|

Getting your Trinity Audio player ready...

|

The latest update of Zenith’s Advertising Expenditure Forecasts report paints a pretty positive picture of the global ad market. Jonathan Barnard, head of forecasting and director of global intelligence at Zenith gives his take on the latest report.

We’re forecasting 4.5 per cent growth for this year, plus 4.2 per cent in 2019 and 2020. We’ve downgraded our forecast for 2018 slightly from the 4.6 per cent we forecast back in March, but that’s mainly because we’ve increased our estimate for last year, providing a tougher comparison. In dollar terms, we’re forecasting that US$580bn will be spent on global advertising this year, US$1bn more than we forecasted three months ago.

Asia Pacific is by far the biggest contributor to global adspend growth

We expect it Asia Pacific contribute 43 per cent of all the new ad dollars added to the market between 2017 and 2020 – US$32.1bn out of the US$75.1bn total. Six of the ten markets that will contribute the most to global growth are in Asia Pacific: China (which by itself will account for 22 per cent of global growth), India (which will contribute five per cent), Indonesia (four per cent), Japan (three per cent), the Philippines (three per cent) and South Korea (two per cent). We forecast that Asia Pacific will account for 33.8 per cent of global adspend in 2020, up from 32.6 per cent in 2017.

North America, currently the largest advertising region, is falling behind in growth. We expect it to contribute 27 per cent of new ad dollars between 2017 and 2020, while its share of global adspend slips from 37.1 per cent to 36.0per cent.

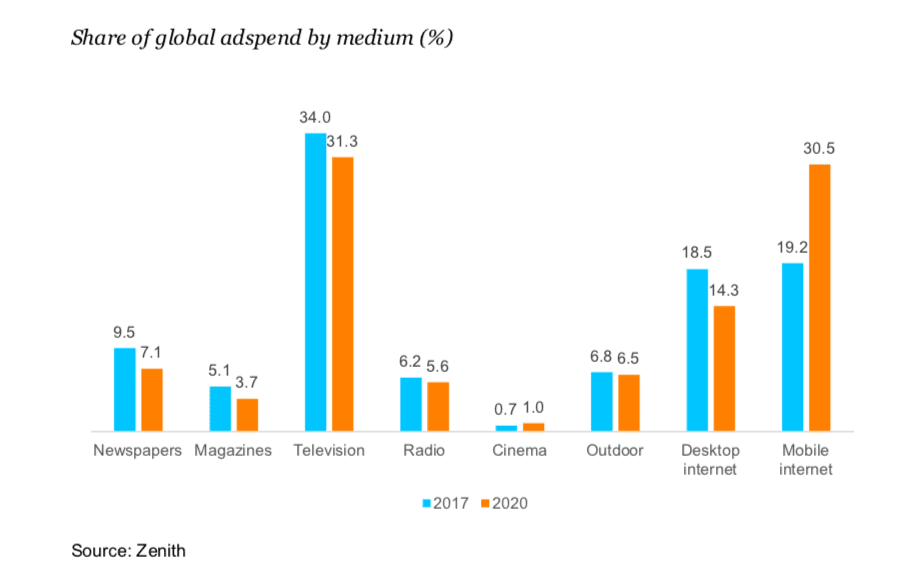

Looking at adspend by medium, the continued rise of mobile advertising remains the stand-out trend. As internet users switch from desktop to mobile devices – and new users go straight to mobile – online advertising is making the same switch. Advertising on mobile devices is rising at a meteoric rate, and is taking market share from all most other media. Mobile adspend grew 35 per cent in 2017, and we expect it to grow at an average rate of 21 per cent a year to 2020.

Mobile advertising to excede 30 per cent of global advertising expenditure in 2020

We now expect mobile advertising to account for 30.5 per cent of global advertising expenditure in 2020, up from 19.2 per cent in 2017. Expenditure on mobile advertising will total US$187bn in 2020, more than twice the US$88bn spent on desktop advertising, and just US$5bn behind the US$192bn spent on television advertising. At the current rate of growth mobile advertising will comfortably overtake television in 2021.

Most of the traditional media are still growing despite the inexorable rise of mobile advertising, but generally at very low rates. We forecast television and radio to grow by one per cent a year between 2017 and 2020, while out-of-home advertising grows by three per cent a year. Cinema, however, is growing at 16 per cent a year, thanks to investment in new screens, successful movie franchises, and better international marketing. The main driver, though, is surging demand in China, where ticket sales increased 22 per cent in 2017. China overtook the US to become the world’s biggest cinema advertising market in 2017, worth US$1.2bn, and by 2020 we expect it to reach US$2.8bn.

Print advertising continues to shrink together with circulations: between 2017 and 2020 we forecast newspaper adspend to shrink by an average of five per cent a year, while magazine adspend shrinks by six per cent. This refers only to advertising within print titles, though – publishers’ online revenues are counted within the desktop and mobile internet totals, so their overall performance is not as bad as the print figures suggest. Research organisations in some markets – such as the Advertising Association/WARC in the UK – provide combined print and digital ad revenue figures for publishers, generally showing that the digital revenues soften but do not reverse the decline in print.

Download Zenith’s executive summary here.

Re-published by kind permission of FIPP, the network for global media