|

Getting your Trinity Audio player ready...

|

Every year, we look forward to the release of the Reuters Digital News Report because it’s one of the most comprehensive reviews of news consumption globally. Based on a survey of 75,000 people in 38 markets, the 156 pages of this report are full of actionable insights. We’ve boiled down the findings to the 5 key graphs that should shape the rest of your 2019 strategy.

Move towards ongoing payments

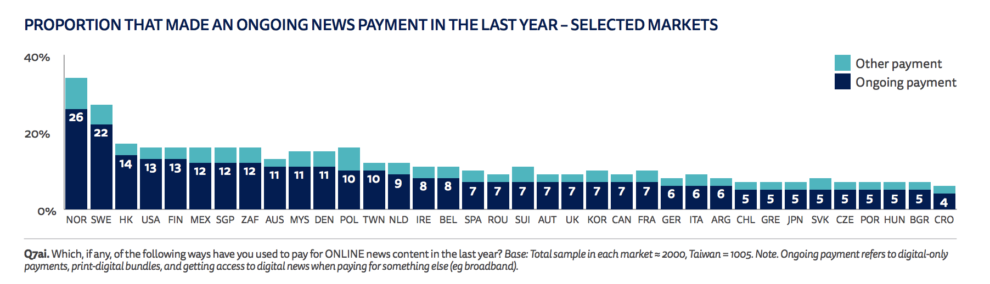

Since last year, there has only been a small increase in readers who pay (in any form) for online news, however we do see more readers moving towards ongoing payments. This move towards subscriptions, and away from one-off payments, is something we expect to continue. We already see the impact playing out in the industry today, with the recent news that Blendle was pivoting from micropayments to subscriptions. This is something we predicted last year, with a growing preference in the industry to develop direct, long-term relationships.

In many countries, the number of people paying for digital news is still lower than those for pay for print news, which can be seen as an opportunity to still grow. Previous research by Reuters shows that the majority of online news in Europe is still free at the point of consumption, meaning many readers today do not feel a need to pay. To better understand this, Reuters asked respondents if they had seen a paywall in the past week. In countries that stand out for their high percentage of readers paying for online news, such as Norway and Sweden, roughly 80% of respondents regularly see paywalls. However in most of Western Europe and the US, only around 60% of respondents frequently see a paywall. This is one of the key mistakes we see when developing a paywall strategy: not having enough of your readers actually bump into it.

Reaching subscription fatigue?

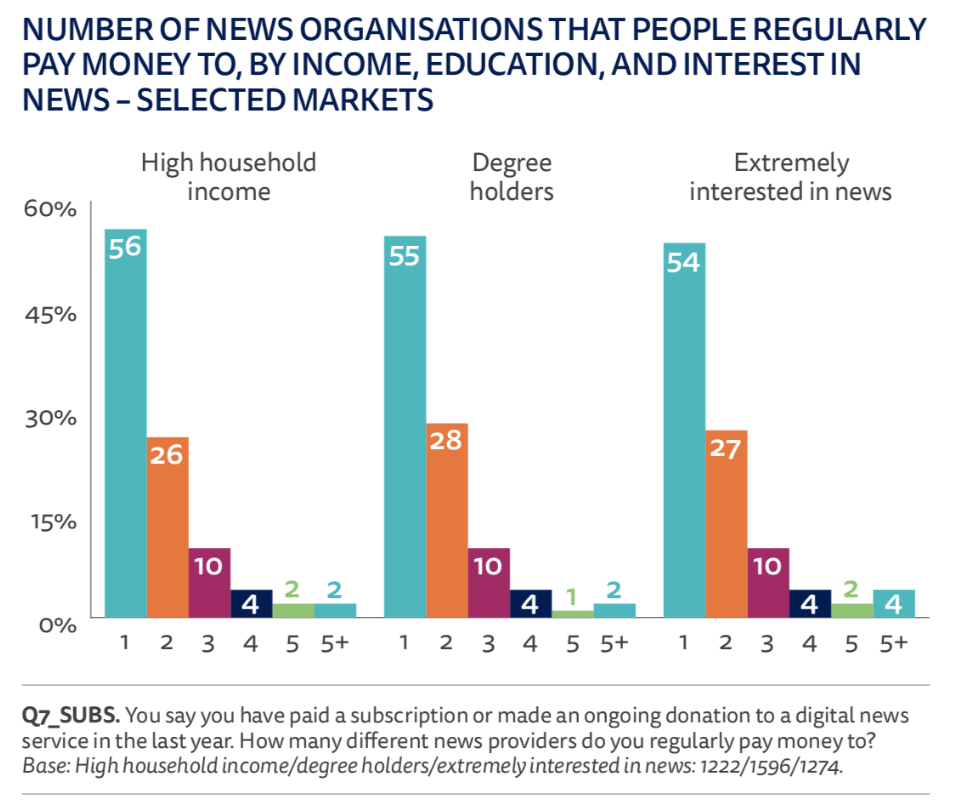

While there’s still some debate in the industry on if some people will ever pay for online news, the conversation today has mostly taken a different form: how many subscriptions will readers pay for? Reuters found that, on average, a person who pays for a news subscription only pays for one. This holds true in almost every country studied.

Even among the three groups of readers most likely to pay for online news (high household income, highly educated, high interest in news), the majority of people still only pay for one source of online news. So while we see big, national titles such as The New York Times or Bild having success with their digital subscription strategies, where does this leave local titles? Reuters does highlight Twipe customer Ouest-France as standing out among regional publishers, something that likely has to do with their long tradition of innovation (such as creating the first digital-only newspaper in France).

Publishers competing against tech titans

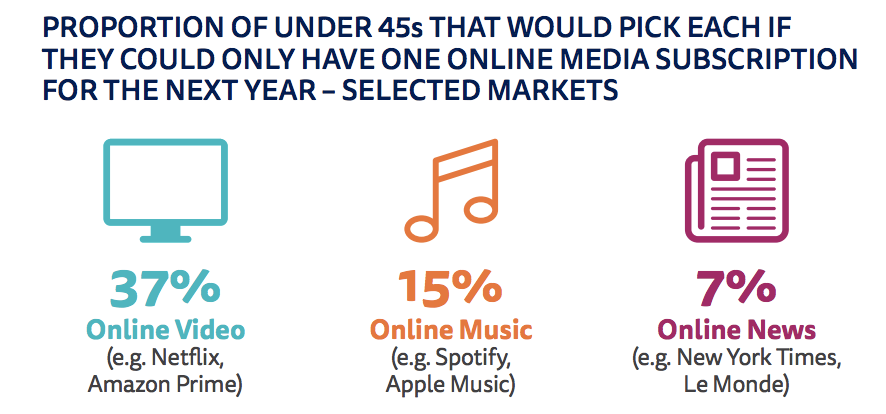

We have to keep in mind that news is just one of many online media services readers are asked to pay for today. Having a subscription model puts publishers in competition with all other subscription services, including Netflix and Spotify. That means the product experience for online news has to be at, or above, the level of these tech giants. This is something we’ve heard Nic Newman of Reuters state before, most recently at the International Journalism Festival.

Recently, we’ve heard publishers starting to place a bigger emphasis on their product experiences. The product is more than just the journalism, it is the entire experience of consuming the journalism. Sophie Gourmelen, General Director of Le Parisien, explained recently at WAN-IFRA’s Digital Subscription Summit that if a news title’s UX is poor, subscriptions will be difficult, as good content is not enough to overcome poor UX.

The future of news is mobile

While no real surprise for many today, Reuters confirms that mobile is the most popular device for consuming news today. The computer has dropped dramatically as the main device for news, going from 71% in 2013 to just 28% today. Readers are still using computers to access news, but it is no longer their preferred device. Instead smartphones are winning, due in part to their convenience and versatility. Tablet usage has remained stable in recent years.

This move of readers towards mobile has an impact on publishers, both for revenue sources as well as content formats. Firstly, display advertising does not work as well on the smaller screens of smartphones. This can continue to encourage publishers to adopt reader revenue strategies instead. Secondly, this move is causing publishers to change the content formats they used in the print and desktop eras. Today we see publishers experimenting with the Stories format, digital-only editions, or even mobile optimised ePapers, such as Twipe’s NextGen technology.

Ultimately, we expect to see publishers rethinking their mobile experiences for readers. For example, today 70% of Le Parisien’s audience is on mobile, so now their strategy is focused on moving readers to apps, where they have much better retention rates. With the growing importance of smartphones, publishers will most likely increase the investment in their apps.

Growing importance of triggers

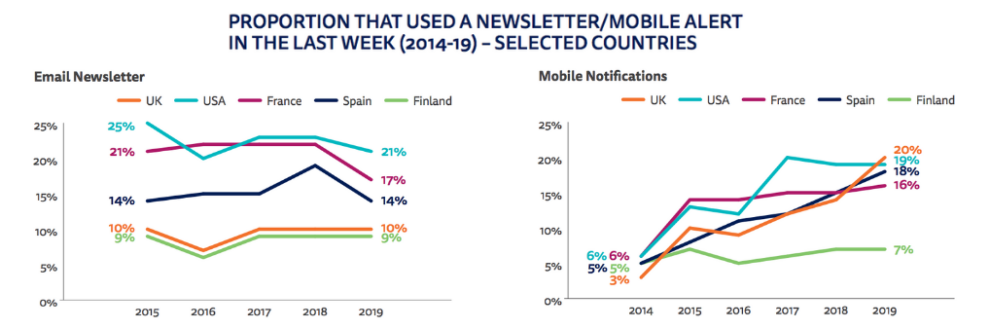

Just last week we looked at the importance of triggers for publishers in creating a daily habit (which is most closely correlated with increased retention). Reuters examined two of the most common triggers: email newsletters and push notifications. What stands out here is that while Scandinavia has a higher percentages of readers paying for online news, they are lagging behind in the use of triggers. Just 17% of respondents in Norway have used at least one email newsletter in the past week, compared to 42% of US digital subscribers. It’s clear that there’s room to learn from each other here.

In recent years, email usage has remained relatively stable. Reuters points out that email is particularly effective for highly engaged news users, however at Twipe we’ve also had success in using email to trigger lower engaged readers. We’ll be sharing more of our work on this, from the collaborative project “JAMES, Your Digital Butler“, later this month. Push notification usage has grown considerably however, growing from 3% weekly usage to 20% in the past five years in the UK. We’re seeing more mature push notification strategies emerge as well, with publishers using alerts for more than just breaking news.

The full report can be found here.

Mary-Katharine Phillips

Media innovation analyst @ Twipe

Republished with kind permission of Twipe Mobile