|

Getting your Trinity Audio player ready...

|

(Part Four, ideas 41-50: Content)

This is the fourth and final part in a series, examining how different ways in which publishers are seeking to “make media pay.”

In previous months we’ve explored Paywalls and Subscriptions (Part One, ideas 1-12), Advertising and Ad-Free opportunities (Part Two, ideas 13-29) as well as Events and eCommerce (Part Three, ideas 30-40).

The whole set is also available to download in our new report, 50 Ways to Make Media Pay.

In this concluding installment, we identify popular – and emerging – methods to make money through content.

41. Podcasts

Podcasts are hot right now. In a recent survey of 200 editors, CEOs, and digital leaders, the Reuters Institute for the Study of Journalism found that:

“With many publishers launching new daily news podcasts, it is perhaps not surprising that the majority (75%) think that audio will become a more important part of their content and commercial strategies.”

Podcasting’s momentum has been boosted by the launch of new, high-profile, daily podcasts from publishers such as The Washington Post and the Guardian, as well as the acquisition of Gimlet Media and Anchor by Spotify.

As Billboard notes, these are “two of the podcast industry’s largest production houses and distribution tools, respectively.”

“Gimlet — home to popular shows such as Reply All, StartUp and Spotify exclusives Crimetown and Mogul — previously called itself the “HBO of audio,” and will be sold to Spotify for a reported price of around $230 million. Anchor claims that it powers 40 percent of new podcasts entering the market and accounted for 15 billion hours of audio content on Spotify in Q4 2018.”

It’s too early to tell what the implications of this are for publishers. But, for now, many podcasters will continue to explore the traditional revenue opportunities afforded by the medium.

Specifically, this tends to include sponsor messages – either read by hosts, or as separate ads – which typically tend to be found at the start, middle and end of the podcast.

In late 2015, the Financial Times commented that podcast ad rates “tend to fall in the range of $15 to $30 per 1,000 listeners — about five times the cost of a traditional radio spot — with the most popular shows commanding $100 or more.”

Arguably, the relative scarcity of advertising space can make for a more premium advertising experience.

Ad revenues for this medium are projected to double by 2020, with CNBC recently highlighted how both “PwC and the Interactive Advertising Bureau (IAB) [are] predicting that U.S. ad spend will go up from an estimated $314 million in 2017 to $659 million in 2020, with “baked-in” ads (that are read by the presenter) the most popular type.”

Furthermore, new technological possibilities – such as dynamic ad insertion, whereby adverts are available for a certain number of plays – as well as programmatic advertising, and more detailed analytics, are already coming to audio, providing valuable data for publishers, and advertisers, alike.

“Podcasts may not offer a pot of gold,” the Reuters Institute’s Nic Newman wrote last month, “but easier access, better discovery and millions of new audio devices suggests there is considerable growth left in the market.”

42. TV partnerships

As we noted in Part Three of this series, a number of podcasters – such as Slate, Pod Save America, Radiolab and This American Life – have also taken their show on tour, opening up new financial avenues in the process.

Alongside this, a number of podcasters and publishers have also embarked on partnerships with TV networks, again creating new income streams.

Last year, Amazon Prime adapted the podcast “Homecoming” into a highly successful show starring Julia Roberts (both the TV series and podcast are excellent BTW). Not to be outdone, Pod Save America partnered with HBO for a series of specials, following in the footsteps of another highly successful podcast 2 Dope Queens.

Traditional publishers have also delved into this space.

- The New York Times partnered with the network Showtime to create a fascinating four-part documentary series about paper in the Trump era,

- Netflix worked with BuzzFeed on a show (now cancelled after one series) which followed reporters “as they probe topics ranging from quirky internet crazes to safe injection spaces for opioid users,” and

- Axios partnered with HBO on a four-part series which kicked off with an in-depth interview with President Trump.

Although the success of some of these ventures is debatable, there does seem to be a clear trend among TV producers to look for talent and ideas among other mediums; and the glare of the studio lights are clearly appealing to many of these outlets and content creators.

Interestingly, This American Life is an example of a show which turned its back on the TV medium. As they explain, despite winning numerous awards, “after two seasons we asked the network to take us off the air.”

“It was too much work doing both the radio and television shows,” they admitted. “We hope to return to TV someday, maybe with specials, maybe in some other form.”

43. Newsletters

Newsletters, like podcasts, are a communication form which have enjoyed a renaissance in recent years. In the preface to a short 2016 report “Back to the Future- Email Newsletters as a Digital Channel for Journalism,” LSE’s Charlie Beckett observed that:

“As the digital ecology evolves, it sometimes pays to go back to basics and adapt relatively old ideas for new times.”

Players in this space include specialists like TheSkimm – which has 7 million subscribers and last year raised raised $12 million in a funding round, and $28 million since 2012 – as well publishers like The Washington Post which has more than 70 newsletters.

Monetization strategies abound, ranging from sponsorship of content (see, for example the partnership between Mozilla and NextDraft), through to paid banner ads, and recognition of the role newsletters play as a lead generation tool.

Miki Toliver King, Vice President of Marketing at The Washington Post, told WAN-IFRA’s World News Media Congress in Portugal last year that newsletters “expose the reader to our content whether or not they come to our site, so that helps us to build a way of communicating with the reader and in some cases reminding them, giving them a brand reminder, when they are not on our site.”

That reminder can also be used as a subscription nudge.

No wonder Digiday argued in 2016, “Newsletter editors are the new important person in newsrooms.”

44. Memberships

There are a vast array of excellent, constantly evolving, resources dedicated to helping publishers make sense of the opportunities provided by newsletters and membership programs.

Membership models have arguably grown for a number of reasons, often blending revenue potential, with the opportunity to build closer links between the newsroom (and business development teams) and members themselves.

As we mentioned earlier, Slate Plus – offers one approach, with members able to access both ad-free and bonus content, as well as early-bird tickets for events.

Elsewhere, Tortoise, the slow news initiative which recently raised £539,035 on Kickstarter, is an example of an outlet seeking to incorporate editorial and creative input from their paying members. Led by James Harding – a former Editor of The Times and Head of BBC News – Tortoise has promised members access to open news conferences, which they call “the ThinkIn.”

“You will be able to dial in, listen in or walk in and be part of the live, unscripted conversation each evening – Monday-Thursdays – in our newsroom that informs our point of view.”

In this scenario the ability of members to not just access, but also inform, content is key to their financial model.

Tortoise’s approach harnesses an ideal for openness with its members that others are also seeking to emulate.

The Correspondent – an ad-free US offshoot of the Dutch based De Correspondent – which also recently completed a successful crowdfunding campaign, promises to “collaborate with you, our knowledgeable members.”

In California, the Voice of San Diego offers members access to meet and greets with their journalists, as well as an opportunity to “Plug your favorite cause or your business through a special shout-out in the Member Report or at an event.”

And on 5 November 2018, a speech at the Society of Editors annual conference in Manchester, Katharine Viner, editor-in-chief, Guardian News & Media shared that since March 2016:

“…the Guardian has received financial support from more than one million people.

Over half a million of them continue to support us every month – through either a subscription, membership, or a recurring contribution.”

Arguably, many of these contributions are altruistic, supporting journalism for public good and – as the Guardian is keen to mention – helping to ensure that they do not have to put their content behind a paywall.

45. Research and Analysis

Skift, a website which describes itself as “Defining the Future of Travel. Global travel industry news, analysis & data on online travel, airlines, hotels, tourism, agents, tours, startups, tech & more,” successfully blends news, newsletters and events, with detailed research papers.

Promising “50 new reports every year” and with “125 reports in our library,” the team produces twice-monthly reports on topics such as The New Era of Food Tourism: Trends and Best Practices for Stakeholders, A Deep Dive Into AccorHotels 2018: Measuring Success From Asset-Light to Acquisitions and the U.S. Airline Sector: Skift Research Estimates 2019.

Reports cost from $50 for a short eBook on the Amazon factor (estimated by the site to be under a 5 min read) to $695 for more detailed reports like “Digital Advertising Trends in Travel 2018.”

Readers can buy individual reports or subscribe for full access. An individual subscription currently costs $2095 USD annually with other rates available for larger numbers of users.

Subscribers can also access Analyst Sessions (audio webinars) which dive deeper into topics.

Other outlets which also harness research services include The Economist, with The Economist Intelligence Unit (The EIU) and Business Insider. BI, for example, will often feature the highlights of their research in an article on the website, encouraging readers to subscribe for full access to their reports and briefings.

You don’t even need to be a large operation to deploy this approach. Back in 2015, Mathew Ingram reported that “Ben Thompson’s Stratechery is doing $200,000 a year in revenue.”

Stratechery “provides analysis of the strategy and business side of technology and media, and the impact of technology on society.” Based in Taipei, Taiwan, Thompson is fully supported by his work at Stratechery, which offers free access to Weekly Articles and three Daily Updates a week for subscribers only. Subscriptions cost $10 a month and $100 for the year. If you’re not familiar with his analysis, then I highly recommend checking it out.

46. Sponsored Content

Sponsored content, in the form of advertorials, is nothing new. But in the digital age, we’ve seen a slew of publishers rush to create their own content studios.

Outlets such as Reuters, the New York Times, Refinery 29 and CBS Interactive have all created branded content shops, separate from their core editorial operations.

Alongside this, publishers like TechRepublic (also part of CBS Interactive) provide access to White Papers, “free vendor-supplied technical content,” which range from the likes of Oracle, Microsoft and IBM, as well as less known smaller companies such as 8×8, Inc. and Vonage.

Both routes offer potential revenue streams for publishers, as brands seek to find different routes to eyeballs.

47. Unlocking the power of your archive

Publishers have long recognised the power of their archive. Many newspapers have historically sold reprints of photographs, and date-specific front pages (e.g. from your date of birth).

In the digital age, some outlets have begun to recognise that their depth, and breadth, of their archives can be an asset. For example, in 2014, the New York Times’ Innovation Report, observed that:

On Oscar night, The Times tweeted a 161-year-old story about Solomon Northup, whose memoir was the basis for “12 Years a Slave.” After it started going viral on social media, Gawker pounced, and quickly fashioned a story based on excerpts from our piece. It ended up being one of their best-read items of the year. But little of that traffic came to us.

In a digital world, our rich archive offers one of our clearest advantages over new competitors. As of the printing of this report, we have 14,723,933 articles, dating back to 1851, that can be resurfaced in useful or timely ways. But we rarely think to mine our archive, largely because we are so focused on news and new features.

“You have a huge advantage,” said Henry Blodget,the founder of Business Insider. “You have a tremendous amount of high-quality content that you have a perpetual license to.”

“We can be both a daily newsletter and a library — offering news every day, as well as providing context, relevance and timeless works of journalism,” the report concluded.

It is a model many other publishers can potentially follow.

48. Obituaries

Not applicable to everyone, but in a 2017 research report on American local newspapers – produced for the Tow Center for Digital Journalism at Columbia University – Dr. Christopher Ali and I found that this was a growing revenue source.

The Courier Record of Blackstone, Virginia, was one such paper which we found had changed its approach to this area of their business.

“We used to never charge for obits, then we charged for some versions and didn’t charge for others. Now, basically most obits in our paper are paid,” owner Billy Coleburn told us. “Do a color photo, and it’s not a bad additional piece of revenue,” he said.

At the same time, Coleburn also indicated that “obits are a very important part of record of the paper, no doubt, [and a] record of the community.”

Not everyone is comfortable with doing this. According to Steven Waldman, co-founder and President of Report for America (as well as the lead author of the FCC’s 2011 study “Information Needs of Communities: The Changing Media Landscape in a Broadband Age”):

“There’s still a couple newspapers out there that do it for free. They [see] this is a service to our community and we’re not gonna charge for it. I think those are very few and far between, but I have come across some like that, and some have kept their prices down in the forty–fifty-dollar range, something like that. But, certainly in the metro papers, the rates [for obituaries] are going way up.”

My colleague Michelle Nicolosi, later shared with me that “many newspapers use legacy.com as the vendor.”

Founded in 1998, Legacy.com describes itself as “the global leader in online obituaries, a top-50 website in the United States, and a destination for over 40 million unique visitors each month around the world.” It partners with more than 1,500 newspapers and 3,500 funeral homes across the United States, Canada, Australia, New Zealand, the United Kingdom, and Europe.

49. Content for new markets

Arguably, the most obvious way of thinking about this idea is international and/or digital expansion.

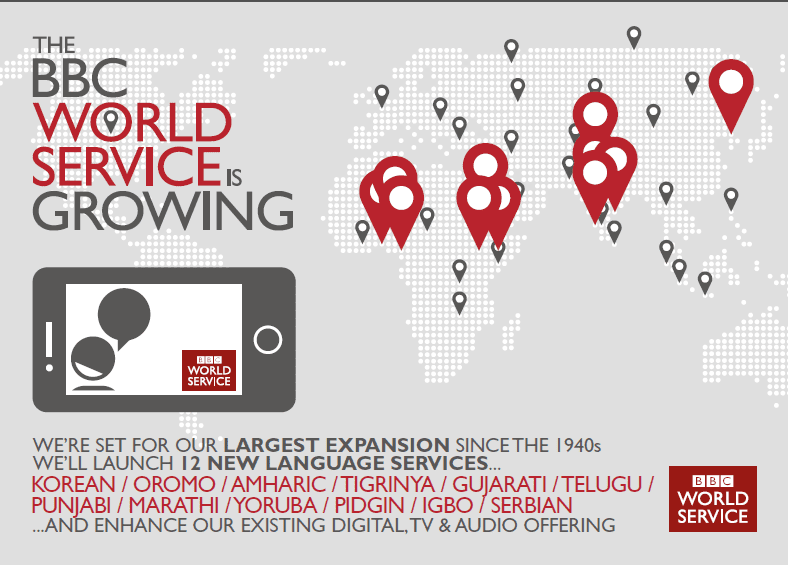

We have seen this tactic used by publishers such as Quartz – which moved into the Indian market in 2014 – as well as Netflix (also pushing hard in India), CNN, the BBC (funded by the UK Government) and others.

However, an often overlooked approach is to look at totally new verticals.

Blue Chalk Media, an award-winning Brooklyn and Portland based digital media company, has successfully done this by partnering with the higher education division of Pearson, to “produce a number of series of hosted “explainer” videos to complement Pearson’s digital college curriculum.”

“The videos use current events to explain key concepts and offer context to 500,000 to 1 million college students nationwide every school year. To date, we have produced videos that explain basic concepts in American Government, Sociology, and Communication.”

“Video is the new coin of the realm,” CEO Greg Moyer told me and a group of my students last summer, “and companies need to be able to tell their story in video.”

50. Partnerships with Platforms

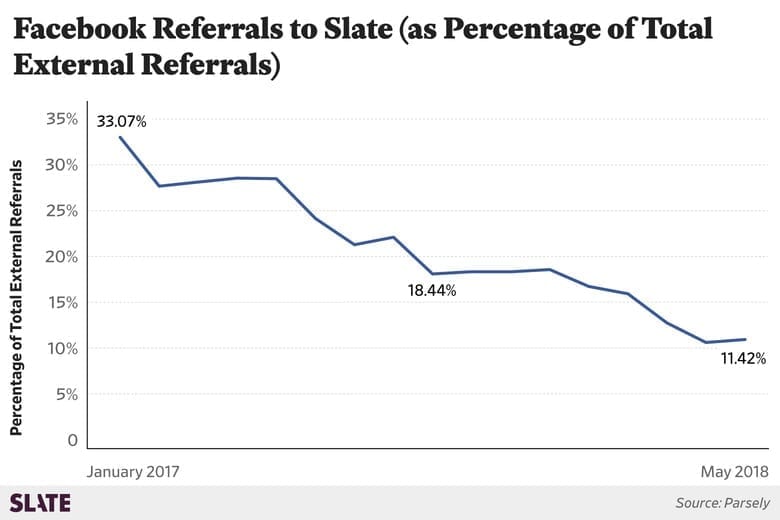

Finally, it is of course also impossible to overlook the relationship between publishers and platforms. The relationship is not always an easy one. Changes to Facebook’s algorithm last year notably hit Slate’s referral traffic and caused the closure of Little Things.

More recently, the cancellation of a Facebook Watch series was seen as a major factor in major changes at Mic. The millennial oriented website laid off most of its staff in late November; and was sold for a fraction of its previously estimated value.

Despite this, there remains a clear independency between content creators and platforms. The relationship shows no sign of ending any time soon.

One key reason for this is the revenue potential this dynamic can unlock for publishers.

Snapchat has partnered with a a number of media companies in a range of markets, including the Middle East. The ephemeral messaging network paid its publishing partners “more than $100 million” in 2017, through revenue-sharing advertising arrangements.

Facebook has commissioned content from a similarly broad of media companies. In December 2018, Ad Age reported the service had 75 million daily viewers, and that “its 75 million daily viewers spend 20 minutes on average every day on Watch videos, and there are 400 million people who visit Watch each month for at least a minute.”

Meanwhile, publishers are also exploring revenue possibilities with Apple News and the powerhouse that is YouTube. The video streaming service has been working with publishers commissioning content and paying out revenue from ads. Their partners include everyone from Elle to the Singaporean conglomerate, Mediacorp, as well as UK production companies, YouTube influencers and online stars like PewDiePie.

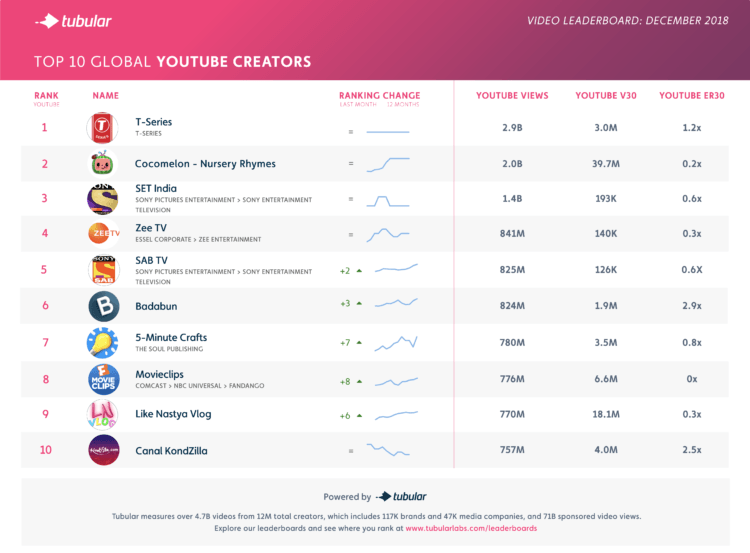

Data from Tubular Insights revealed that the Top Ten creators, brands, and channels which publish primarily original content to the platform, garnered over 12 billion views on YouTube in December 2018.

With reach like this, it’s not surprising that publishers continue to explore opportunities to partner with the streaming behemoth.