|

Getting your Trinity Audio player ready...

|

“Digital revenue is the biggest source of income growth”

The majority of the publishers surveyed by WAN-IFRA for its World Press Trends Outlook 2021-2022 report are “decisively upbeat about their companies’ future prospects,” says Teemu Henriksson, Research Editor, WAN-IFRA.

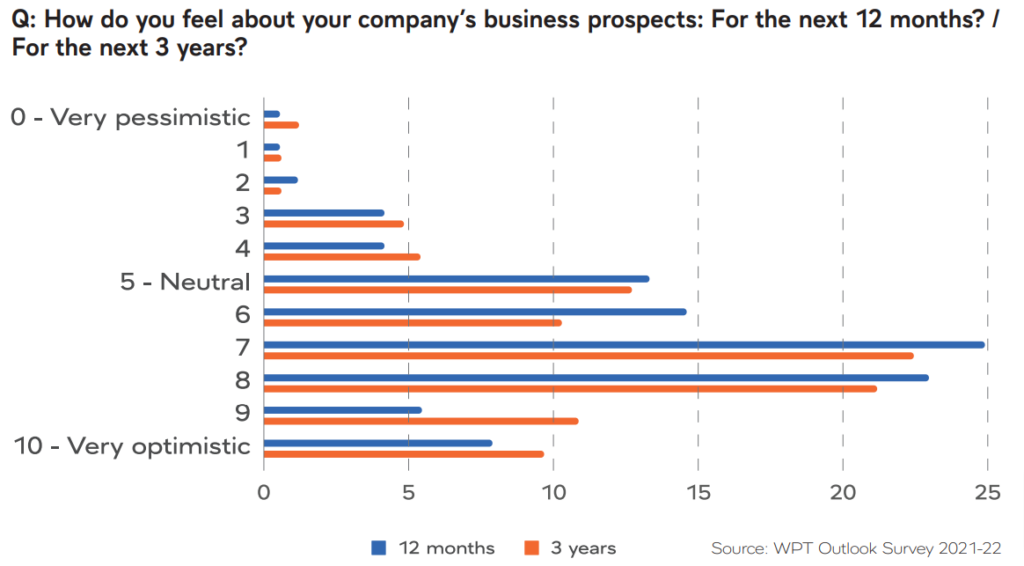

81.8% of the 162 publishers from 58 countries say they are optimistic about their business outlook this year. The figure reduces slightly to 78.8% when they are asked to rate their prospects for the next three years.

“Digital promises to be the key revenue driver”

“Optimism levels have grown year-on-year, in part because of where we were,” according to the report. “But, it’s also a reflection of the fact that we are also seeing growing advertising markets and increased profitability; two key reasons for some media companies to be optimistic about their prospects for the year ahead.”

Success in digital transformation is indicated as an important reason for this confidence. 49.1% of the respondents described the level of digital transformation at their company as “very advanced” (12.7%) or “advanced” (36.4%).

“Digital revenue is the biggest source of income growth,” the authors write, “despite the fact that print dominates existing revenue streams, it is digital advertising (+16.5%) and reader revenues (+14.3%) that have grown in the past year.

“In contrast, income from both print readership (-2.6%) and print advertising (-8.7%) have both decreased, despite print’s continued dominance of the overall revenue pie.”

Digital promises to be the key revenue driver over the coming years. Publishers are becoming digital hubs and they are transitioning to become a better partner in life.

Matthew Lynes, Media Innovation Analyst, Twipe

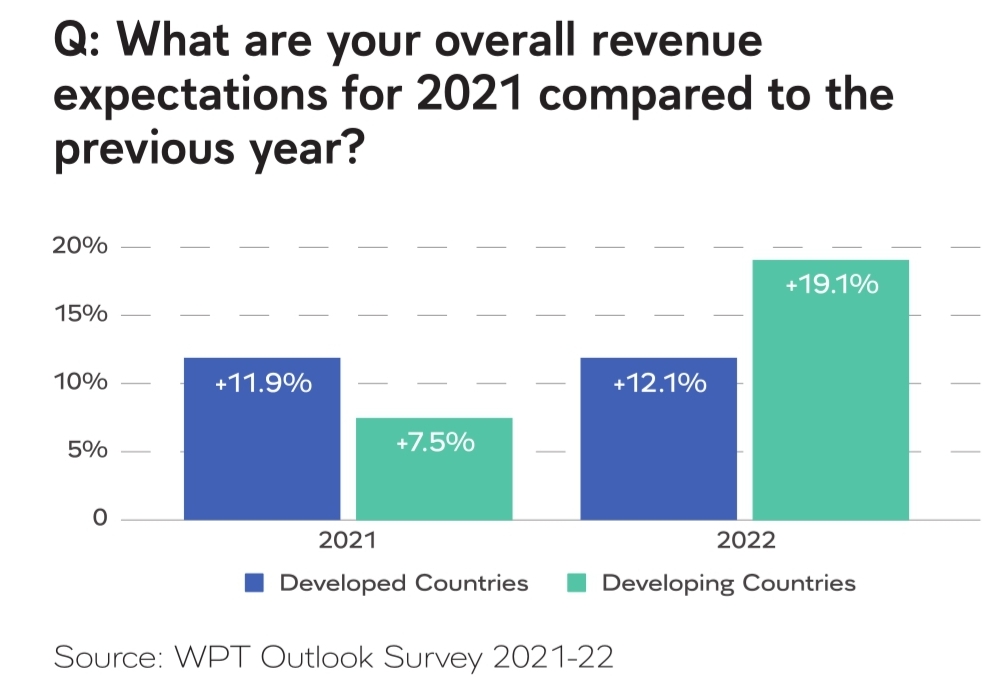

“The effect of growth in digital revenue is also seen in the overall revenue figures for 2021-2022,” adds Lynes. “Digital paid news circulation grew overall by 3.4% YoY totaling an audience of 52.5M subscribers. This growth represented a circulation revenue of $7.5B, up 8.3% YoY from 2020-2021.

“This astronomical growth over the last 2 years gives hope to publishers. People are willing to get behind their digital business models.”

Advertising, the leading source of income

The survey participants are also optimistic about revenue in the coming year. They expect growth in 2022 with advertising being the leading source of income. It accounts for nearly half (46.8%) of anticipated income for the next 12 months. Reader revenue is expected to bring in around a third of total income in 2021-22.

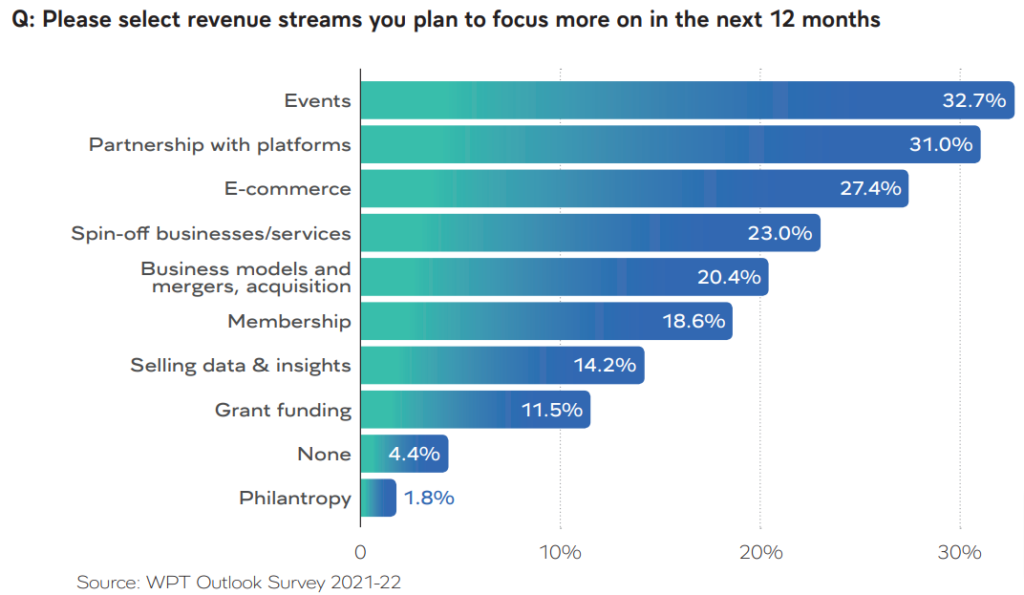

While advertising and reader revenue remain important revenue sources for publishers, the need for diversification is increasing. Publishers are making efforts to cultivate additional revenue streams. Events (32.7%) are the leading focus for non-advertising and reader revenue followed by partnerships with platforms (31%), and eCommerce (27.4%).

“When everyone is digital, strategy is the differentiator”

“Before long, every business will be a digital business,” according to Deloitte. “CEOs must make explicit choices about their strategy to win in a digital economy. When everyone is digital, strategy is the differentiator.”

“Digital possibilities must shape strategy. And strategy must shape digital priorities.”

Deloitte

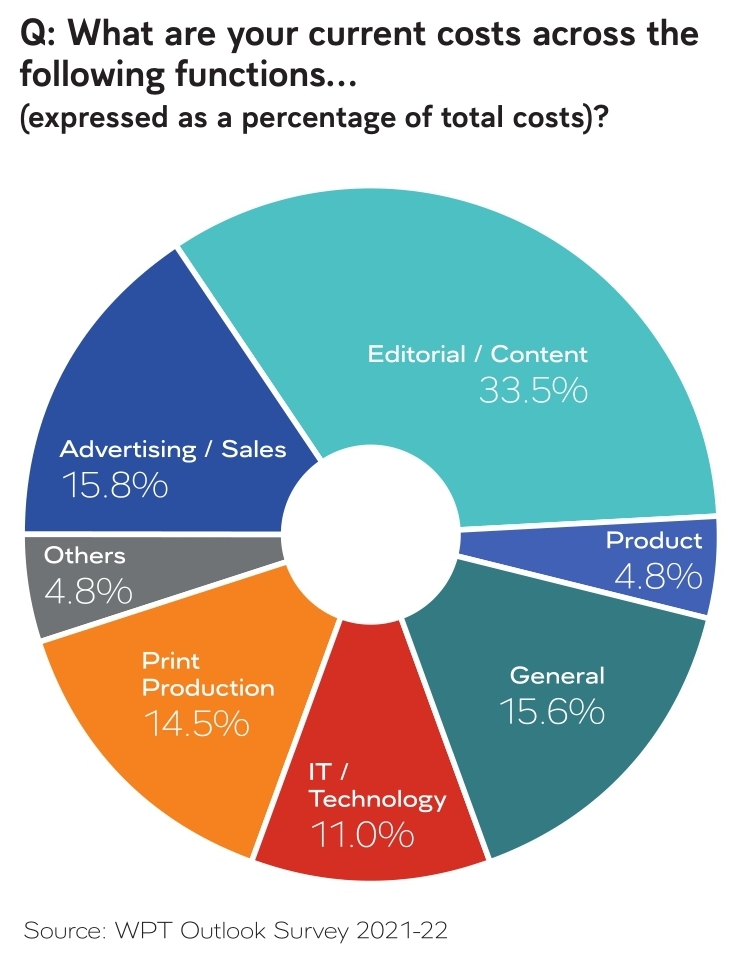

This includes prioritizing content quality and creating innovative products. It’s reflected in the survey as editorial and content occupy the largest slice of publishers’ costs. They account for 33.5% of expenditure—much more than other core activities like advertising and sales (15.8%), general costs (15.6%) and print production (14.5%).

The costs include creation of digital-only materials such as video and podcasting, distribution outlets like newsletters, as well as hiring of talent. The respondents identified product development and data analytics as core areas for investment.

Given the importance of content as a way for publishers to potentially differentiate themselves from their competition, it’s perhaps no surprise that this is an area of strategic investment for publishers.

World Press Trends Outlook 2021-2022

“Digital is the primary driver for revenue growth over the past year; and is likely to be for some time to come,” the authors note.

“For news publishers, these strategic plays might include launching new products, identifying fresh – or untapped – income streams, and investing in existing subscribers by reducing churn and growing average subscriber revenues.”

The full report is available at WAN-IFRA:

World Press Trends Outlook 2021-2022