|

Getting your Trinity Audio player ready...

|

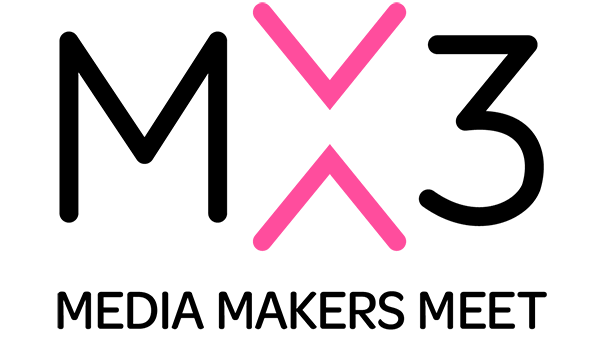

65% of publishers believe their business will fully recover from the pandemic, according to WAN-IFRA’s World Press Trends 2020-2021 Outlook report. And accelerating digital transformation is the “overwhelming top priority” for 44%.

If publishers have been muddling their way through a long-term digital transformation strategy, the shock waves of the pandemic have put those plans into overdrive.

World Press Trends 2020-2021, WAN-IFRA

“Despite the damage done, the pandemic has accelerated publishers’ plans to transform their business now, not tomorrow – and to embrace the uncertainty and challenges that come with that,” writes Dean Roper, Director of Insights WAN-IFRA.

The report is based on a global survey of publishers and experts undertaken to gauge financial performance, forecasts and insights. More than 90 news executives from 51 countries participated. The report also references WAN-IFRA’s WPT data and that from PriceWaterhouseCoopers (PwC), Zenith, Chartbeat and Mather.

“Pillars of an evolving digital transformation strategy”

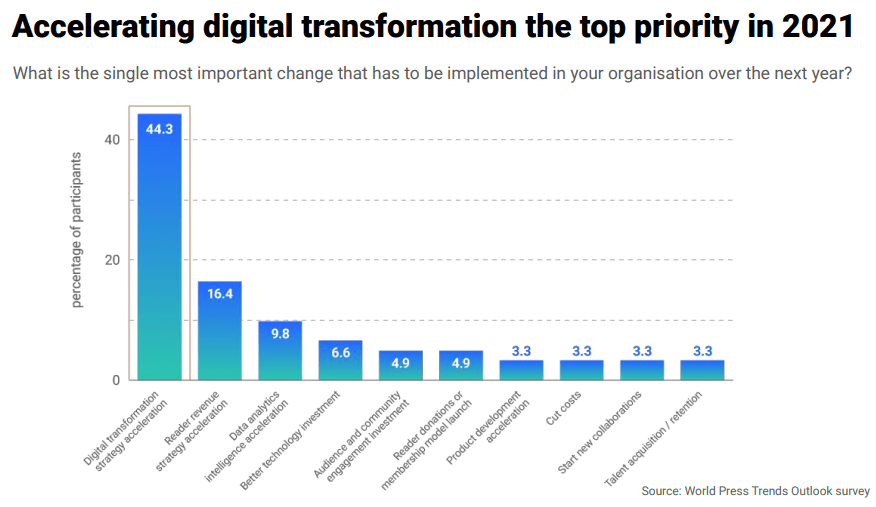

Digital reader revenue and digital readership continue to increase significantly, the survey found. They were up nearly 27% and 36% respectively, last year. This was a result of people seeking out trustworthy information amidst the pandemic, and publishers focusing on digital subscriptions and audiences-first strategies.

“Digital transformation is an overarching strategy for most companies but the specifics of that are increasingly audiences-first, reader revenue, data and product development,” the authors note.

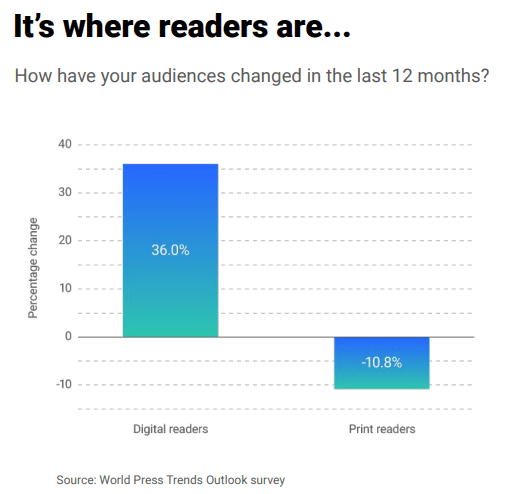

Most publishers selected digital paid content as their leading choice when asked about their top investment plans in 2021. It was followed by the technologies and data needed to support reader revenue strategies, skill sets in the newsroom, product development, and new forms of journalism.

Digital circulation revenue grew 23% YoY. Although globally it makes only 6% of publishers’ revenue, it has “all the key ingredients of a reader revenue strategy,” the report states. These are audience engagement, a rich data and analytics culture, product development and cross-departmental collaboration – “the pillars of an evolving digital transformation strategy.”

Digital subs (or some form of it) alone are not a panacea for solving a publisher’s or the industry’s business model challenges. But it can go a long way in building a more sustainable future and aligning the entire news operation (editorial, tech/data, commercial, marketing) – all focused on your audience, serving it, learning from it, and, ultimately, reaping from it.

World Press Trends 2020-2021, WAN-IFRA

“Publishers can venture into other areas of business built on that loyal base,” they explain, “like ecommerce which exploded during the pandemic, or premium content services or events or newsletters or podcasts or partnerships, or, yes, advertising.”

Advertising: The most important source of income

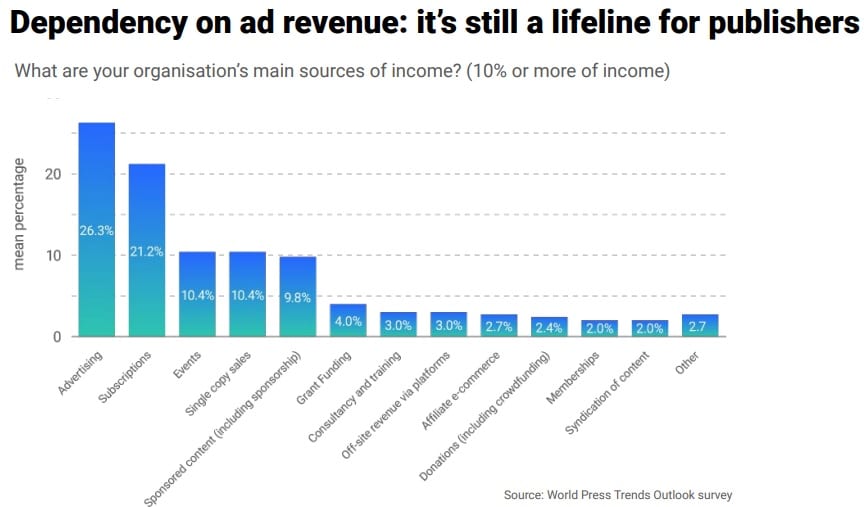

Coming to advertising – it currently accounts for about 46% of publishers’ traditional income (advertising and circulation) globally. And despite the continued decline in print and challenges of digital, 26.3% of the respondents cited it as their single most important source of income. It was followed by subscriptions (21.2%), events and single copy sales (both 10.4%).

In fact ad revenue contributes as much as 70-80% of publishers’ revenue in some markets/regions and depending on the business model. Moreover, much of it is still coming from print.

Consequently, publishers see the ongoing decline of advertising as the biggest risk to their organization’s success (30.6%), followed by the inability to diversify revenue streams (21%).

As the push for digital reader revenue continues, even those publishers advanced in digital subs are not simply turning off the ad spigot (as some analysts seem to suggest), nor are they “discounting” print.

World Press Trends 2020-2021, WAN-IFRA

It’s encouraging to know that despite facing multiple challenges, digital advertising increased 8.8% last year when overall revenue on average was down by 11%. Zenith forecasts that digital advertising will grow 10% in 2021 followed by an average rate of 9% a year to 2023, when it will reach 58% market share.

“Future rests in building stronger engagement”

An audience focused digital transformation strategy can help boost both subscription and advertising revenue. Publishers are “refining their ad strategies based on an audiences approach and first-party data,” according to the authors. “In particular, preparing for the coming cookie-less world next year, while also working on pricing (higher) and bundling of print / digital products.”

The pandemic created an opportunity for news publishers to strengthen connections with their audiences. And their “future rests in building stronger engagement with their audiences,” the report concludes.

The full report is available at WAN-IFRA:

World Press Trends 2020-2021