscription. “We are able to reach a new audience that we think is of high value to us,” says Katharina Neubert, Director of Business Development, Insider. “It also enables us to grow our subscriber base, as they are all on an auto-renewal.”

Positioning subscriptions as an employer benefit: When the pandemic struck and work from home became common Schibsted pitched digital subscriptions for all employees over print subscriptions for a select few. It reframed the subscription as a work tool and repositioned it as an employer benefit like insurance or gym membership.

Events: “Providing business customers with events is one more way to provide a value proposition for business-class customers,” notes Felps. WSJ offers them as a part of its c-suite memberships. The New York Times converted its popular live summit, DealBook, into a free virtual event in 2020. Japanese publisher Nikkei uses a series of webinars to generate leads and then narrow down on potential B2B prospects.

We have found that the conversion rate for online sales is the same as in-person sales.

Yosuke Suzuki, Digital Business Development Lead, Nikkei

“There’s probably market opportunity in the places you’re already good at”

In conclusion, Felps suggests publishers to leverage their core strengths and coverage. “Attempting to create a new product for a new business vertical is taking on more than most news companies will be able to manage successfully,” she writes.

Cultivating that (core strengths) into a B2B vertical allows teams to focus on building the business without having to develop an entirely new product.

Paula Felps, Author, The Growing Promise of B2B In Media’s Reader Revenue Model

“I don’t think you need to bend over backwards trying to add [new features],” says Komporlis. “I think it’s good to get the core proposition right, make sure you’re targeting the right people, make sure your pitch is right, and you’re bringing value to your customers.

“Look at where you’re strong in your content because there’s probably market opportunity in the places you’re already good at. Then, you ask the customer, ‘This is our proposition. What else can we do to make you interested?’”

The full report can be downloaded from INMA:

The Growing Promise of B2B In Media’s Reader Revenue Model