|

Getting your Trinity Audio player ready...

|

This is an excerpt from our free-to-download report, 50 Ways To Make Media Pay

“Subscription-based website revenue is recurring and more predictable than ad rates, which can vary by season,” notes Admiral. “The base recurring reader revenue can be even more helpful for smaller companies to forecast and plan for growth,” they suggest.

Nonetheless, for all the efforts to grow subscribers and increase reader revenue, advertising remains an incredibly important income stream for most publishers.

Although at many outlets this level of income/revenue is declining, globally the advertising market continues to grow and certain segments – such as podcasting – are growing ahead of the curve.

Research from MAGNA, published in June 2021, predicted that global advertising spending will grow by $78 billion this year (+14%) to $657 billion. This is an all-time high, following a decline of -2.5% in 2020. The global marketplace will continue to grow in 2022 (+7%).

The largest increases will be seen in the UK (+17%) and China (+16%), with the U.S. market adding $34 billion in 2021 (+15%) its strongest growth rate in 40 years). The American advertising market is expected to be worth $259 billion, 39% of the global total.

“Welcome to the roaring ‘20s,” WPP-owned Group M wrote in their U.S. mid-year forecast, noting that they expect digital advertising (excluding political advertising) to grow by 33% in 2021 (compared to +10% in 2020). Digital is expected to account for 57% of all U.S. advertising this year, growing to 69% by 2026.

These revised figures build on earlier Group M predictions which showed advertising bouncing back across most segments around the world, although – in line with long-term trends – growth is expected to be anaemic for newspapers (+0.8%) and magazines (-3.7%).

What these figures demonstrate is continued challenges for some media platforms, as well as the continued growth of the wider advertising spend. Given the latter, it’s no surprise that advertising remains an important part of the revenue strategies for most publishers, although it is a source that few outlets can rely on in the way that many did in the past.

Here are some of the ways in which publishers are harnessing advertising dollars, as part of their wider monetisation efforts.

1. Traditional Advertising Products

Although there are examples of innovation taking place in the advertising space, there remains considerable energy being exercised (and money being spent) in traditional products. This includes spots across TV and Radio, as well as display and classified advertising in print media.

Online, adverts for digital media can take many forms, including banner ads, pre-roll video and image carousels. USA Today provides details for 19 different types of digital ads specs in a spreadsheet for prospective advertisers, as well as an annual editorial calendar highlighting potential opportunities for “package alignment.”

Just as publishers have tried to bundle print and digital subscriptions to audiences, many outlets also continue to offer similar arrangements to advertisers.

2. Advertising networks

The ability for “group” buys across companies, or types of organisations, are appealing to advertisers – delivering scale for minimal effort.

Publishers are able to tap into this by stressing their reach and the ease with which advertisers can spend across multiple markets.

MediaNews Group notes in their Twitter bio that they offer “third party advertising and directory opportunities through over 800 multi-platform products on the web, mobile, tablet and print.” They run 98 daily and weekly print publications across the U.S.

Networks can also comprise multiple publishers, alongside those with multiple titles.

The Local Media Consortium (LMC), for example, has a wide range of companies as members, from large corporations to small family-owned stations and newspapers. With 90 local media companies representing 3,000 media outlets, the LMC promises potential partners “one contract, one point of contact, one seamless way to grow your revenue.”

Classifieds and obituaries delivered the highest ad revenue to LMC members in 2020, followed by cross-platform digital advertising through Centro and AdCellerant; as well as email marketing via LiveIntent and recruitment advertising through Monster.

3. Programmatic

“US programmatic digital display ad spending continued growing at double-digit rates during the pandemic,” eMarketer reveals, “and we expect it to reach a milestone next year when more than 9 in 10 digital display ad dollars are transacted using some form of automation.”

The company estimates that $75.09 billion was spent on programmatic digital display ads in 2020 by U.S. advertisers.

Worldwide, programmatically sold advertising was worth $129.1 billion in 2020, and it is expected to grow to 155 billion in 2021. Pre-pandemic, North America accounted for nearly three-quarters of the global programmatic spending (2019 figures).

4. Native Advertising

Although its importance has declined, more than six in ten (61%) of industry leaders surveyed by the Reuters Institute at the end of 2020 indicated that native advertising was likely to be “important or very important” for their company in 2021. Native advertising ranked third on their list of revenue streams, some way ahead of the next category, events (40%).

It’s a revenue stream that can enjoy a love-hate relationship with readers, and members of your newsroom. One key reason for this, as the academics Anocha Aribarg and Eric M. Schwartz explained in a 2019 article for the Journal of Marketing Research is because:

“In practice, the choice between display and in-feed native advertising presents brand advertisers and online news publishers with conflicting objectives. Advertisers face a trade-off between ad clicks and brand recognition, whereas publishers need to strike a balance between ad clicks and the platform’s trustworthiness.”

This problem can be exacerbated when the content is not clearly – or consistently – labelled; a move that can hurt the credibility and trustworthiness of a publisher.

Nonetheless, according to James Breiner, a former ICFJ Knight Fellow who launched and directed the Center for Digital Journalism at the University of Guadalajara, “One of the advantages of native advertising for independent news outlets is that it returns control to the publishers. They sell the ads that appear on their sites and keep all the revenue. They no longer rely on third parties like Google, Facebook, or algorithm-driven ad exchanges to deliver the ads.”

As more publications invest in content studios (see #44) this type of content looks set to remain important, but as Ava Sirrah, a former ad maker for the New York times and PhD student at Columbia University has outlined, “if more people become aware of the trend and its prevalence at trusted newspapers, they may be more willing to demand transparency in exchange for subscription dollars.”

Given the continued appeal of this format for publishers (and advertisers), coupled with the confusion and distrust seen among some consumers, it is incumbent on media providers to be more transparent with labelling and how/why this type of content is created.

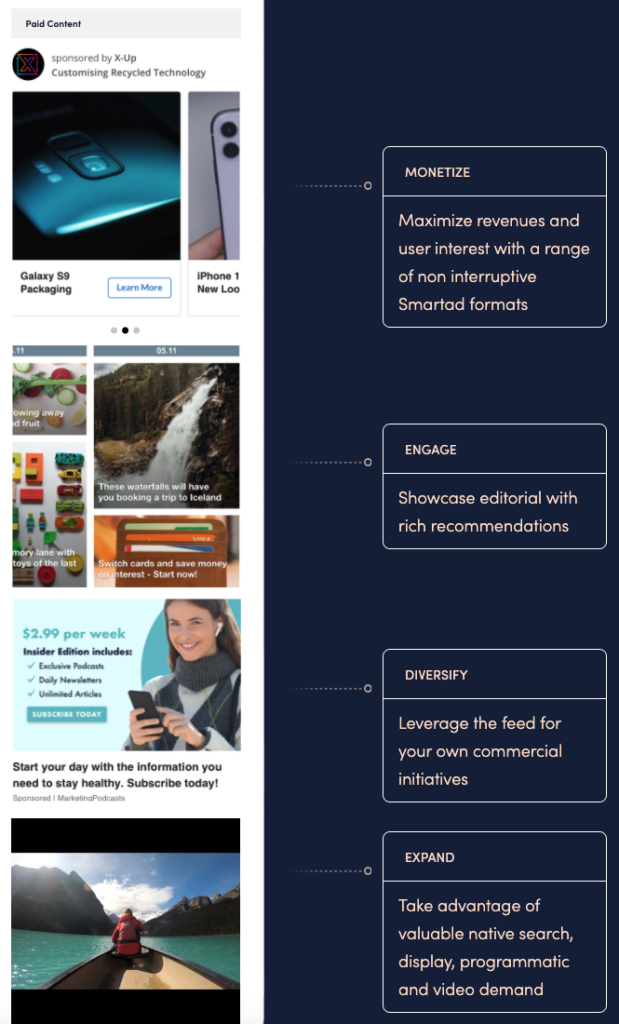

5. Recommendation Engines

Recommended content, typically at the bottom of online articles, webpages, and provided by companies like Outbrain, Taboola and Revcontent can be seen across the web. These recommendation engines promote content from brands, other sites, and potentially even the site you’re on, with external clicks generating revenue for both parties.

This relationship has historically been financially attractive for many publishers, with some benefitting from annual financial guarantees in the region of seven figures.

During the pandemic, this revenue “continued to monetize well,” one publisher told Digiday, although another executive also expressed concern that overuse of these platforms “could compromise their sites’ user experience,” and cheapen the advertising experience.

Outbrain’s revenues increased 57% year on year for Q2 2021, generating $247 million in revenue and $59.1 million in profit over a three month period. The company went public in July 2021 and after a proposed merger between Outbrain and Taboola fell through.

David Kostan, Co-CEO of Outbrain, argues the company is “a driving force of the open web,” helping media owners (and brands) compete with Google and Facebook by offering an advertising alternative.

“We’ve directly generated over $3 billion in revenue for the publishers that work with us,” Yaron Galai, Co-CEO, chairman and co-founder of Outbrain told AdExchanger this summer, “and that has supported a lot of journalism and local publishing.”

6. Sponsorship

Sponsorship can take many forms, including specific beats, websites and offsite activity.

In 2014, the News & Record in Greensboro announced that the nonprofit grant-giving arts organization, ArtsGreenboro, would sponsor the paper’s arts coverage for the next year.

The Triad Business Journal reported that the deal was worth “$15,000 on a one-year contract. That’s about $214 per article.”

The website Longform, which recommends new and classic non-fiction from around the web, has a long-standing relationship with Pitt Writers, the University of Pittsburgh’s Writing Program. As part of this partnership, Pitt provides interns who help to select content for their site, and the site is used by “Faculty and students at the University of Pittsburgh… as a consistent and reliable source for the best new and classic nonfiction, many using articles from the site as their sole course textbooks,” the Longform site says.

More recently, The Boston Globe sold sponsorship for several Slack channels that they set up to support small business owners, as they navigated the fallout from the early stages of the COVID pandemic. “The Globe took on a new role as a convener,” Kayvan Salmanpour, chief commercial officer at Boston Globe Media told Digiday.

In the digital arena, NowThis News’ video series “Seen” is focused on underrepresented narratives. It focuses on highlighting the experiences of entrepreneurs, influencers, and trailblazers.” The series is sponsored by the U.S. retail giant Target.

7. Underwriting

Underwriting has long been a staple form of support for public media (like NPR and PBS) in the United States. These channels do not broadcast adverts, but rather acknowledge the support that they have received from businesses, foundations, individuals and other supporters.

This is a regulated space, and as the PBS website explains: “From the FCC’s standpoint, the purpose served by underwriting credits is to identify the funder in the interests of full disclosure, not to promote the funder or its products and services.”

As Mara Liasson, an NPR Correspondent on National Politics, wrote back in 2006:

“NPR has worked hard and done lots of audience research to design its “sponsorship” so listeners will not perceive these spots as commercials. That would presumably damage NPR’s image as non-commercial (which I just learned is called “brand equity!”) and lead to a drop in listener support.”

It’s a potentially semantic and ethical minefield and one where organisations are very careful to have clear guidelines about the nature of this type of support. Nonetheless, it’s interesting to note that other non-public media outlets have also adopted the principles of underwriting, including the Vermont-based non-profit VT Digger.

In North Carolina, The News & Record’s announcement of their partnership with ArtsGreenboro, often used the term “underwriting” to describe the relationship.

“…Every story or review underwritten by ArtsGreensboro will appear with this note: “This News & Record arts coverage is supported by contributions to ArtsGreensboro’s Arts & Theatre Media Fund,”” Jeff Gauger, the News & Record’s executive editor and publisher wrote.

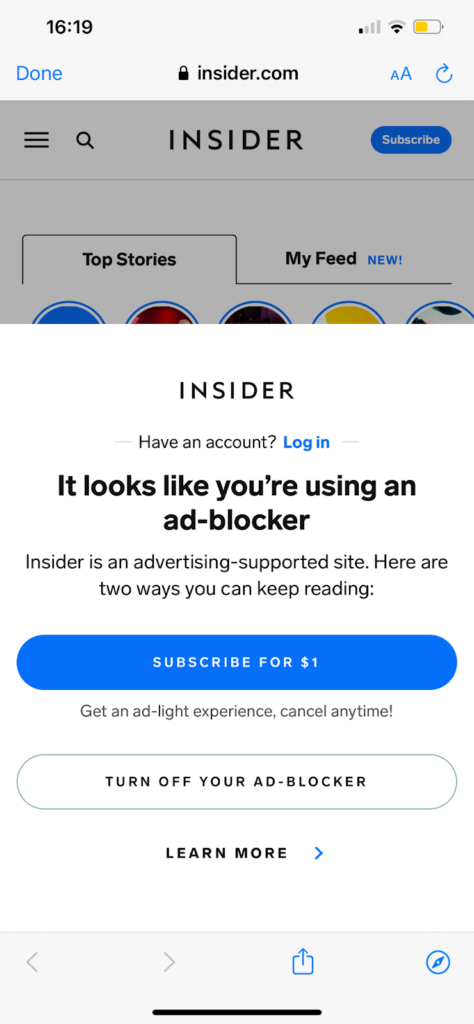

8. Ad Blocking

Research seems to suggest that the use of ad-blocking isn’t growing as quickly as it once was. Nonetheless, it continues to rise and is a global habit. Data from Hootsuite found that 42.7% of internet users worldwide (16-64 years old) use ad-blocking tools, with usage highest in emerging markets like Indonesia, India, South Africa and Malaysia.

For publishers, many of whom are reliant on serving digital ads, this has revenue implications as a result, we have seen numerous publishers encourage users to whitelist their site or turn ad-blockers off.

Consumers may use ad-blockers for a variety of reasons, including: volume of ads (too many), perceptions of intrusiveness with ads disrupting the user experience, irrelevant ads, as well as on-site and cross-site repetition (as parodied in The Onion’s 2015 article “Woman Stalked Across 8 Websites By Obsessed Shoe Advertisement”).

Publishers are also responding to this challenge by increasingly offering ad-lite, or ad-free subscriptions. Another solution, of course, is to just make better ads.

9. Legal and Public Notices

Many newspapers in the U.S. and the UK have benefitted over the years from legal obligations by government institutions to publish public notices. However, the advent of the internet has long threatened this revenue stream, giving the opportunity for government agencies to share this material on social media and their own sites.

“Putting public notices on a government-run website is like trusting the fox to build and watch the henhouse,” the Pennsylvania Newspaper Association argued back in 2010. It’s an argument that many critics (including those who benefit from this revenue stream) continue to make.

Nevertheless, the threat of these revenues disappearing is a constant one, even if it has yet to be realised. “Despite growing legislative challenges, newspapers have managed to retain nearly all their public notice business,” David Westphal observed in an article for Poynter last year. “And for many, it has become indispensable to survival,” he added.

The hit for newspapers, should this revenue stream disappear, therefore could be discernible. Perhaps pre-empting that risk, the digital start-up Column aims to improve this process, by acting as a conduit for publishers, governments and legal services. It’s clients include a number of state press associations, the Washington Post and local newspaper groups such as Wick Communications, Swift Communications and McClatchy.

Excerpted from our free-to-download report, 50 Ways To Make Media Pay