|

Getting your Trinity Audio player ready...

|

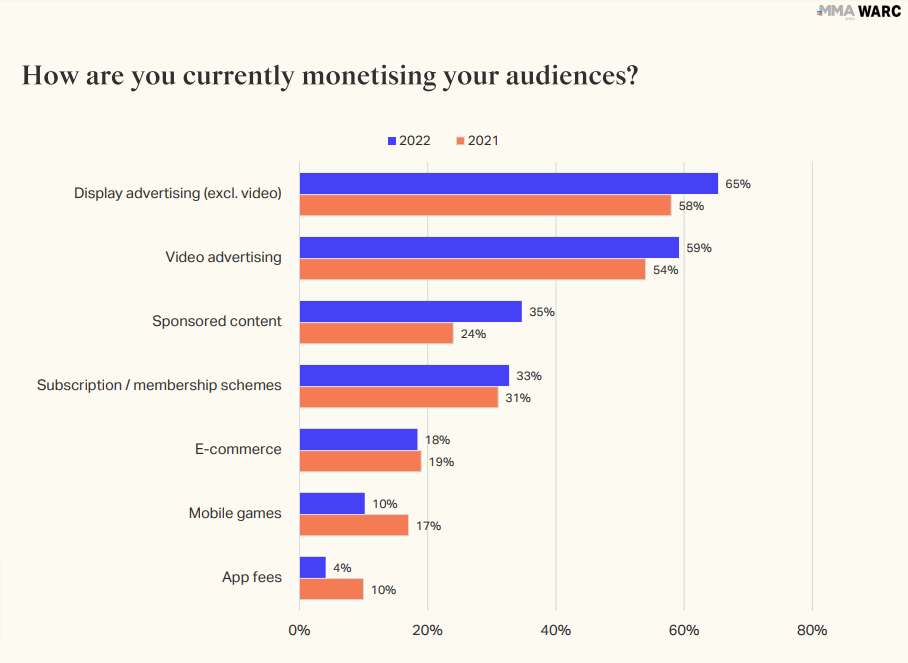

65% of media owners rely on display advertising and 59% on video advertising, to monetize their audiences, according to the State of the Industry 2022: Modern Marketing in EMEA report from WARC and MMA. These categories along with search, account for 69% of digital marketing budgets.

The report is based on a survey with 700+ marketing professionals carried out in May and June this year. It looks into how brands, agencies, media owners, and tech vendors in the region are driving growth, challenges of current trends, and future opportunities.

“Battle for long-term and sustainable growth”

The survey also finds an 11% increase in the number of media owners using sponsored content between 2021 (24%) and 2022 (35%). 33% are using subscription/membership models – a slight increase from 2021 (31%).

While display and video advertising continue to be important sources of income for publishers, revenue diversification is key in the battle for long-term and sustainable growth.

State of the Industry 2022: Modern Marketing in EMEA

The quest for diversification and direct revenue from readers also necessitates building a better user experience. This is reflected in the findings – 68% of the overall respondents have adopted a customer-centric approach to digital marketing. “Brands that take this approach place good service and customer experience at the heart of their business culture and strategy,” according to the report.

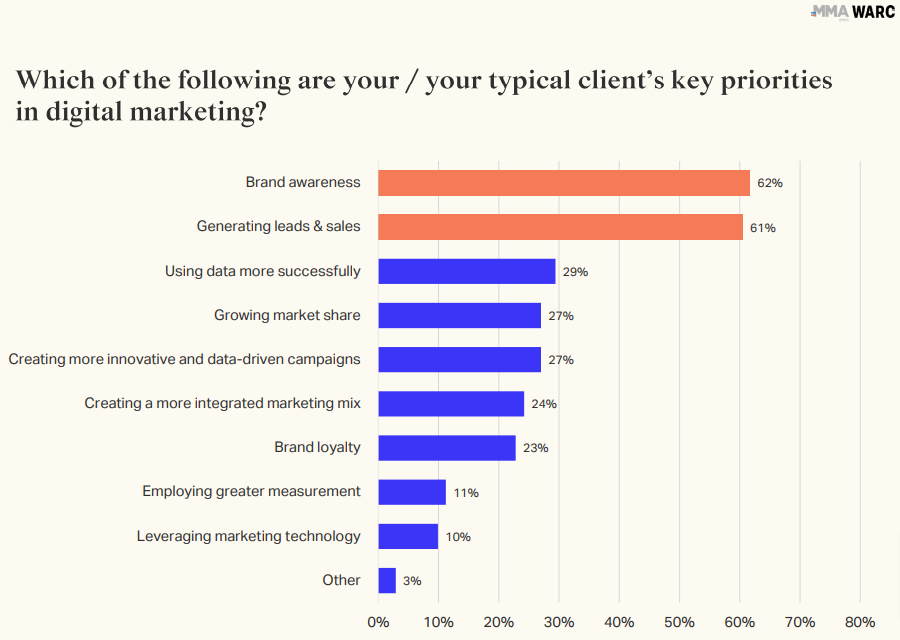

The survey also finds that brand awareness (62%) and generating leads and sales (61%) are the key priorities of digital marketing. Other priorities include using data more successfully (29%), growing market share (27%), and creating more innovative and data-driven campaigns (27%).

“Key building block in digital marketing strategies”

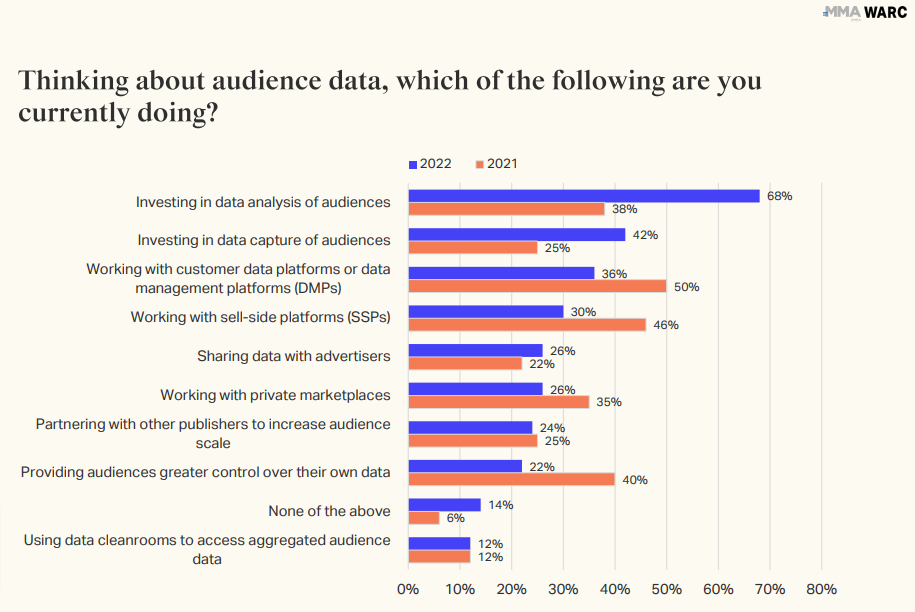

“Data is a key building block in digital marketing strategies,” the authors write. It is “being leveraged widely to drive improvements in marketing.” Overall, 73% of the respondents say their marketing strategy is driven by insights derived from consumer data. 68% of media owners indicate they are investing in data analysis of audiences compared to 38% in 2021. 42% have increased investment in data capture compared to 25% last year.

“One explanation for this uptick is the impending demise of third-party cookies,” according to the report, “which is causing many publishers to shift their focus to building quality, first-party audience datasets, increasingly through subscription-based revenue models.” 65% of the overall respondents have expressed concern that the shift to a cookieless world will adversely affect their audience targeting capabilities.

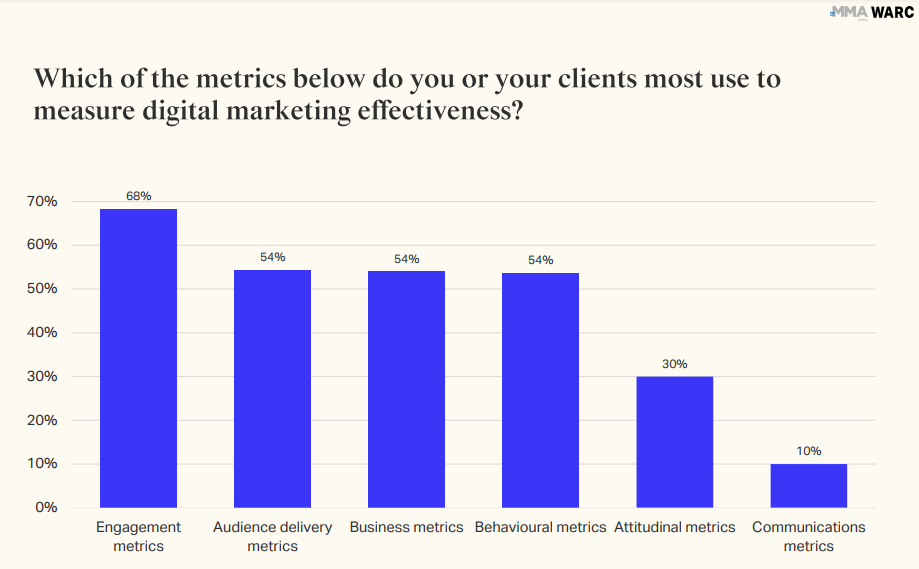

“Despite brand awareness and generating sales being two key priorities in digital marketing, marketers are not always using metrics that enable them to measure brand and business outcomes,” the authors note. The most suitable metrics i.e., behavioral and attitudinal, are used by 54% and 30% of the respondents. The vast majority (68%) use engagement metrics to measure marketing effectiveness, which is “criticized for failing to adequately capture the role of advertising in driving brand and business outcomes.”

“New revenue opportunities for publishers”

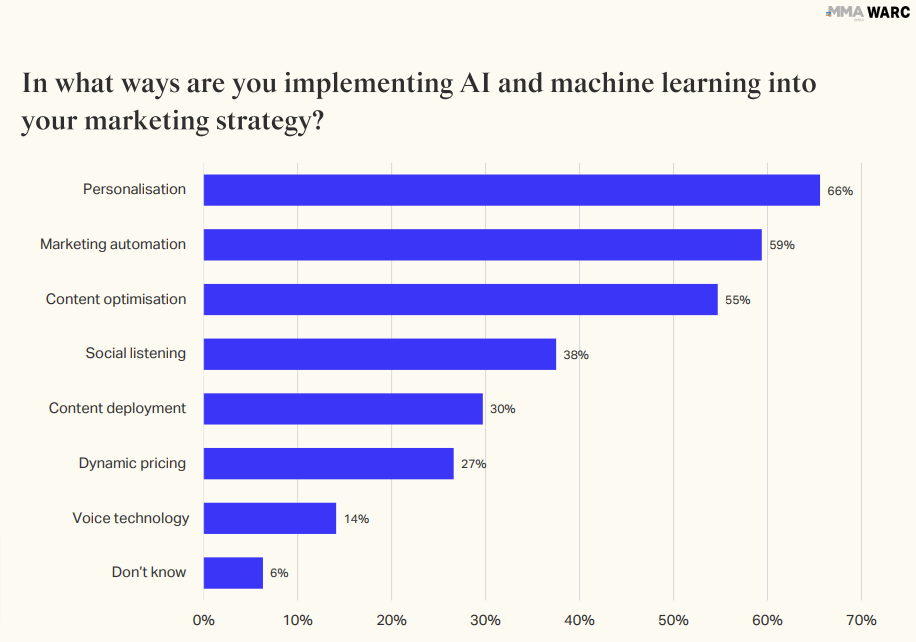

Looking ahead, 53% of the respondents believe that artificial intelligence (AI) and machine learning (ML) will be significant in the next five years. 66% are implementing AI and ML to drive personalization, followed by marketing automation (59%) and content optimization (55%).

44% of the respondents expect the metaverse to significantly impact digital marketing and some brands are already experimenting with it. Web3 technologies also appear promising for the creation of new marketing opportunities. 38% of the respondents say they are preparing for it. However, it’s not clear “how decentralization will shape the next iteration of the internet.”

51% of media owners say they have partnered with Facebook, followed by Instagram (45%) and Google (41%). However, 35% have not partnered with any of the listed platforms. It could be “due to privacy concerns, or speak to a desire for greater independence from the major tech platforms as publishers look to grow their own data and revenues.”

Data and content partnerships with platforms present new revenue opportunities for publishers. However, this should not come at the expense of focusing on building quality and privacy-compliant first-party audience datasets.

State of the Industry 2022: Modern Marketing in EMEA

The full report is available here:

State of the Industry 2022: Modern Marketing in EMEA